One-Time Hourly Financial Planning

What is the Process?

PLEASE NOTE:

I’m currently full and have no one-time hourly financial planning slots available for 2026. I have a waitlist. Please email me if you’d like to be added to the waitlist in case I have any cancelations in 2026 or to be added to the list for 2027.

Please also email me if you’d like a referral to another financial planner I trust who still has availability.

Otherwise, I still have availability for ongoing financial planning and investment management.

We work together to do a comprehensive review and answer your questions at an hourly rate of $420 an hour, billable in 15 minute increments.

Most comprehensive engagements range between $4,200 and $6,300, which includes a financial independence plan, tax analysis, investment analysis and recommendations, insurance review, and more.

Typical Process:

- Introductory meeting.

- You take time to think whether it is a good fit. I’ll also let you know if I don’t think it’s a good fit.

- I send a simple thank you email, and if you don’t get back to me, you’ll likely never hear from me again. I’m not here to sell you on anything you don’t want to do.

- If you want to work together, please email me.

- I’ll send my client agreement for you to sign digitally, set you up in a financial planning portal where you can upload documents, and ask you to upload a list of documents (tax returns, investment states, insurance policies, estate plan, etc.)

- You upload documents within a week or I move on to my next engagement. If there is a waitlist, I’ll let you know when I want you to upload documents.

- I review the documents and ask questions over email as I create my recommendations. If needed, we have another meeting to go through the questions.

- Schedule two 1-hour recommendation meetings to go through everything together. Sometimes it takes less time, sometimes more.

Once the one-time plan is delivered, you have a 30-day follow up window to ask questions. After that point, the engagement ends.

The short window is intentional.

I want people who are committed to asking questions and implementing the recommendations they agree with to move their financial life forward.

I don’t offer engagements that address one or two questions that may only take a few hours.

Below are examples of topics that may be included:

- Review overall investment allocation

- Review your investments and whether each investment is in the most tax-efficient accounts

- Do Roth conversions scenario analysis to help optimize taxes over your lifetime

- Charitable giving strategies, such as Qualified Charitable Distributions (QCDs), giving stock, and Donor Advised Funds (DAFs)

- Read your estate plan and go over it with you to identify areas that may need updating

- Build a financial independence plan to determine the likelihood that you need to save more or adjust your spending in retirement

- Provide long-term care insurance guidance

- Discuss extra support services, such as eldercare consultants, home health aides, or therapists

- Review home, auto, umbrella, and life insurance to identify any gaps in coverage

FAQ

- Do you answer questions about only a few topics?

- No, these are comprehensive plans where I’ll build a retirement plan, review your investments, tax planning, insurance (homeowners, auto, umbrella, disability, life, etc.), estate plan, college savings, etc. While I understand you may be seeking answers about one or two topics, these areas of financial planning are interconnected. Decisions in one area can significantly impact others. It’s a little like going to a doctor and asking them to only look at your foot because you are having pain there, but not allowing them to look at the rest of your body or doing blood work to make a diagnosis. There are financial planners who will answer ad-hoc questions, but I don’t work that way because of the risk that my advice could be completely different based on what I discover in other areas of your financial life.

- After our engagement ends 30 days after our last recommendation meeting, can I pay by the hour?

- No, this service is not ongoing. If you want an ongoing relationship, I offer it under a different fee arrangement. These one-time financial plans are meant to last you years or until there is a significant change in your life. The end result of the one-time engagement is a Word document that is often 10 to 40 pages providing advice in nearly every area of your financial life for you to implement. They are great for do-it-yourself folks. They are not a good fit for people who want a sounding board, accountability partner, and the ability to ask questions on an ongoing basis to a financial planner who already knows you, your values, and family.

- Why do you have a 30 day follow up window after the last recommendation meeting?

- I want people who are motivated and committed to make changes quickly. In the past, I didn’t have a 30 day follow up window and people would pay me good money for a plan, do nothing, come back eight months later and ask if they should still make the changes I recommended. Unfortunately, I didn’t know what happened in their life, so I couldn’t confidently say whether they should make those changes.

- Do you upload the 10 to 40 page Word document of your recommendations prior to our meeting for me to review?

- No, I’ve done this in the past, and it was simply too overwhelming and caused anxiety. I’ll take you through the Word document in the order that makes sense and along the way, you get to ask questions. After our meeting, I will upload what we covered. The first recommendation meeting usually is a bit overwhelming as I present new ideas, strategies, and information that you may have never considered. After our second meeting and through the 30 day follow up window, you should have peace of mind and confidence about your financial life as you understand the roadmap and action steps you want to take.

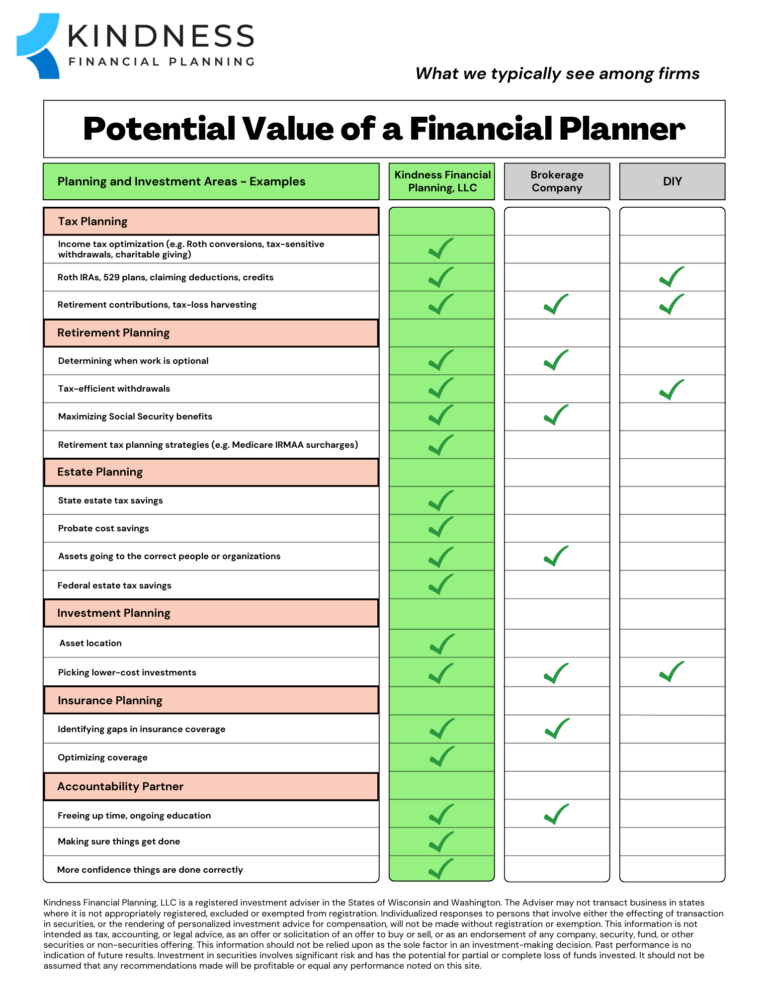

What is the Potential Value?

Wondering about the value of a financial planner? Please see the chart below to see the possible areas where I could add value to your life.

Click to download a PDF copy of the Potential Value of a Financial Planner.