Imagine that you finished making pizza, and it’s hot out of the oven.

The edges are perfectly crispy. The cheese is gooey. The toppings are immaculate. It’s a perfect blend of flavors.

There is an issue though! You made too much.

You have a few options:

- Keep eating and stuff yourself until you are too full. (We’ve been there, right?)

- Freeze it for another day. (I love leftovers.)

- Invite your kids and friends over to enjoy it. (Who doesn’t love a pizza party?)

What would you do?

I speculate that most people would choose option 3 and invite their kids or friends over in most cases.

What happens in real life with money?

Option 2. They save it for another day.

And then one day you die, the freezer becomes your kids, and they get to “enjoy” less-than-optimal frozen pizza when they already have fresh pizza regularly and a freezer with their own frozen pizza.

There was a time when they didn’t have much pizza in their freezer, and that pizza could have been savored and enjoyed together.

Let’s talk about why you should be giving away more pizza money to your kids and what it means if you don’t.

Do You Have Enough?

The common concern I hear from people is, “I’m not sure I’ll have enough. What about long-term care? What if I have large expenses later in life?”

For many people, it’s a valid concern. They may not have enough.

I’m not talking about them. I’m talking about the people who are being overly conservative in their projections, not actually doing the math, and who are likely to end up with millions of dollars when they die. I could even make an argument that a million invested plus your house is likely more than enough for many people.

Yes, long-term care is expensive. Yes, I want you to have funds for when life happens. Yes, it’s nearly impossible to die with zero, despite the popularity of a book with that title.

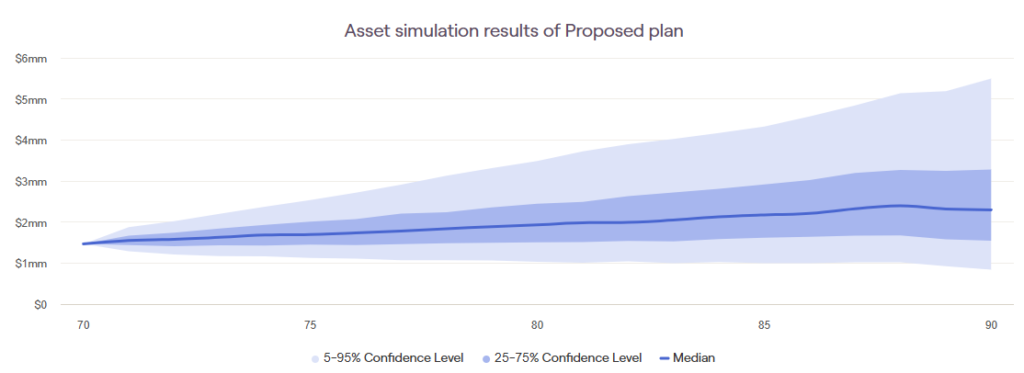

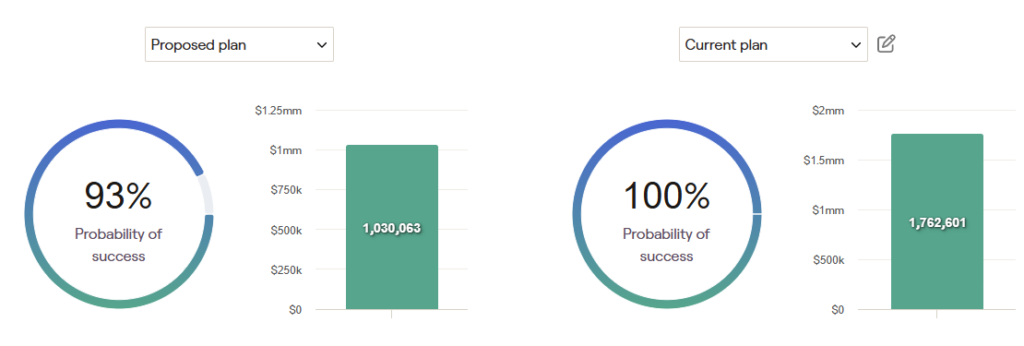

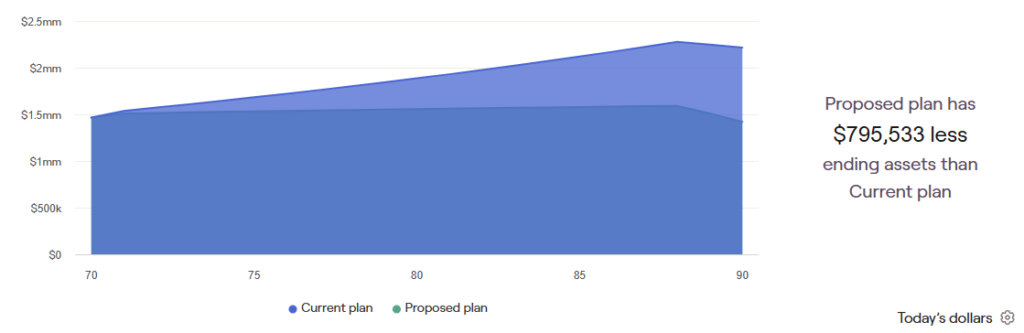

The first step is to run an honest retirement plan. What does it look like 10, 20, or 30 years from today? How much do you have under pessimistic scenarios and optimistic scenarios?

Those ranges can be helpful in seeing the possible outcomes, and it can also show you how much flexibility you have in sharing money throughout life knowing that you can make adjustments later and share less if it’s looking like you don’t have enough.

The financial plan isn’t something you run once, never look at again, and make decisions based off of 10 years later. It’s a continual process of updates, refining, and changing as life changes.

Once you have a plan, you can see how successful it is without giving money to your kids or grandkids. If it looks successful, then you can layer in different amounts of giving to see how it changes. You can look at the probability of success, ranges in wealth, and how much less you might have at the end of life.

You are going to have less if you give money away, but then again, how big of a pizza do you need?

Once you determine you have enough, it’s easier to give money away. If you struggle with the concept of giving, think of it as sharing family wealth.

If it’s wealth they are going to inherit later, you are simply sharing it earlier, when it might be more helpful and appreciated.

Why Waiting to Give Money is a Problem

Think about your own life for a second.

What would it have meant to be given $15k at age 30? How would that have helped? What time could you buy back with it? How would you have changed your life?

What if it was $100k or a higher amount?

We seem to recognize that money today is worth more than money later, but not when it comes to inheritance.

When you know you are very likely going to die with millions of dollars, you are essentially saying that money is worth more later, which we know for most people, is not true.

Talk to someone trying to buy a house, afford daycare, take time off work, go to Disneyland with their kids, pay for groceries, or do anything else in life that costs money.

It’s a theme I am seeing more and more with folks. They recognize it’s harder to afford life today for younger generations. A big part of that is housing. Incomes simply have not kept up with the cost of housing — whether you want to buy or rent.

What if those hard-to-afford things, including housing, were less hard to afford?

Many people reading this have the ability to do that for family members.

What gift would you be giving them?

It could be choosing a more fulfilling career path that allows them to spend more time with their kids because they don’t need to save as much for retirement. It could be allowing them to take a sabbatical from work after burnout. It could be affording a home in a nicer neighborhood with better schools.

It could simply be a vacation.

Many people have the ability to buy their family better quality of life throughout life rather than near the end of life.

What gift would it be for you to see them enjoy the money you give them rather than miss out on it from the grave?

Will I Raise a Spoiled, Useless Kid?

One of the common concerns I hear about parents who are hesitant to give money to their adult children is that they will be spoiled, work less, and not be a productive member of society.

I hear you, and in my experience, more money only amplifies people’s behavior.

Most people want an engaging life connected to a community, work that fulfills them, and the opportunity to see how their actions contribute to others.

If you have a kid who doesn’t care about any of that, it doesn’t matter whether you give them money or when you give it to them. They are likely to lead the life they want to live, whether that includes your money or not. Any money given is probably not going to be used in a way that you approve of or appreciate.

Wouldn’t it be better to give them money throughout life? That way you get to figure out how they use it before they inherit millions and really can spend it however they wish. Think about it this way: you get the opportunity to give thousands or tens of thousands a few years in a row to see what they do. Better to lose that amount of money and chalk it up to a life lesson than wait 20 years and give them millions to lose in a year. That’s a much harder life lesson.

As you give money, try to do it with no strings attached. I often see families want to control how their children spend it, and that often comes with resentment. It’s okay if you want to incentivize certain behavior, such as matching what they contribute to a retirement account, for a portion of it, but when the entire gift comes with strings, they may simply refuse the money and your relationship may change for the worse.

After all, you wouldn’t share pizza with your kids based on certain conditions. You’d simply let them have a few slices.

This is your opportunity to talk about the money, what it means to give, and ask them what they might do with it. They don’t have to share, but it can create meaningful conversations around money. They may even ask for your help or guidance. You could even include actual pizza during the conversation.

If they aren’t using your gifts responsibly, that gives you time to change your estate plan to potentially include an irrevocable trust with an independent trustee that controls distributions to them.

I’m not a fan of giving money with strings attached in most situations, but it can make sense. For example, if your adult child struggles with substance use issues or mental health, more money may only cause more problems. In that case, having a well designed estate plan with an independent trustee (i.e. not a family member) who can say no to distributions is critical.

If you talk about money as a family (and many don’t, unfortunately!), your kids will be better prepared for saving, investing, using, and spending it in a way that aligns with the life they want to live. By avoiding the topic, which many families do, you are making it this secret thing that isn’t to be discussed and then they have to figure out how to do it on their own.

Tax Benefits of Giving Money to Your Kids

Besides the personal and emotional side of giving, there can be meaningful tax benefits of giving money to your kids throughout life versus at death.

While many people are not concerned about the federal gift and estate tax exemption amount because it’s currently $15M per person, many states have lower estate tax exemptions amount. For example, Washington has an estate tax exemption amount of $3M, Minnesota has $3M, Illinois has $4M, and Oregon only has $1M.

Let’s say that between your investment assets, home, and other assets, you have $5M in Washington state and are married. You both are 60 years old. You plan to use a bypass trust on the first spouse’s death to preserve their estate tax exemption amount at that time.

You don’t currently have a Washington state estate tax problem because by using the bypass trust, you get $6M of an exemption; however, you likely have an estate tax problem later.

If the estate tax exemption amount increases by 3% per year and your estate grows by 6%, by age 85, your estate may be worth more than $21M. If the future estimated estate tax exemption amount is $12.5M for two people, that means you have a taxable estate of about $8.9M, which might mean about $1.6M in estate taxes due.

If you don’t need those assets, you could give more of them throughout life to chip away at the amount of your estate subject to estate taxes at death. If as a married couple you gave $38,000 per year to two kids ($19,000 gift tax exclusion amount times two being married), that is $76,000 that can be given away to two kids without needing to file a gift tax return. If we assume for easy math that the gift tax exclusion amount never goes up (a very bad, not realistic assumption), that’s still over $1.9M that can be given away over 25 years.

Assuming that $1.9M would have been taxed at 30% (Washington estate tax is between 10% and 35%, depending on the amount), that is $570,000 less in Washington estate taxes.

In other words, heirs are receiving about $570,000 more instead of the government.

When you save your pizza until the end of life, it can actually mean less pizza goes to your heirs.

How to Give Money to Your Kids

I’ve previously written about how to give money to family members, so I’m not going to go into the technical ways you can give money. Instead, I’m going to talk about the impact you could make and give ideas of meaningful gifts.

The easiest way to give is simply to give cash up to the annual gift tax exclusion amount each year.

It’s like prepaying for a pizza and letting them choose the ingredients that would be best for them.

If you want to give more, feel free. You’ll simply need to file a gift tax return, and any amount above the annual gift tax exclusion amount will be subtracted from your lifetime gift and estate tax exemption amount.

If you don’t want to prepay for a pizza, you can select the ingredients and have it delivered.

If you aren’t comfortable giving money directly, start with other ideas, such as funding a grandparent–owned 529 plan. You could even superfund a 529 plan. Grandparent-owned 529 plans are helpful for future educational expenses, particularly if your adult kids may fall within an income range that allows them to get financial assistance for college.

Another option is to buy your adult kids a home in a better school district. This happens often. Your kids may have a home they bought before 2021 with a very low interest rate and in order to move to a nicer neighborhood, it might double or triple their current housing payment. Your gift may allow them to put more down on a house in a better neighborhood while keeping their housing payment similar.

A popular option is to pay for childcare. Have you looked at daycare rates recently? It’s not uncommon to spend $2,000 to $4,000 per month per child. For some people, daycare is more than their mortgage. What a gift it would be to not worry about that expense. It may also allow one partner to continue working when they otherwise would have to stay at home. Or, it may allow someone to go part-time and allow them more time at home.

I’ve also seen families pay for kids and grandkids to come on a family vacation. They will pay for airfare, housing, and spending money while on vacation. The memories and photos that have been shared with me from these trips are amazing. While the younger generation enjoys them, I’ve seen the older generation, who is paying, light up when they talk about it decades later.

One other gift, although not technically a gift, could be doing Roth conversions. If you can move money from your IRA to your Roth IRA at a lower rate than your heirs may be able to, accounting for them having to distribute money fully from IRAs within 10 years of your death, prepaying some of that tax today could be helpful. It can also remove money from your estate, reducing any potential estate taxes. That means less in taxes and more money to your heirs.

There are other ways to make impactful gifts. These are some of the main pain points I see younger generations have. When you can solve those major main points, it gives them more flexibility to live life on their own terms.

What a gift.

Final Thoughts – My Question for You

Over the next decade or two, I’m confident many families are going to discover they have “too much” pizza money.

That feeling of, “Do I have enough money?” is going to fade, and there is going to be more scrambling of how to pass it to the next generation in the most tax-efficient way.

Unfortunately, the best planning starts today and adapts as life changes.

I’ve seen families scramble when parents are in their 80s and 90s.

It’s challenging. Family conflicts come up. Cognitive impairment is at play. Changing estate plans feels dangerous.

Try giving more money to your kids or grandkids this year. Call it an experiment. See what happens. You can always stop or change the experiment.

Think about it as sharing a slice of pizza they are going to get anyway, except right now, you can share it when it’s perfectly crispy and hot out of the oven — not frozen at death.

I’ll leave you with one question to act on.

How will you change your family giving plans?