Being a financial planner comes with incredible privilege. You get an intimate look into the lives of people who can start out as total strangers and transform into being one of the most trusted persons in their life.

I hear about people planning for kids before they tell others. I hear about the depths of grief when losing a spouse. I hear about how challenging it is to save money for decades and then be afraid to spend it.

I listen for what people want for their kids — some who are excelling at life and others who are struggling. We talk about fears, dreams, anxieties, how to protect those we love, how to provide for those we care about, charitable endeavours, and more.

We talk about money. After all, I’m a financial planner. But, it’s mostly not about the money — even if it may feel like it’s about the money. It’s typically not.

It’s a gift hearing these stories. It’s a blessing to be in a position where clients will wrestle with the hard stuff, be open to questions, and enter a space they normally don’t enter.

I not only love helping people align their money into a more ideal life for themselves and family, but I also enjoy bringing their decades of wisdom and experience into my own life and sharing it with others.

Here are 11 things I’ve learned as a financial planner.

Your Health Is Everything

Everybody thinks they want more money, a bigger house, power, prestige, and other lifestyle-chasing things until their health is taken from them.

At that point, they would give it all back for a fraction of their old life.

It’s not until you or your spouse get diagnosed with terminal cancer, organ failure, or have a stroke that you recognize your health is everything. I’ve seen people’s retirement dreams evaporate overnight. The trip to Europe becomes chemo in a cancer ward or hospice care at home. The garden they were going to build and enjoy every morning becomes round-the-clock care managing medications and watching them waste away in bed. The future memories of caring for the grandchildren become video and voice recordings the grandchildren can have as they get older because they won’t know their grandparent.

Take everything you know and love in your life and ask, “How much meaning would it have if I were unhealthy?”

I’m not talking about sick-on-the-couch and will-recover-in-a-week-or-two types of sickness. I’m talking about life-changing, world-turned-upside-down sickness, and unlikely to ever recover.

Having seen it happen over and over again, I try to wake up every day thankful for my health. I’m not always the best at treating my health as my number one asset, but when I see health taken regularly from those I work with and those they love, it’s a reminder to do what I can to hold on to my health.

Some health consequences are avoidable. Others are simply unlucky.

Money is Emotional

Money carries weight. It’s emotional. It comes with baggage.

Your upbringing will influence how money operates in your life. If you grew up wealthy, without ever having to worry about money, you are going to look at ordering an appetizer at dinner differently than someone who never went out to eat except on special, rare occasions.

Are you a family that only orders water or do you pay for a beverage when at a restaurant?

What about dessert?

And what’s a good tip?

Who knew dinner could bring up complicated money emotions?

Ask 10 people a question about money and you’ll likely get more than 10 different ideas. People like to pretend that the answers to money questions are in research, data, and come in black and white.

Money isn’t black and white.

It’s the 152 ultima crayon set.

Research and data can help make informed decisions, but sometimes the best decision is the one we can live with emotionally.

That may be helping a struggling parent when it hurts your own financial future or it may be saying no and living with the consequences.

Life Happens, Sometimes at the Worst Time

You can create the best plan — the perfect plan — and then life can happen.

You can spend years thinking about, designing, and building your dream home. Then, a new job, sick parent, or a spouse’s career can move you out of state.

You can do everything right for your kids, and mental illness can prevent them from flourishing into the life for which they hoped. They may be living with you again right as you imagined selling your home or traveling more.

You can spend your entire life saving and dreaming about what you’ll do in retirement with a spouse only for them to be diagnosed with a terminal disease the month after retiring.

The most content and resilient people I’ve met are those who have experienced tragedy. Life happened. They grieved and continue to grieve, but they also learned to live. It was different than they imagined, but it was still good. They found a way to get up every day and knew they couldn’t control what happens to them, but they could influence how they felt about it and what they did in response.

Life insurance, disability insurance, homeowners/renters insurance, auto insurance, and proper estate planning can help when life happens, but emotional resilience can be a powerful asset.

The “Best” Investment is the One You Can Stick With

I’ve known people heading into retirement with a 100% cash or bond portfolio, others with 100% stocks (sometimes concentrated in only a handful of individual stocks), and others with a diversified mix somewhere in between.

Those can all be appropriate depending on your circumstances.

If you posted on a personal finance forum asking if a 100% bond portfolio is okay for retirement, most people would say it’s not.

But, it can be.

Imagine you don’t spend more than your pension and Social Security benefits, and you have $3 million in bonds. I’d argue that person is in a better spot financially than most people and will continue to be even if they only own bonds. They could even keep it in cash and likely be okay.

You can argue all day that they would likely have more wealth if they invested that money partially in the stock market, but they are uncomfortable with it and likely to sell even during the smallest decline.

The “best” investment for them isn’t in stocks.

They saved enough and kept their lifestyle in line with their income sources that they don’t have to invest money. The “best” investment for them was cash or bonds because it’s the one they can stick with.

Most people don’t have the flexibility to do that and likely need to get comfortable with some exposure to stocks.

On the other side of the spectrum, I’d be extremely hesitant to be 100% stocks in retirement, but some people are comfortable with it and can stick with it. There is good research about why that’s not a great idea, but assuming they stick with it, and it works within their financial plan, there is nothing wrong with it.

There is no perfect portfolio or “best” investment.

There are “ideal”, “okay”, and “in the comfortable range” investments that become a “best” investment. And that should be documented in an investment policy statement.

Divorce is One of the Most Expensive Financial Decisions

Have you heard this joke?

Do you know why divorce is expensive?

Because it’s worth it.

Divorce is one of the most expensive financial decisions, and it can still be valuable and well worth it, particularly in unsafe and unhappy marriages.

People often spend their entire lives saving and investing toward a shared retirement. The moment you divorce, that money tends to get split in half, but the living expenses don’t. It can be a difficult and expensive adjustment going from two incomes to one while seeing your net worth decline by about 50%.

If your divorce is amicable, the actual divorce costs may be relatively inexpensive. If your divorce is contentious, you may watch tens of thousands of dollars go to attorneys while you and your spouse fight over the smallest, inconsequential details or one of you chooses not to participate in the process at all.

Divorce tends to be an expensive process. Choosing the right spouse you can grow with through multiple decades can be one of the most important financial decisions you make.

Otherwise, a divorce often means working longer, selling a home and renting or buying a smaller house, and significantly adjusting your lifestyle and spending.

If you are considering a second marriage and either of you are coming to the marriage with assets, talk to an attorney about a prenuptial agreement. Everybody has one. It’s your state’s default laws. You might as well create a custom one that you create while in love.

It’s like an insurance policy — you hope to never use it, but if you do, you’ll likely be glad you had it instead of trying to figure out how to divide assets when you aren’t in love.

Divorce is one of the quickest ways to blow up a financial plan. I’m not saying don’t divorce.

I’m saying to invest time with your spouse, stay curious, continually date them, grow together, and remember to do the small things, along with saying thank you, to do everything possible to stay in love and remain married.

People Rarely Feel Financially Secure

I haven’t counted, but if I had to guess, there are fewer than five people I’ve ever met who feel completely and totally financially secure with what they have.

Almost every person I meet said it would be helpful to have more.

It’s why we have so many people who think they are middle class. People who have $500,000 want $1,000,000. People with $2,500,000 want $5,000,000. The cycle goes on. As you have more, you may spend more time with people who have more than you, and then you feel less secure.

People often think there is a magic number that will make them feel secure. For most people, that number is not right. It’s a moving goal post. Once they get there, it will be a new one.

Go browse Reddit’s ChubbyFIRE or fatFIRE discussions. There are people with $5,000,000 or more with reasonable expenses relative to their investments that struggle with retiring.

Financially secure, although tied to money, is also a state of mind.

If you can figure out how to feel financially secure with what you have, you are likely going to have far more peace of mind than almost anybody you meet.

Ugly is Okay If the Intention is Right

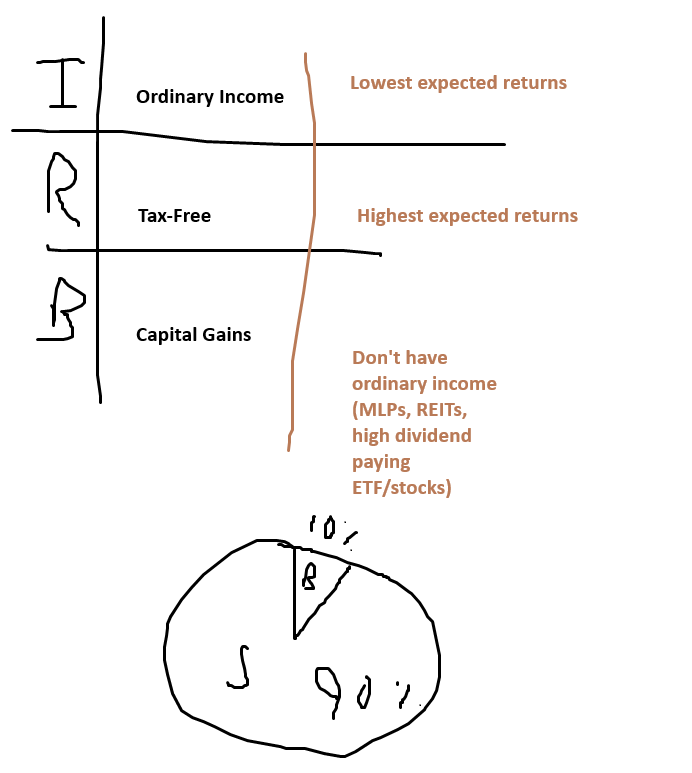

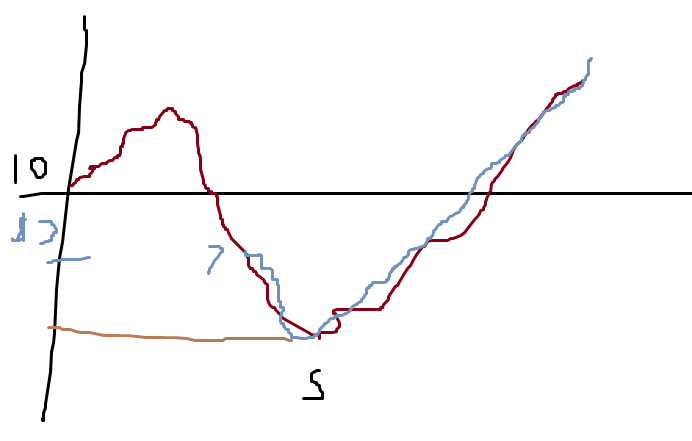

Below are pictures I’ve drawn in client meetings. They’re hideous, right?

I’ve only recently begun saving these ugly drawings. I wish I had started saving them over a decade ago to show you that they haven’t improved. I’m guessing I would have hundreds and maybe even thousands of these drawings.

I laugh when I see people in the industry produce really sleek reports or big Wall Street firms have these great graphics. There is a time and place for beautiful reports, but mainly, people want to understand and feel comfortable that they are going to be okay. You can do that with ugly drawings.

You can laugh at these drawings. I do. I’ve created better graphics, but they don’t seem to have the same effect.

When I draw them in real-time, people ask questions, and we have a conversation. It is a better conversation than throwing a fancy graphic on the screen. And the laughter is a bonus.

It’s a reminder that often, simpler is better.

You Need Community

The people I see thrive in retirement are those who have community.

They regularly meet with friends, volunteer, take care of grandkids, work a fun part-time job, join a board, mentor, garden, exercise, and other activities that give them purpose while spending time with others.

The people who struggle in retirement are those without community.

They tend to be people who worked long hours, work was their identity, and they are struggling with how to discover who they are outside of work.

If you feel like you are struggling in retirement, you aren’t alone. It often takes time to find new hobbies, rediscover old ones, and create a new community. It’s become harder to create community in third spaces because there are fewer of them today, which is why activities tied to something you enjoy are often a great way to build community.

I meet people in retirement that frequently say, “I have no idea how I’m so busy! I feel busier now than when I was working.”

What a sense of belonging.

It feels like people are more afraid than ever to ask for help because they don’t want to be a “bother.” Let’s flip the script. When has anybody asking you for help been a bother? For those you care about, it’s a privilege to help. By not asking for help, you are denying them the opportunity to help!

Those who ask for help often have great support. Ask for help frequently and often. Others will do the same. Before you know it, you are creating community.

Purpose Brings Meaning

One of the most miserable persons I ever met was also the wealthiest person I’ve ever known.

No community. No friends to call on. No purpose in life.

He ran a successful business, but his life was devoid of purpose and meaning.

He bought nice things — homes, cars, and other toys. He’s on his third marriage before age 50. At least one person in his family cut off communications.

He is your stereotypical person trying to throw money after happiness and purpose. It doesn’t work that way.

On the other hand, I know someone who wakes up every day oozing purpose. She volunteers for organizations that help kids caught up in the foster system. She gardens. She spends time with her husband.

I have zero doubts she has meaning in every corner of her life.

Wake up where you are needed and wanted. Make contributions and help how you can. Purpose will find you and meaning will be walking around the corner shortly.

Habits are Rarely Broken, but Can Be Moved

Because of what I do, I naturally interact with people who are more frugal. You don’t usually get to the position of hiring a financial planner if you are frivolously spending and your expectations are always higher than your income.

What’s interesting is how engrained that frugality can be. It’s a habit. They spend 30 or more years saving, and the moment they have to start spending from their investment portfolio, they feel anxious and like they are doing something wrong.

The habit of saving is hard to break.

I know people who still try to save a portion of their monthly withdrawal from their investment portfolio. They know it makes no sense, but it makes them feel better.

Habits are hard to break, but through hard work, a desire to change, or an independent person to help, they can be moved.

I love seeing people splurge on a vacation they could only dream of 10 years ago. I enjoy when people give a little more to their family to help with education, a car, or down payment.

Money is a tool, but if you are constantly keeping the tools in your garage without using them, what use are they?

Time and/or Luck is an Asset

You’re reading this because of a little luck and incredible timing.

I don’t know how you got here to this page specifically, but there are a few key moments that brought me here.

- A former branch manager at Charles Schwab took a chance on hiring a sophomore in college after repeated rejections from many other financial services companies who wanted only juniors or seniors. Thanks, Todd, for changing my career trajectory.

- A former operations manager, Clint, took me to lunch and asked, “Who else have you not met that you should meet?” When we got back to the office, on my second to last day, I met Ethan, a partner at a wealth management company. He’d become the best mentor I could have ever asked for even though he never saw himself as one.

- My friend Jillian convinced me to crash her boyfriend’s colleagues’ birthday party, where I would meet my eventual wife and her career would take us across the country — giving me enough of an excuse to launch Kindness Financial Planning.

It’s easy in hindsight to identify those key moments and what they have become today. It wasn’t so easy in the moment to be satisfied with what was happening. It skips over the hard parts full of fear, failure, and wondering.

But the timing and luck — impeccable.

There is a common quote that says, “Warren Buffett made 99% of his wealth after age 50.” It’s estimated that at 50, his net worth was about $300 million. That’s obviously a ton of money, but not an amount that puts you on the wealthiest lists or has journalists jumping at any opportunity to interview you.

But 152 billion?

That does.

Buffett has made successful investments, but his greatest asset was time. He is 94 years old. He had many more decades after 50 for his investments to compound. Had he died in his 50s, how much do you think would have been written about him?

Buffett even discusses the role of luck in his life.

Working in Seattle during the hey-day of tech IPOs, I was a firsthand witness to the role of luck.

People who joined Uber or Pinterest early received millions when it went public. What if they had chosen a different company? One can argue they had a belief in it, but I’d argue it’s luck. Those who joined Amazon or Google and held their RSUs saw their incomes and net worth skyrocket. Again, luck.

There were plenty of startups that weren’t Uber or Pinterest. There were plenty of tech companies that didn’t grow like Amazon or Google. Those are the ones you never heard about. The people who joined them weren’t as lucky.

Sometimes an idea is too early and a company fails. Sometimes a company goes bankrupt and you are out of a job. Sometimes you take a risk on your career and it doesn’t work out.

Then there are other times you get diagnosed with a lifelong condition that changes how you can work and for how long. A spouse goes to the doctor and is diagnosed with terminal cancer. A drunk driver kills your kid.

Time and luck are an asset. It’s not something you get to put on your balance sheet, and it’s not anything you can measure, but if you have it, you know how valuable it can be.

Final Thoughts – My Question for You

As a financial planner, I have the privilege of hearing people’s stories.

I hear about what money was like growing up, how they saved, what they like to splurge on, financial mistakes, financial wins, family struggles, and more.

The one thing I hear most is that people want good health. They want to stay active, healthy, and maintain movement. Without it, life isn’t the same.

I take what I’ve learned and try my best to incorporate these lessons into my own life. If I had to boil it down, it would be that I try to move regularly throughout the week, connect with people, invest time into relationships, not fret the small decisions, build small habits that work toward what I want to accomplish, and remember that time is on my side when it feels like things are going wrong.

If I do that, good stuff will probably follow.

I’ll leave you with one question to act on.

Which lesson will you take with you?