Your credit score impacts many parts of your life – interest rates on loans, credit card applications, and more.

Unfortunately, how to build a good credit score is often counterintuitive.

For example, did you know closing an old account could cause your credit score to drop?

Your credit score is a signal to lenders about how responsible you are in borrowing money and paying it back. It’s one number lenders use to accept your credit card application, offer you the best interest rate on a loan, and even how much your auto and homeowners insurance will cost in some states.

Let’s look at what impacts your credit score, how it’s calculated, the ranges of a good credit score, mistakes people make trying to improve their credit score, and strategies to build a good credit score.

What Impacts Your Credit Score?

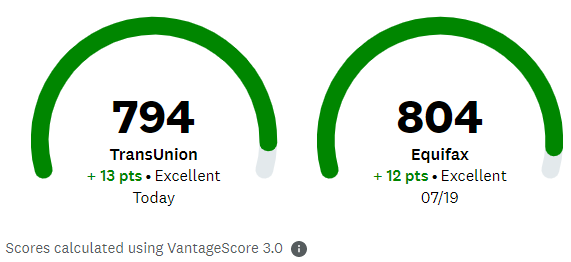

First, there are many different types of credit scores. You may be most familiar with a FICO score, but you may also have heard of a VantageScore. They are competing companies that provide credit scores ranging from 300 to 850.

Although they create scores fairly similarly, there are differences. Your score likely won’t be the same with each company, but if you follow general tips about building a good credit score, you shouldn’t need to worry about the differences.

Another aspect to keep in mind is that their models have changed over time. An older model that a lender uses may be slightly different than a newer scoring model a different lender uses.

Even within FICO, there are industry-specific credit scores. For example, there are different scores for auto lending, credit cards, and mortgage lending.

The key is to keep in mind that what impacts your credit score is not uniform across models. This is a general outline of what impacts your credit score.

Your FICO score is calculated using the following pieces of information:

- Payment history

- Amounts owed

- Length of credit history

- Credit mix

- New credit

In the next section, I’ll talk about how much each impacts your credit score, but let’s first understand each category better.

Payment History

Payment history shows how often you’ve paid your credit accounts on time. It could be credit cards, installment loans (i.e. car loans), or mortgages.

A late payment or two isn’t the end of the world, but it is better to show no late payments. How overdue you are on a payment also affects the payment history. For example, if you are one day late, that is less of a concern than if you are a few months late.

Bankruptcies will significantly impact your payment history and count negatively against you.

Amounts Owed

Amounts owed is a difficult category to understand because it’s made up of five different factors, but it generally is how much debt you have relative to your credit profile.

The five factors are:

- Amount owed on all accounts

- Amount owed on different accounts (credit cards vs. installment loans)

- How many accounts have balances

- Credit utilization ratio on revolving accounts

- Current balance of installment loans compared to original amounts

The key factor in amounts owed is your credit utilization ratio on revolving accounts. This is how much of your available debt you are using, such as on a credit card.

For example, if you have a $10,000 limit and a $5,000 balance is reported to the credit bureaus, this is a 50% utilization ratio. You generally want a utilization ratio below 30%, but in an ideal world, it would be under 10%.

Generally, if you owe a lot of money on many different types of accounts, have a high utilization ratio, and haven’t paid down much of a loan, that will negatively affect the amounts owed.

Length of Credit History

Length of credit history is a combination of three factors, but it generally is how long you’ve been using credit.

The three factors are:

- Age of credit (oldest, newest, and average age of accounts)

- Length of time specific credit accounts have been open

- Length of time since accounts have been used

Generally, the longer you’ve had accounts open, the better your credit score. The average age is also important, which means if you have one really old account and five new ones, the average age of your credit is going to be very young. It doesn’t necessarily mean you will have a bad credit score, but it might be lower than if you had two older accounts and one newer one.

Credit Mix

Credit mix is the type of credit you have open.

For example, if you have only credit cards, you don’t have a great mix of credit. The credit score methodology likes to see a mix of accounts, such as credit cards, installment loans, and mortgages.

Although it seems like you may want to start applying for different credit lines, you normally don’t because a hard inquiry can lower your score and multiple accounts opened in a short amount of time can be a red flag.

Most people naturally build a credit mix over time as their life changes, though as you get older and pay off a mortgage and car loans, your credit mix may be limited, but that’s okay. You often use credit less in your 70s and 80s, and your credit score becomes less important.

New Credit

New credit is how many new credit accounts you’ve opened recently.

The FICO score looks at “hard credit inquiries” from the last 12 months, which means if you apply for five new credit cards, your credit report is going to show five new hard credit inquiries.

When you check your own credit report or a company does a “soft inquiry”, that won’t affect your credit score.

Besides hard inquiries, if you open new credit, that may also lower the average age of your credit, which may lower your credit score.

New credit can also help increase your credit score long-term if it adds to your credit mix. For example, if you didn’t have an installment loan before and now have one, that would help your score down the road.

It’s confusing, right? Some actions can help or hurt your credit score, depending on your credit profile.

How is Your Credit Score Calculated?

Now that you know what impacts your credit score, let’s look at the weight of each category.

- Payment history: 35%

- Amounts owed: 30%

- Length of credit history: 15%

- Credit mix: 10%

- New credit: 10%

As you can see, payment history carries the highest weight, making it the most important. What this means is that paying your bills on time is one of the most important actions you can take to increase your credit score.

Amounts owed is also very important. At 30% of your credit score calculation, it’s important to keep your credit utilization ratio below 30% (ideally 10%). If you are using most of your available credit, that could lower your credit score.

Paying your bills on time and not using much of your available credit is 65% of your credit score. The other three categories are important, but carry much less weight.

The length of your credit history is important because it carries a 15% weighting, and this is one that often surprises people. There are many stories online about people closing credit accounts and discovering that their credit score went down.

For example, let’s say you had one credit card opened 30 years and another opened 2 years. You have an average credit age of 16 years. If you close the card that has been opened 30 years, your average credit age is now 2 years.

Finally, credit mix and new credit are important at 10% each, but don’t stress if you don’t have a mix of loans or recently applied for credit. It’s not necessary to have a mix of credit to have a good credit score, and hard inquiries won’t impact your credit score after 12 months and typically fall off your credit report after 2 years.

If you are doing everything else correctly, these categories matter less given their small weighting.

What is a Good Credit Score?

Some people obsess about having a score as close to 850 as possible, which is the highest possible score, but it’s not necessary.

Most people are going to be offered the lowest rates with a credit score of 760 or higher.

For lenders, they are not going to care very much if your credit score is 780 versus 795. Both are very good credit scores that indicate you are good at managing credit.

If you want to assign words to a FICO score, generally, the ranges are as follows:

- 300 – 579: Poor

- 580 – 669: Fair

- 670 – 739: Good

- 740 – 799: Very Good

- 800 – 850: Excellent

Again, people in the very good range can often get the same deals as people in the excellent range.

Don’t fret if you are in the high 700s. They have to set the ranges somewhere, and the only thing that matters is which credit you have access to and what rate you can get.

If you are curious what percentage of people in the US fall within each range, it is below:

- Poor: 16%

- Fair: 17%

- Good: 21%

- Very Good: 25%

- Excellent: 21%

While these ranges exist, remember, most lenders will give you the best deals as long as your score is above 760.

Mistakes People Make Thinking it Will Improve Their Credit Score

There are actions people often take thinking it will improve their credit score, but it actually ends up lowering their credit score.

Let’s take a look at a few common mistakes people make trying to increase their credit score.

Avoiding Credit

Some people decide to avoid credit altogether by paying off loans and closing credit cards. It’s problematic if you ever need credit again in the future.

When you avoid credit, you are not showing a payment history, don’t have any credit mix going forward, and your length of credit history will be poor.

Using credit regularly, even if it is a credit card, can help maintain your credit profile.

You never know when you may rely on your credit score to move homes, obtain a loan, or get a new credit card.

Carrying a Balance/Paying interest

Some people think they need to carry a balance, which results in interest being paid, to build a good credit score.

You don’t, and you probably shouldn’t.

Your credit balance is reported to the credit bureaus when the lender does a final accounting on a certain day each month (called the closing date). For example, if you have a balance of $2,000 on your credit card on June 25, the day they report, and your payment isn’t due until July 15, you can pay off your balance and it will still show up as a $2,000 balance being used on your credit report.

You don’t need to carry a balance to build a good credit score. You can pay off your balance each month while building a good credit score.

Closing old accounts

As mentioned earlier, closing older accounts can make your length of credit history go down, which can lower your credit score.

Although you may be tempted to close a credit card account you opened 20 years ago that you no longer use, it may be better to occasionally make purchases on it (in case they close inactive accounts) and pay it off each month.

Although you can’t avoid it, the same thing can happen with an auto loan or mortgage. If you had a mortgage for 29 years and paid it off in the 30th year, you may see your credit score drop because your open loan for 30 years is no longer there helping extend the length of your credit history.

Not Using a Credit Card

Some people will try to avoid using a credit card, which can be prudent if you have debt problems, but some companies may close your account if they see no activity after a certain period of time.

It may be worthwhile to occasionally make a purchase and pay it off to keep the credit card open. If an older account is closed, that may shorten your credit history length, which could lower your credit score.

Strategies to Build a Good Credit Score

Now that you know more about what impacts your credit score and common mistakes people make when trying to build a good credit score, let’s look at strategies you can use to build a good credit score.

Pay on Time

Although it seems simple, paying your lenders on time is going to be one of the biggest steps you can take to build a good credit score. Your payment history contributes 35% to your credit score, which makes it critical to having a good credit score.

One of the easiest ways to pay your bills on time is to set up automatic payments. If you put your banking on autopilot, you don’t need to worry about manually making payments each month.

Pay Throughout the Month to Maintain a Low Utilization Rate

An underused strategy is to pay your credit card balance throughout the month, similar to how a debit card works.

For example, instead of spending for the entire month and letting your closing date balance reflect your entire spending for the month, you could pay your credit card off weekly to reduce what is reported to the credit bureaus. This could make your utilization rate lower.

Let’s say you spend $4,000 per month on a credit card with a $10,000 limit. If the $4,000 is reported, you have a utilization rate of 40%. Instead, if you paid it off throughout the month and only $1,000 was reported as of the closing date, you now have a utilization rate of 10%, which is much better.

Personally, I pay my credit card balance off throughout the month, so I can show a lower utilization rate and have a better sense for my total spending. In a way, I use it almost like a debit card, but it has better fraud protection and rewards.

Keep Old Credit Accounts

I know it’s tempting to close old credit accounts, and there is a time and place for it, but if you want to maintain or build a good credit score, keeping your old account open may help.

I’m a fan of simplicity and fewer accounts, but if you are going to need a good credit score for a loan application in the next year or two, keeping an old account may be beneficial.

Limit Credit Requests & Opening New Credit

If you apply for a new loan, the lender will likely make a hard inquiry, which will ding your credit score for a few months. If you are planning to make a large purchase that requires a loan, you may want to hold off on any new credit inquiries 12-24 months prior.

A hard inquiry may only drop your score 5-10 points temporarily, but that may be enough to influence your credit application.

It’s okay to apply for new credit, but you want to be careful about the timing of it.

Review Your Credit Report Regularly

Lastly, and although it doesn’t directly impact your credit score, you should review your credit report regularly.

If there are errors or fraudulent accounts on your credit report, you want to report and correct them as soon as possible. One way to help prevent fraudulent accounts is to do a credit freeze.

You can request your credit reports from annualcreditreport.com every 12 months.

Instead of checking your credit report from TransUnion, Equifax, and Experian at once, you could check each one throughout the year to stagger it. This way you can see your credit report multiple times per year and check for accuracy.

Final Thoughts – My Question for You

Building a good credit score takes work and an understanding of the methodology.

There are many actions you might intuitively take that you think would improve your credit score, such as closing an old account, but it could end up lowering your credit score instead.

If you focus on paying your bills on time and having a low credit utilization ratio, that’s about 65% of your credit score.

Don’t worry if you don’t have a credit score above 800. Most lenders are going to offer the best deals to people with credit scores about 760.

I’ll leave you with one question to act on.

What changes, if any, will you make to build a good credit score?