It’s hard to believe Kindness Financial Planning turns four on December 9.

I never thought I would be an entrepreneur (and still struggle with that word even though I meet the technical definition), and now I have a business that does meaningful work for clients while supporting the life I want to live.

I’m a bit at a loss for words this year. One word that comes to mind is “floaty.” This year kind of felt like it came and went. There were no huge wins. I didn’t achieve most of my goals I set last year.

And yet, the business is in a good place. It feels strange to be in a good place and still question the success. But, that’s where I am at this year.

Here are my reflections from this past year.

What Happened in the Business and in Life?

There weren’t many big “wins” in the business this year. It felt a little like driving through eastern Montana and North Dakota — you are cruising along quickly and most of the drive is boring, but occasionally, you see something interesting.

There was modest growth in new clients, I survived my second examination by the state of Wisconsin regulators, and I registered in California. That means I am now registered in three states: Wisconsin, Washington, and California. I hope to have fewer than five clients in other states since most states only you require to register once you have more than five clients.

I was most excited about starting client appreciation events again. In the first few years of the business, I didn’t see a huge point in doing them because I didn’t have many clients. I wasn’t sure I could fill one!

They were a hit this year. Since I’m a virtual firm, I have to be a little more creative in engaging folks. We did a virtual empanada cooking class, and people had a much better time than they anticipated. Everybody enjoyed coming together from their kitchens to cook delicious empanadas!

That was followed up by a cheese tasting class where we explored different Wisconsin cheeses. People learned more about cheese, and my palette is clearly not refined. When they asked at the end which cheese was our favorite, I was the only one who picked a certain cheese.

At my last firm, I was in charge of planning client events for the longest time. Unfortunately, it was a lose-lose situation. If the event happened without any issues, there was a thank you. If there was anything that could have been done differently according to a certain someone at the company, it ruined that next week for you.

It’s strange how those feelings follow you years later. As I prepared for the first event, I was nervous, and I had to remind myself to enjoy and just be myself.

One of the bigger successes is that my forward revenue estimate is about on pace with what I made at my prior company. I was highly compensated at my last company, so I’m proud that the small steps I’ve made each year have paid off. Of course, after taxes and business expenses, it will be less and inflation has eaten away at that number, but it’s still a milestone worth celebrating.

One of the huge losses is that website traffic has declined. If one of my articles doesn’t get picked up by one of the bigger financial bloggers or aggregators, I see about a third of the traffic I used to get from Google. I’ve heard the same from other writers. AI is decimating traffic, and it’s too bad. I know people want answers quickly, but I spend a lot of time on my articles, and there is good information to learn if you read the entire article.

On the personal front, I joined the board of ARC Community Services. I wasn’t looking to join a board, but after a tennis friend invited me to a restaurant where a percentage of proceeds would be donated, I asked about making a stock donation since I couldn’t attend. They didn’t have the capability set up, so after a few conversations, I wrote something for their website about how to give stock and the benefits of giving stock, which are being incorporated. That led to a conversation with their Executive Director and an invitation to join their board.

That’s been a great change of pace. Coming from the corporate world and male-dominated, it’s been fascinating to join the non-profit world and primarily female-dominated. I’m excited about the work they are doing and the goal to seek more funding outside of grants.

From a travel perspective, it was a good year. My wife and I went on our best trip yet. We spent a long weekend in New York City. We ate, walked, and saw shows. What made it really special is we both disconnected from work, which never happens on vacation. One of us is always doing something.

I also went around Lake Michigan with my mom for a big milestone birthday. We went rock hunting and explored smaller towns.

I also had the chance to go back to Seattle in August for a couple of weeks, which was a mix of seeing clients, friends, and family. It was a whirlwind, and it’s hard to beat the PNW in August.

My volunteering was down this year, but it wasn’t for a lack of trying. I’m still regularly volunteering with Savvy Ladies. It’s a great organization that connects women with professionals to provide financial education for one hour at a time. I love it because I can sign up for the one hour slot as my availability allows and people are very grateful.

Unfortunately, Wings for Widows changed their model and instead of matching widows with volunteers, widows have a database where they choose a financial coach to contact. Maybe my picture and bio isn’t as friendly as others? I only worked with one widow all year, whereas I used to work with three or five a year.

My understanding is some financial coaches worked with many people and others like me worked with few to none. We’ll see how it goes next year. I may decide to explore other volunteer opportunities as more of my time has been spent on administratively keeping up with the organization than actually helping widows.

The Waves Are Real

The first half of this year was hard — really, really hard.

My financial planner friends and I always talk about how there are waves in this business. It can be quiet and then suddenly prospective families show up, seemingly out of nowhere. When it’s quiet, it can be tough.

You start to wonder, “Am I doing enough? What else should I be doing? How should I be marketing? Am I a failure?”

Waves normally last a month or two, but this year, it lasted longer.

I had a fair number of prospective client meetings, but then it dropped off a cliff and the few meetings I had, nobody was moving forward.

I started to get frustrated and a bit depressed.

I worked through it and reminded myself the business is doing fine and simply to enjoy the journey. Easier said than done, right?

It took some time, but I was feeling better about everything.

Then, as waves do, they changed in the later part of the year, and by the fall, I was referring a few people to other financial planners as I was booked out to 2026 with one-time plans. Where were all of those people earlier in the year?

Managing the waves is a work in progress. I keep reminding myself the best part of a hike is the journey to the top of the mountain — it’s not the view from the top. The same goes for building a business.

I Didn’t Accomplish My Goals

I’m giving myself grace on this one, and though I am a bit disappointed, I’m not overly disappointed.

I hoped to be at 1,000 newsletter subscribers by this time. I hoped to be at 1,000 YouTube subscribers. I wanted the draft of the book I’m working on done and in the hands of my proofreaders. I wanted to be working with 30 families.

I didn’t accomplish a single one of them.

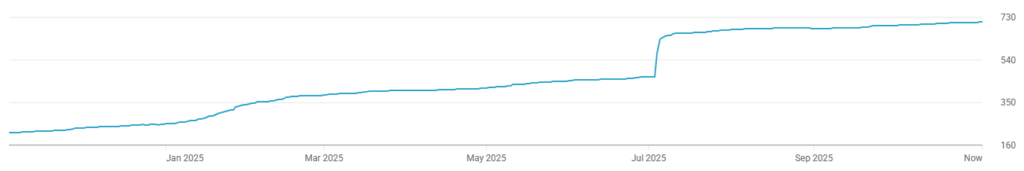

I have over 900 newsletter subscribers, over 700 YouTube subscribers, the book hasn’t been finished, and I’m working with about 25 families on an ongoing basis.

I’m close on many, but not there.

I’m most disappointed with the YouTube subscriber count falling short. I spent more time on it this year. I’m producing two videos a month. I’ve reworked my thumbnails and titles because I spent a lot of time learning about how much those impact viewer count.

Most of the subscribers came from a video I produced as the One Big Beautiful Bill Act passed (see image below). I simply beat most people to producing a video, which was the strategy, but unfortunately, my other videos aren’t getting views like many other financial planners’ videos. It’s a disappointment because I think my videos are on par with many others, and yet, some people get over 1,000 subscribers in a few weeks of starting.

Although it wasn’t a goal I had last year or any year, I am very proud that in the four years I’ve been in business, I haven’t had a single client quit who hired me on an ongoing basis and moved their money to Charles Schwab to be managed. I’m being specific about moving money because there was one person who initially hired me, but never transferred their assets when they decided they didn’t want to invest in the stock market.

I’m sure the 100% client retention rate will fall at some point, but I’m proud of it.

My Wishes for Next Year

My goals are similar for next year.

I hope to be working with 30 to 35 clients long-term. I’d love it if that happened in the next year, but if it doesn’t, that’s okay. The business is in a good place, and I keep reminding myself to enjoy the journey and the waves.

I’d like to say yes to a few more random things. I did that quite a bit in year one and two, and it led to interesting experiences and opportunities that often led to business growth, albeit in an indirect way I never saw or expected.

I’d like to continue growing on YouTube. Although I love writing because it helps clarify my thoughts and shares information, video seems to be the preferred format for taking in information these days.

Matt and I will continue with the podcast. We’ve thrown around a few ideas for a course or other collaborative project, which would be great.

I’m planning to go to XYPN Live next year. I haven’t been to a conference in a couple of years because I wasn’t sure what I wanted to get out of them and wanted to focus on my business instead. I’d like to get back to those connections and the larger financial planning community.

I’ve been toying with the idea of a retreat with other financial planners for a few years. I don’t know if I’ll make it happen, but I’m writing it here to put it out into the world. The world is feeling less connected these days, and I’d really like to create a space for people to come together for a weekend and see what happens.

Second to last, I’d like to not get too stressed about upcoming life changes with my wife’s career. I’m a naturally anxious person and have struggled with anxiety in the past. Big life changes are hard for me. Moving to the Midwest was a challenge.

Although she doesn’t finish her Cardiology Fellowship until June 2027, this next year is likely a year of interviews, weighing options, and potentially securing her first attending job.

Lastly, I’d like to continue exploring what the next phase of Kindness Financial Planning looks like. I don’t have any concrete goals for this phase other than five to ten more clients. I’ve started talking with other financial planners to learn more about how they see their eventual exit from their firm. I’m nowhere close, but what I do in this next decade matters a lot for two or three decades from now.

What I mean by that is I intend to stay small. I’m weighing whether that means solo, solo with an assistant, a merger with another solo advisor, or solo with a younger advisor that may one day take over the firm. I’m still leaning toward solo for the foreseeable future, but I know another advisor that followed the solo with a younger advisor path, and it has some appeal as it has worked really well, but it may simply be one of those “unicorn” scenarios.

Final Thoughts – My Question for You

I’m incredibly grateful to my clients. Without them, I wouldn’t have a business. They’ve entrusted me to be an integral part of their lives, and that’s a special relationship.

I love what I do. I love what I get to learn from the families I work with and how it informs my work. I love marrying the technical side of planning, such as tax planning, retirement planning, income planning, and more, with the emotional side of money.

I’m thankful I love what I do and get to do it for people I admire, respect, and enjoy seeing.

Matt and I have regular conversations about life, and he asked me this year “What multiple would you need to sell your firm?” I stumbled for a moment thinking about the number.

There wasn’t one.

Even if it made me financially independent.

I don’t know what else I would do!

While building a business comes with highs and plenty of lows, I’m very happy to be a financial planner with my own business and work with families in the way that I think best serves them — not what a boss, private equity firm, or other competing interests think.

I’ll leave you with one question to act on.

Are you feeling confident about all aspects of your financial life? If not, let’s talk and figure out if we can get you there.