Ongoing Financial Planning and Investment Management

How Does it Work?

We work together on an ongoing basis to provide proactive financial planning advice and investment management.

This service is designed for people who are about to lose a spouse, recently widowed, want to turn over some of the responsibilities of being a power of attorney, or anybody else looking for more guidance in their financial life.

Losing a spouse is one of the most life changing events someone can experience. Brain fog, grief, and not feeling like oneself often come up at seemingly random times. If there were ever a time to have another layer of support, it’s while you are experiencing loss.

Fees & Value

What Are My Fees?

Fees are based on assets under management.

- $0 – $1,000,000 = 1.00%

- $1,000,001 – $3,000,000 = 0.75%

- $3,000,001 – $5,000,000 = 0.50%

- $5,000,001 and above = 0.35%

Fees are tiered, meaning the first $1,000,000 under management is billed at 1%, and amounts above that are billed at the next rate.

For example, if you had $2,000,000 under management, you would pay approximately $17,500 per year ($1,000,000 x 1% + $1,000,000 at 0.75%).

Fees are billed based on an average daily balance of the accounts under management in arrears. For instance, if you signed up on January 1, the first quarterly fee would be based on the average daily balance of your accounts under management between January 1 and March 31. The management fee would be debited directly from your accounts in April.

To be eligible for this offering, you need to have a minimum of $500,000 of assets under management.

What is the Potential Value?

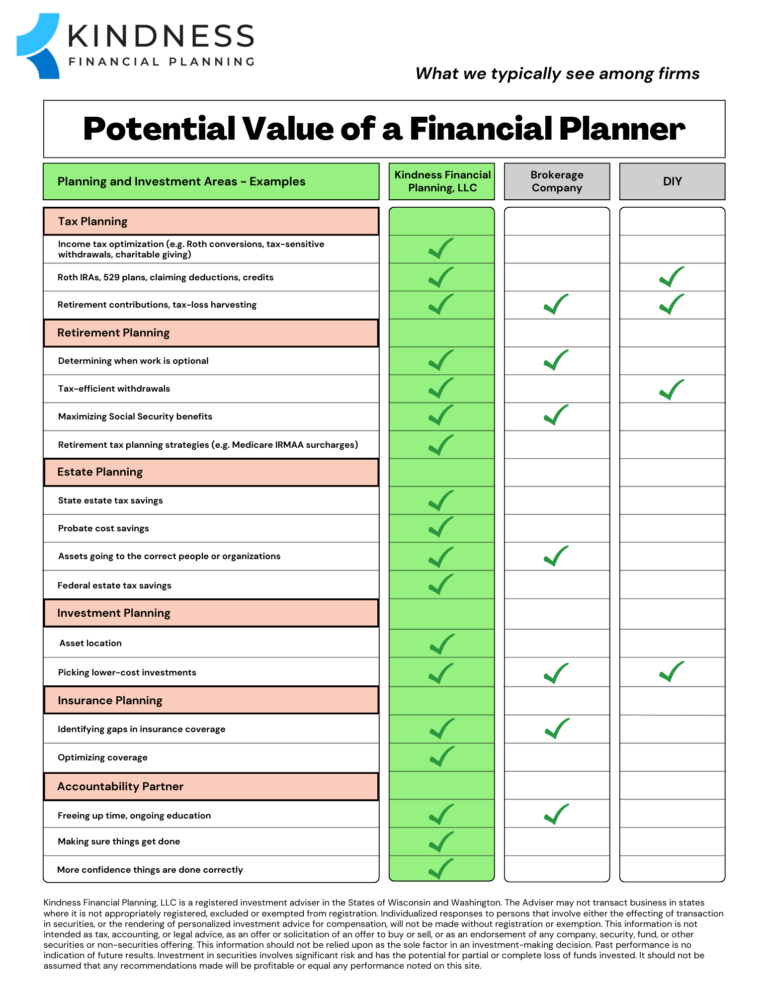

Wondering about the value of a financial planner? Please see the chart below to see the possible areas where I could add value to your life.

Click to download a PDF copy of the Potential Value of a Financial Planner.

“ There is a sacredness in tears. They are not the mark of weakness, but of power. They speak more eloquently than ten thousand tongues. They are the messengers of overwhelming grief, of deep contrition, and of unspeakable love. ”

— Washington Irving

Instead of you determining what you need to do during an already difficult time, I will help you organize your financial life, decide what needs to happen immediately and what can wait, and then create a roadmap for us to tackle together.

In addition to helping you organize everything, you’ll have someone who will stay up to date on tax laws, set up a tax-efficient investment portfolio, and create income on the schedule you need. It’s my responsibility to bring ideas to your attention, make you aware of changes that will affect you, and ensure you get the income you need when you need it.

It’s your responsibility to grieve, navigate what you are feeling, and let me know how best I can support you.

You can call me your accountability partner.

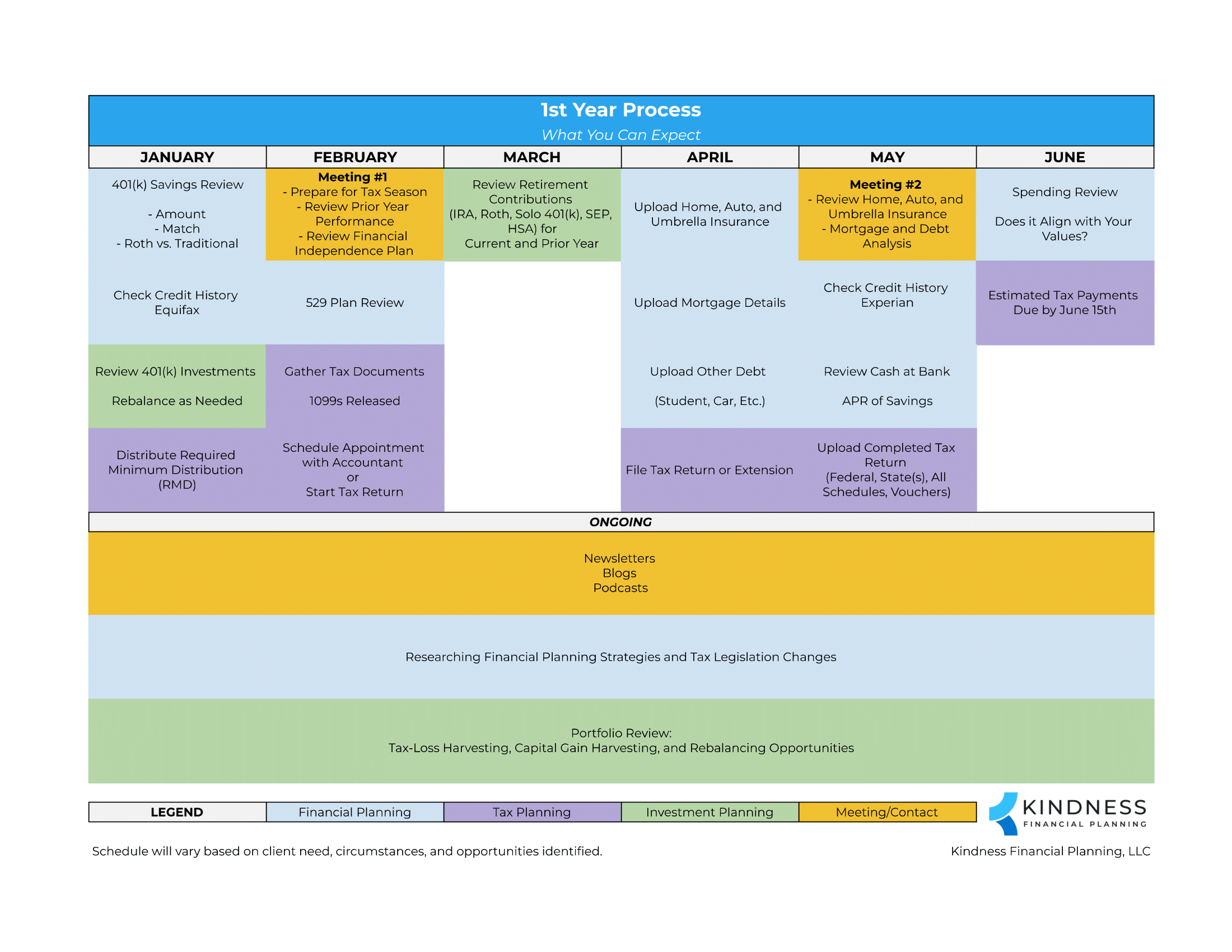

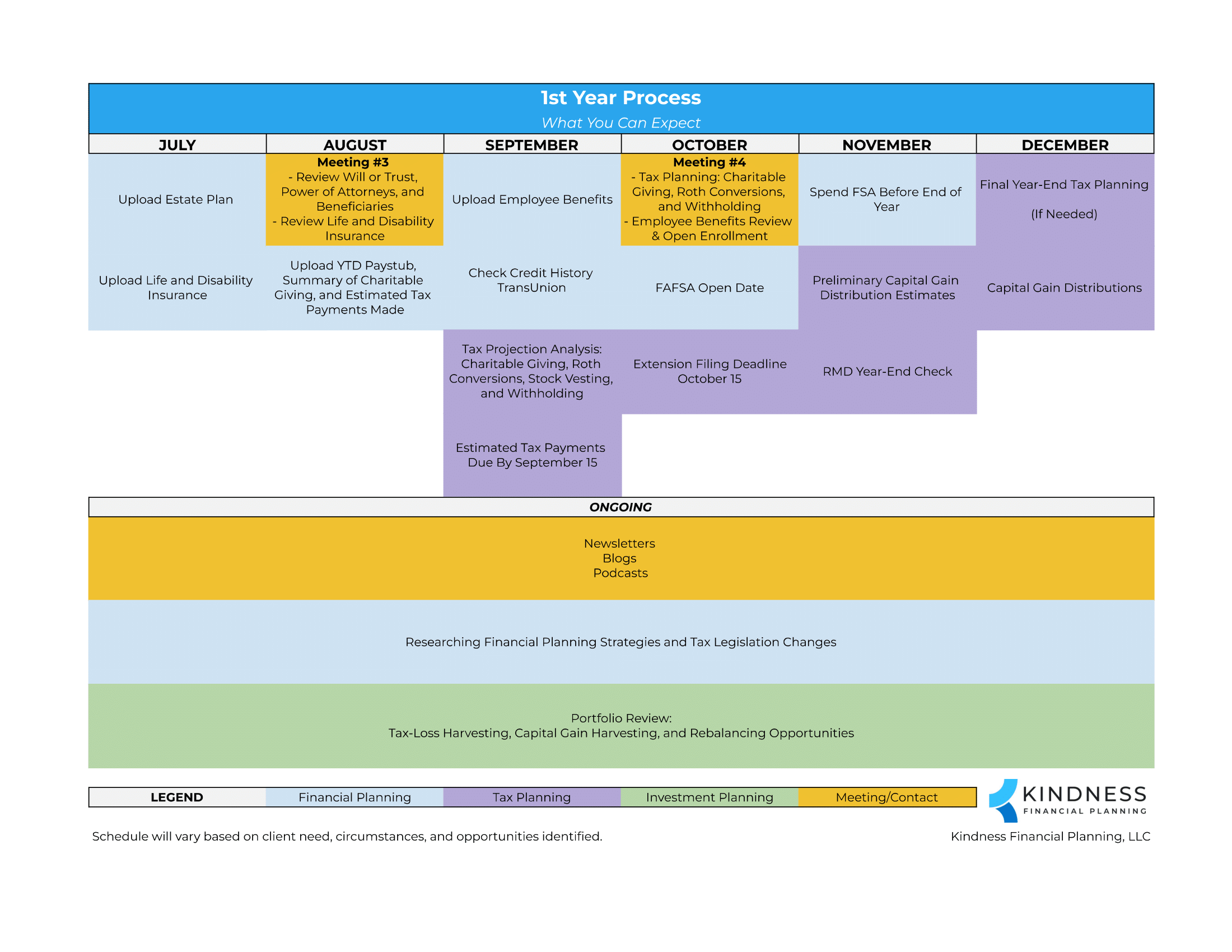

Below is an example of how the first year might look as a client and what you can expect. You can download a PDF of the first year process by clicking this link: 1st Year Process – What You Can Expect

Tax Planning Example

Roth Conversion

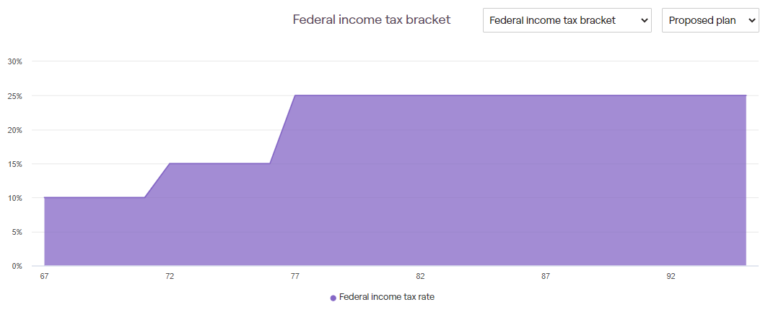

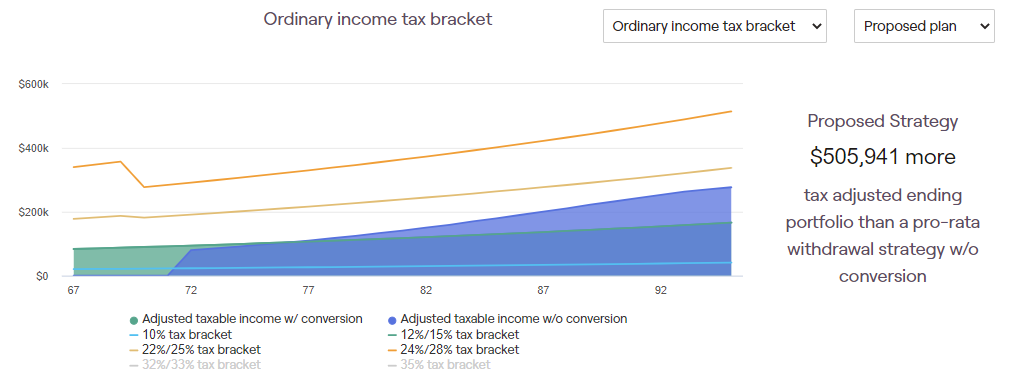

I’ll do a Roth conversion analysis each year to compare your current year tax rate to an estimate of your tax rate in the future.

If there are opportunities for you to pay less in taxes over your lifetime by doing a Roth conversion, I’ll recommend how much of a Roth conversion to do, when to do it, and help you decide how much in estimated tax payments to make. Then, you get to decide how much of a Roth conversion you want to do, and I’ll take care of it.

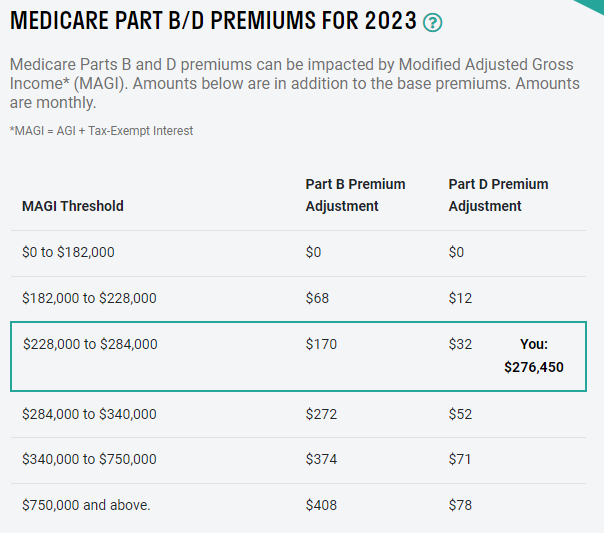

I’ll also show you how your Medicare premium could potentially change because of the Roth conversion and how that affects the effective tax rate of the Roth conversion.

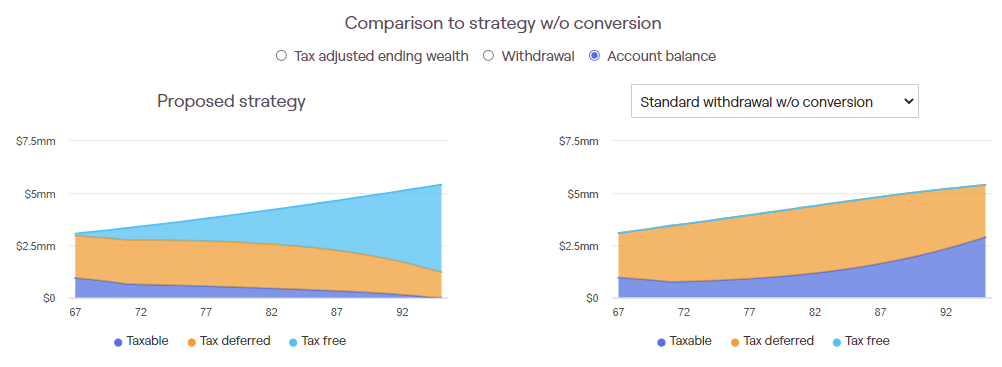

You’ll see the potential benefit of a Roth conversion in how it may change your estimated taxable income in the future, estimated investment balances after taxes, and the estimated account balances by tax status (tax-free, tax-deferred, and taxable) for you and your heirs.

Financial Independence (Retirement) Plan Example

Financial Independence (Retirement) Plan

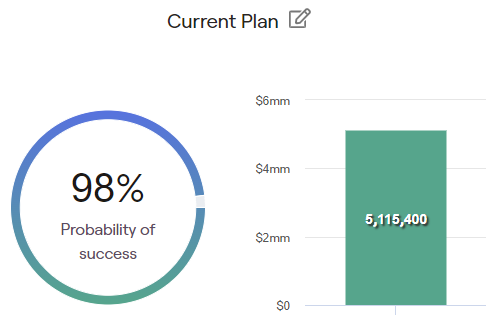

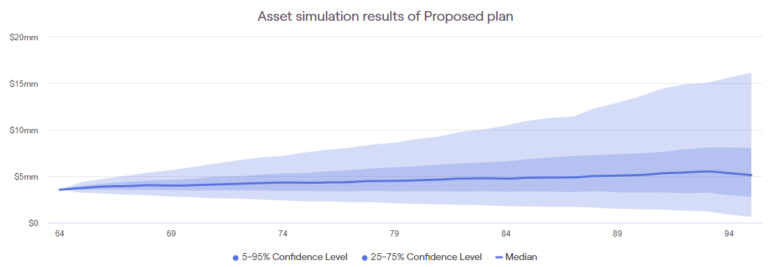

We’ll create a financial independence plan together to help you decide when you want to retire and how much you may want to spend per year. You’ll see the chance you need to change your spending throughout retirement and the range of your account balances throughout life.

We’ll revisit the plan regularly, through the stock market ups and downs, to help you give confidence you are on the right path. As your life changes, we can update the plan with increased travel expenses, gifting to grandchildren, health care spending, long-term care expenses, and more. You can see how your Required Minimum Distributions (RMDs) may change over time and what sort of income your investment portfolio needs to support to meet your spending needs.

The financial independence plan is where we can model the “what if” scenarios of life and the uncertainty of stock market returns.