Last Updated on July 17, 2023

How to plan for long-term care and whether to purchase long-term care insurance is a difficult decision.

Most people never plan on living years or decades with health issues, but it is becoming more common, which makes planning for long-term care important.

How will you pay for care? Which assets will you use? Do you plan to receive care at home? Can you rely on friends and family for care and if so, for how long? Is long-term care insurance worth it?

Let’s talk more about all the questions you may have surrounding long-term care and long-term care insurance.

How Much Does Long-Term Care Cost?

First, how much does long-term care cost? You’ve probably heard many different answers because it depends on which type of care someone needs and for how long.

If you only need help at home for a few hours each week, that is going to cost far less than someone who has dementia and needs to be in a memory care unit.

Everybody experiences long-term care differently, and while that may be obvious, it’s important to note because that factors into how people view long-term care and the costs.

If you are curious how much long-term care costs, I’d encourage you to use Genworth’s Cost of Care calculator and ask local agencies or facilities in your area.

For example, as of this writing, the hourly median cost of a home health aide in Olympia, WA is $35 an hour in 2021, but I know from personal experience that most companies are charging $40+ an hour in 2022. The median assisted living facility cost is $4,805 per month, but that is likely without any additional services, which many people may require in an assisted living facility.

It’s also important to note that your cost and availability of care is going to depend on location. For instance, a nursing home facility may cost over $24,000 in Anchorage, AK while it may cost $12,000 in Seattle, WA and less than $10,000 in Madison, WI.

Costs can vary widely on your location and access to care is also an issue for many parts of the United States. Many people are struggling to find consistent and reliable help at home, even if they have the resources.

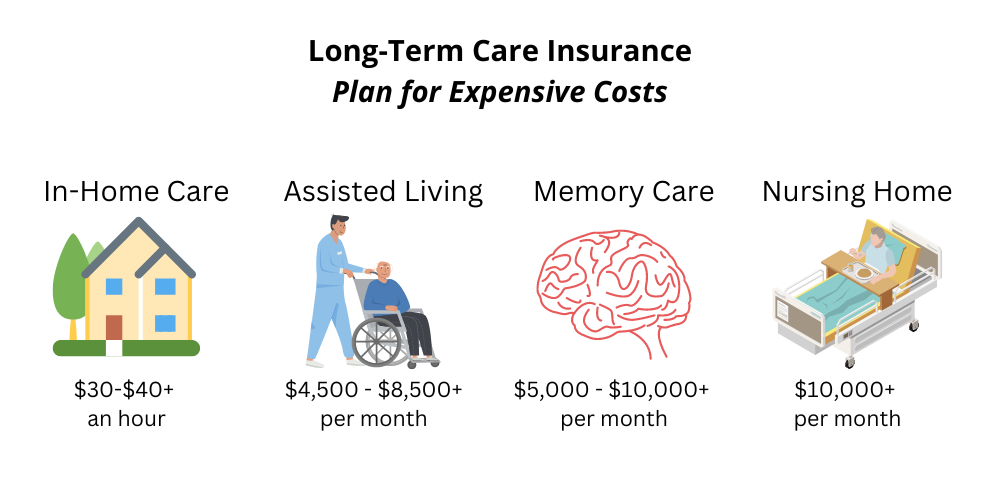

As a starting point, I’d recommend planning on paying the following:

- $30-40+ an hour for in-home care

- $4,500 – $8,500+ per month for an assisting living facility

- $5,000 – $10,000+ per month for a memory care facility

- $10,000+ per month for a nursing home

It will depend on many different factors. I would not count on the published rate being the price you pay. The published rate on many calculators and even living facilities websites is their minimum. It often does not include extra services that you may need.

Now that you know how much it costs per hour or month, how long do people tend to need care?

How Long Do People Usually Need Long-Term Care?

On average, someone turning age 65 in 2020 had an almost 70% chance of needing some type of long-term care services.

Interestingly, 33% of people aged 65 in 2020 may never need long-term care, but 20% may need it longer than 5 years.

That makes planning difficult. You may never need it, or you may need it for a long time.

Women and men also need care for different amounts of time. Women tend to need care for about 3.7 years while men need it for 2.2 years.

If men need care for an average of 2.2 years and we assume the cost is $7,000 per month, that means it could cost $182,000. You can scale up or down depending on the type of care.

If women need care for an average of 3.7 years and we assume the cost is $7,000 per month, that means it could cost $301,000. Depending on the progression of the illness or aging, you can scale the cost up or down.

Please keep in mind that these are averages. While some people never need care, others may need it for 10+ years. People with Alzheimer’s often still live a long time, but need care in memory care facilities for more than a decade. It could cost $1,000,000+ over those 10 years.

Long-term care costs are expensive and often increase at a faster rate than normal inflation, which makes planning for it important.

You can see the types of care, number of years people use it, and the percent of people who use the type of care below.

| Type of Care | Average Number of Years Used | Percent of People Who Use Care |

| Any services | 3 Years | 69% |

At Home

| Type of Care | Average Number of Years Used | Percent of People Who Use Care |

| Unpaid care only | 1 year | 59% |

| Paid care | Less than 1 year | 42% |

| Any care at home | 2 Years | 65% |

In Facilities

| Type of Care | Average Number of Years Used | Percent of People Who Use Care |

| Unpaid care only | 1 year | 35% |

| Paid care | Less than 1 year | 13% |

| Any care at home | 1 Year | 37% |

Source: https://acl.gov/ltc/basic-needs/how-much-care-will-you-need

These statistics are why long-term care and long-term care insurance is such a polarizing topic with many different opinions. If you meet a daughter who had a mother who spent 10 years in a memory care facility and saw a long-term care insurance policy provide benefits for her stay, she may really want long-term care insurance for herself.

However, if you meet a son who had a mother who spent 20 years paying for a long-term care insurance policy, but his mom never used it because she died suddenly, he may not see the value in it.

Many people may decide they want to age in place. Before you decide you are going to age in place, decide if aging in place is the right decision. It may not make the most financial or emotional sense for you and your family.

Long-term care insurance is a deeply personal decision. While it’s easy to see how long-term care is expensive, there is a good likelihood the average person will need some type of long-term care.

How Does Long-Term Care Spending Fit With Other Spending?

When planning for long-term care, remember that much of your other spending often decreases when you need long-term care. For example, in the financial independence plans I go through with clients, people often assume that long-term care costs are on top of all of their other spending. If they are spending $100,000 per year, they assume that they may need to spend another $100,000 on long-term care, bringing their total spending to $200,000.

That’s often not the case.

Usually, when you need long-term care, your other spending often declines or ceases entirely. For instance, you may no longer travel, buy new cars, or spend as much on entertainment. Assisted living facilities often have transportation options, provide entertainment, and you may not feel well enough to travel. If those cost $30,000 per year, perhaps your normal spending goes down by $30,000, so your total costs would be $170,000 instead. It could even be less.

When planning for long-term care, you usually don’t need to add the costs of care to your existing spending. Long-term care costs often increase someone’s total spending, but not by the full amount.

What is Long-Term Care Insurance?

While many people choose to self-insure or spend down their assets until they qualify for Medicaid, others choose long-term care insurance to help cover the costs of long-term care.

Long-term care insurance is an insurance policy that may help to cover the costs of in-home care, an assisted living facility, memory care facility, or a nursing home.

Long-term care insurance may help cover the costs for custodial care, which is different from skilled, acute, or rehabilitative care that health insurance may cover.

You may be able to activate your long-term care benefits when you are unable to do two of the six activities of daily living or have a cognitive impairment.

Types of Long-Term Care Insurance

Like life insurance, there are many different types of long-term care insurance. There are different ways you may see policies broken down, but I like to break them down as follows:

- Traditional stand-alone

- Hybrid life insurance with long-term care benefits

- Annuity with long-term care benefits

I’ll explain the pros and cons of each, but if you are looking for 60+ pages of information on long-term care insurance, you can check out A Shopper’s Guide to Long-Term Care Insurance, which is put out by the National Association of Insurance Commissioners.

Traditional Stand-Alone

Traditional stand-alone long-term care insurance policies are where you pay purely for long-term care benefits. You aren’t bundling a policy with other benefits and also aren’t paying more for those benefits.

Many insurance companies are no longer offering traditional stand-alone long-term care insurance policies because of a few reasons:

- Insurance companies mispriced them in the 80s and 90s.

- Interest rates declined and stayed lower than anticipated.

- Policyholders did not let their policies lapse at the rate insurance companies thought they would.

- Payouts were higher and profits were lower than anticipated.

If you are looking for more information about why insurance companies left the long-term care insurance market, there was a study in 2013 that explored those reasons.

There are a couple companies, such as Mutual of Omaha and New York Life, among a few others, remaining that sell stand-alone long-term care insurance policies.

Traditional stand-alone long-term care insurance policies normally work by paying a certain premium annually or monthly that buys you a certain “pool” of benefits that can be used for long-term care.

The premium is normally designed to be level throughout the policy period, but can be raised on entire classes of policyholders by asking the state insurance commissioner for permission to raise premiums if they foresee not being able to fulfill their obligations to pay benefits in the future.

This is what you may have read about in the last decade where companies like Genworth and others have sought approval to raise premiums because they mispriced policies. Insurance commissioners then look at the insurance company’s records and approve or decline a premium rate increase request.

Pros of Traditional Stand-Alone Long-Term Care Insurance

Cheaper Premiums: You normally get the most benefit per dollar of premium paid when buying a stand-alone long-term care insurance policy. If you are looking for an inexpensive policy purely designed to cover potential long-term care expenses, a stand-alone policy is normally going to be your best bet.

Customize Policy: These are often the easiest policies to understand. They usually come with four levers that affect the price:

- Benefit amount: the monthly or daily amount the policy would pay if you qualify for benefits

- Benefit period: how long the benefits will last

- Cost of living adjustment: how much the benefit amount will increase annually, often 3% or 5% (simple or compound interest, depending on the policy)

- Elimination period: how long you need to pay for your own care before the policy will pay benefits

I’ll talk about each of these in more detail later in the article.

You can normally customize each lever to design a policy that works well for what you want to protect and how much you are willing to pay.

Highest Leverage of Your Money: Stand alone insurance policies often provide the most leverage. For example, you may pay a few thousand dollars and then have access to a bucket of money for long-term care worth over a hundred thousand dollars. This means you may be able to leverage your money over 50 times on day one.

Cons of Traditional Stand-Alone Long-Term Care Insurance

Premiums Can Increase: A con of a stand-alone long-term care insurance policy is that the costs are technically unknown. While the premium is meant to stay level, that is not guaranteed. Costs could go up late in life, when you need it most and when you’ve already paid a significant amount to the insurance company. If you decide you don’t want the policy anymore, you can let it lapse, but you also may not receive anything in return. If premiums go up, you often can also adjust the levers previously mentioned to reduce the cost.

Underwriting Can Be Difficult: These policies can sometimes be hard to qualify for depending on your health conditions. Since long-term care insurance is concerned about your morbidity risk – not your mortality risk – certain conditions, such as memory issues could disqualify you from getting a policy.

Use It or Lose It: Some people have issues with paying money into a policy and receiving nothing in return if they don’t need long-term care.

Personally, I look at insurance as hoping I never have to use it. I’m happy that I’m alive and have never collected on my life insurance. I’m glad I’ve never had to file a homeowner’s insurance claim, despite paying the premium each year. I’ve had to file an auto insurance claim when someone hit me, and it was a painful experience. I’d rather never file a claim for insurance. The same can be said for long-term care. If you don’t file a claim, that usually means life went fairly well.

Some people want to get value out of a policy they have paid into though, so some people see the fact that you don’t usually receive value out of your policy if you don’t have a qualifying long-term care event as a con.

Hybrid Life Insurance with Long-Term Care Benefits

Hybrid life insurance with long-term care benefits is a bundling of insurance. Instead of purely paying for and receiving long-term care benefits, you are paying for life insurance with the ability to access money within the policy for long-term care or a critical illness.

Some people gravitate to these policies because they want to be assured that they will get some value out of it – either for themselves through long-term care or to their heirs through the life insurance.

Hybrid policies come in a variety of types:

- Linked benefit

- Adding a long-term care rider

- Chronic illness or critical illness rider

Each functions differently in how you purchase, how it is activated, and how benefits are paid.

The linked benefit policy is typically where you pay a lump sum and receive about three times the lump sum amount in death benefits. For example, if you put $100,000 into a policy, it might provide about $300,000 in death benefit that can also be used for long-term care.

Adding a long-term care rider to a life insurance policy may allow you to use a portion of the death benefit amount for long-term care under certain conditions. When you use it for long-term, the death benefit amount is usually reduced.

Adding a chronic illness rider to a life insurance policy is typically the least generous option for long-term benefits. Like the long-term care rider, accessing the benefits usually reduces the death benefit, but you are more limited in when you can access the benefits. Typically, the illness has to be expected to last the rest of your life whereas with a stand-alone or linked benefit policy, it does not. For example, a stand-alone or linked benefit policy may pay out during a hip replacement if you have a long recovery time and can’t perform two out of the six activities of daily living. A life insurance policy with a chronic illness rider may not.

Hybrid policies have many different rules and fine print, which means if you decide to go this direction, you should work with an experienced insurance agent, ask a lot of questions, and have a clear understanding of what the policy provides prior to purchasing.

Let’s look at the pros and cons of hybrid life insurance with long-term care benefits.

Pros of Hybrid Life Insurance with Long-Term Care Benefits

Won’t Lose Benefit: A pro of a hybrid life insurance policy with long-term care benefits is that as long as you pay the premium and the policy remains in force, you or your heirs will benefit from it. You won’t possibly pay the premium for decades, die, and then not receive any payout as could happen with a stand alone long-term care insurance policy. Although you may not receive the full amount of the premiums paid, you could receive a portion.

No Premium Increases: You can fix the premium amount without the risk of it going up. Some people shy away from the stand-alone policies because it’s possible for premium rates to go up. With a hybrid life insurance policy with long-term care benefits, you could design a policy to be fully paid up with one lump sum deposit, pay over 5 years, 10 years, for life, or a variety of other structures. People often like the certainty of these policies.

Repurpose Old Life Insurance: These policies can be purchased via 1035 exchange, which means if you have a life insurance policy with a large gain that you no longer need for life insurance and could qualify for a new life insurance policy, you could potentially move those funds into a new policy with long-term care benefits. It’s a way to repurpose old life insurance for a new purpose without paying taxes on the gain in the policy.

Leverage Your Money: Hybrid policies provide leverage. Although it’s usually not as much as a stand-alone long-term care insurance policy, they may provide around three times your initial premium if you pay a lump sum. If you pay for life insurance over your life, the leverage may be even higher. For example, if you pay $10,000 a year for a $1,000,000 death benefit that can be used for long-term benefits, you have 100 times leverage on the first day.

Cons of Hybrid Life Insurance with Long-Term Care Benefits

More Expensive: It is usually more expensive than a stand alone long-term care insurance policy. Since you are paying for life insurance and the insurance company has a much higher likelihood of paying out the death benefit, it will cost more. Your premium dollars are not going to go as far in buying benefits as a stand-alone policy.

Life Insurance Underwriting: Qualifying for a life insurance policy can be difficult as you age. Since these are life insurance policies, underwriters look for mortality factors. If you have certain conditions or family health history, you may not qualify for a policy and might have an easier time qualifying for a stand-alone policy. It depends on your individual situation.

Reduced Death Benefit If Used for Care: If you use the life insurance policy for long-term care benefits, you are often reducing the death benefit, which means if you have a need for life insurance policy, you may be short on that goal. You may need a different life insurance policy to fulfill your legacy planning wishes.

Annuity with Long-Term Care Benefits

You can also purchase annuities with long-term benefits, which is often done through adding a rider to a fixed or indexed annuity contract.

Unlike stand-alone long-term care insurance policies, you are paying more for the annuity benefit with the option to use it for long-term care, meaning it will likely cost more than a stand-alone policy.

Similar to life insurance with long-term care benefits, the benefit for long-term care is often two to three times your annuity value. For example, a $100,000 annuity might pay out $200,000 or $300,000 for long-term care benefits.

Pros of Annuity with Long-Term Care Benefits

No Premium Increases: Many people like the fact that annuities with long-term care riders can be purchased with a lump sum, meaning their premium will never be raised. Unlike stand-alone long-term care insurance policies, you don’t need to worry about what your premium will be 20 years later because your policy is already paid for.

Less Stringent Underwriting: Annuities with long-term care benefits often have easier medical underwriting to qualify. While stand-alone long-term care insurance policies and hybrid life insurance with long-term care benefits can be difficult to qualify for, annuities with long-term care benefits often only require a series of questions. If you answer no to all of them, you may qualify. If you answer yes to one of them, you may not qualify. They likely won’t need to order your medical records or do labs like they may with the other types of long-term care policies.

Repurpose Old Annuities: If you have money in an old annuity with high fees, poor investment options, or it simply doesn’t meet your needs anymore, you may be able to do a 1035 exchange into a different annuity with long-term care benefits. The benefit of doing a 1035 exchange is that you may be able to continue deferring taxes on the gain inside the old annuity while repurposing it for long-term care needs.

Leverage Your Money: Similar to life insurance, you can often get two to three times the value of your annuity to use for long-term care benefits. Annuities don’t provide the most leverage, but they do provide benefits on day one. For instance, if you put $100,000 into an annuity and needed care the next day, the policy might provide benefits of up to $200,000 or $300,000, which is more than you had the prior day.

Cons of Annuity with Long-Term Care Benefits

Large Up Front Payment: If you are not doing a 1035 exchange, annuities with long-term care benefits often require a large up front payment. For example, you might need to put $75,000+ into a policy, which means you can’t use that money for other purposes or invest it. Depending on the product, that may mean that money won’t grow as much over time.

Withdrawals Taxable for Non-LTC Expenses: Withdrawals for long-term care are tax-free, but if you take withdrawals from an annuity for other expenses, they are taxed as ordinary income. If you take money from a brokerage account, where growth is taxed as capital gains when sold, and put it into an annuity, the taxation is usually worse if not used for long-term care. You are taking capital gains tax treatment and turning it into ordinary income tax treatment on future growth when inside of an annuity.

Lack of Liquidity: Depending on the policy, you may not have access to the money you put into the annuity unless you pay steep surrender charges. Your money may be locked up for years, which means if you need it for something else, you may not be able to get the full value you put into it.

How Much Does Long-Term Care Insurance Cost?

If you know care often costs between $5,000 and $10,000+ per month for assisted living or nursing homes, how much does long-term care insurance cost?

It depends on the type of long-term care insurance you purchase, your health, state of residence, how you customize the policy, and many other factors. Let’s look at a few examples to give you an idea of how much it may cost. Jill from LLIS was kind enough to run example quotes for Washington state as of October 2022 and assumed good health.

Stand-Alone Long-Term Care Insurance Cost

These quotes are from Mutual of Omaha, one of the few remaining stand-alone long-term care insurance carriers. They are based on a $4,000 monthly benefit, 3 year benefit duration, 90 day elimination period, and a 3% compound inflation adjustment.

What this means is that the $4,000 monthly benefit is multiplied by 36 months (3 years) to give you a total pool of benefits worth $144,000. If you need care that is less than $4,000 per month, it would extend how long the policy will last. For example, if you need care that is $2,000 per month, it would last longer than 36 months. If your care costs $6,000 per month, your policy will only pay $4,000 per month, and you would need to cover $2,000 from your own investments.

The 90 day elimination period is how long you would need to cover the costs of long-term care before the policy paid benefits.

The 3% compound inflation adjustment means your monthly benefit amount will increase by 3% annually. If you bought the policy this year, your monthly benefit would be $4,120 next year, about $4,243 the following year, and so on.

You can adjust these levers to increase or lower the premium. I look at these policies as a middle ground. It may cover a good portion of care when people first start needing care, but once you go into an assisted living or nursing home, your policy may cover only a portion while your assets need to cover the rest.

Annual Premiums for Mutual of Omaha Stand-Alone Long-Term Care Insurance Policy

| Ages | Male | Female | Couple |

| 40 | $1,427 | $2,300 | $3,168 |

| 50 | $1,706 | $2,826 | $3,852 |

| 60 | $2,191 | $3,729 | $5,032 |

| 65 | $2,749 | $4,599 | $6,246 |

The couple policy means that each person has access to a pool of benefits worth $144,000 from day one, which means combined, they have $288,000 in long-term benefits.

As you can see, you get significant leverage for your premiums. A female buying a policy at age 65 will pay $4,599 annually for a pool of benefits worth $144,000 on day one. If she needs care the day after she purchases it, she is getting 31 times what she put into it. Even if she pays the $4,599 annually for 20 years, she will pay a total of $91,980 into the policy. By the time she is age 80, her monthly benefit would be about $7,224, giving her a total pool of benefits worth approximately $260,080. That is about 2.8 times what she put into the policy.

While it’s not inexpensive, stand-alone long-term care insurance policies are often the cheapest way to access long-term care insurance benefits if you can qualify for a policy.

I didn’t ask for quotes past age 65 because it’s often harder to qualify in your late 60s or early 70s for a policy, which I’ll talk about more in a section below.

Hybrid Life Insurance with Long-Term Care Benefits

These quotes are from Nationwide, though there are many carriers that offer life insurance with long-term care benefits. If you are looking into these policies, make sure you shop around different carriers to understand the costs, benefits, underwriting, and how you qualify for benefits.

This policy also has a $4,000 monthly benefit, 3 year benefit duration, 3% compound inflation adjustment, 90 day elimination period, $96,000 death benefit, and assumes premiums are paid until age 100.

What this means is that if the policy is not used for long-term care benefits, heirs would receive the death benefit. This solves the problem many people complain about with stand-alone long-term care insurance policies in that they could pay into it for years and get nothing out of it.

If the policy is used for long-term care, the death benefit may be reduced.

Annual Premiums for Nationwide Hybrid Life Insurance with Long-Term Care Benefits Policy

| Age | Male | Female |

| 40 | $2,605 | $2,769 |

| 50 | $3,869 | $4,129 |

| 60 | $5,957 | $6,573 |

| 65 | $7,959 | $8,509 |

As you can see, these policies are much more expensive than traditional stand-alone long-term care insurance policies. For similar coverage, it might be around 1.5 times more expensive.

If a spouse or partner is living in the home, couples can receive discounts even if the spouse or partner does not apply for a policy. Below are those rates.

Annual Premiums for Nationwide Hybrid Life Insurance with Long-Term Care Benefits Policy if Married and Spouse/Partner Living in The Home

| Age | Male | Female |

| 40 | $2,445 | $2,652 |

| 50 | $3,516 | $3,808 |

| 60 | $5,241 | $5,931 |

| 65 | $6,935 | $7,582 |

If you wanted to provide a lump sum deposit of $100,000 and never pay a premium again, below is an estimate of the monthly benefit and death benefit assuming a 3 year benefit period and 3% compound inflation adjustment.

Annual Premiums for Nationwide Hybrid Life Insurance with Long-Term Care Benefits Policy – Female

| Age | Long-Term Care Monthly Benefit | Death Benefit |

| 40 | $6,690 | $160,549 |

| 50 | $5,511 | $132,269 |

| 60 | $4,654 | $111,697 |

| 65 | $3,998 | $95,944 |

Annual Premiums for Nationwide Hybrid Life Insurance with Long-Term Care Benefits Policy – Male

| Age | Long-Term Care Monthly Benefit | Death Benefit |

| 40 | $7,092 | $170,218 |

| 50 | $6,358 | $152,591 |

| 60 | $4,930 | $118,320 |

| 65 | $4,210 | $101,034 |

While it’s attractive to never pay a life insurance premium again, you do tie up $100,000 to get these long-term care benefits. You can also design a policy to pay premiums for 10 years or other amounts of time if you want to limit the payment period, but not do a lump sum.

Annuity with Long-Term Care Insurance Benefits

I didn’t ask for quotes for these policies because they tend to be 2 to 3 times the amount you put into them.

For example, if you put $100,000 into a policy, it may provide access to $200,000 or $300,000 for long-term care benefits.

There are many different insurance carriers that provide annuities with long-term care benefits. Like the other policies, you want to shop around and understand the terms of the policy before applying.

When Is A Good Time to Buy Long-Term Care Insurance?

Many people ask the question, “When should I buy long-term care insurance?”

My joking answer is to have it in force the day before you need it.

If you knew exactly when you would need long-term care, it would be an easy decision, but the problem is nobody knows when they will need it. Some need it at age 30. Others at age 70. Some people never need it.

Typically, people recommend exploring long-term care insurance in your late 50s or early 60s. Generally, many people don’t have any significant health events that would disqualify them from coverage and policies are not too costly; however, you never know when something may happen that may disqualify you.

Some people in their 40s get long-term care insurance because they are afraid they won’t qualify later. Waiting is a risk. There is still a 16% denial rate for people 49 or younger.

Each day that passes means you could be diagnosed with cognitive impairment, Huntington’s disease, multiple sclerosis, Parkinson’s or another illness that disqualifies you from getting long-term care insurance.

I know someone who discussed memory issues once with their doctor, and that note disqualified them from coverage.

You need to decide for yourself whether the risk of waiting to buy long-term care insurance is worth it.

Does Medicare or Medicaid Cover Long-Term Care?

Many people assume Medicare will pay for long-term care, but in most cases, it won’t.

You’ll need to pay for long-term care through the following:

- Personal resources

- Long-term care insurance

- Medicaid

Medicaid is a joint federal and state program that can help with medical costs, including long-term care; however, you have to spend down nearly all of your assets before you can apply and get coverage.

Each state has different rules regarding Medicaid and how much you can spend down, gifting rules, and more.

In many states, you can’t have more than $2,000 in countable assets. You may be able to keep your house (up to a certain equity value), a car, and prepaid funeral expenses, but it’s very limited.

Who Should Not Buy Long-Term Care Insurance

Before I talk about the types of people who may want to consider buying long-term care insurance, let’s talk about situations where it may not make sense.

Limited Resources

If you have limited resources, such as a low net worth or a low income, long-term care insurance may not make sense.

Most policies are going to cost a few thousand dollars a year at a minimum. If you don’t have the income to support it while taking care of your other needs, it likely doesn’t make sense to buy a policy.

Also, if you have limited assets, such as $100,000, a long-term care policy may not make sense. If you needed long-term care, there is a chance you would spend down your assets anyway to go on Medicaid.

Ultra High-Net-Worth (UHNW) Individuals

If you have $10M plus in assets, you may be able to self-insure most long-term care scenarios. While UHNW individuals may decide to buy insurance because of the leverage it provides and for the comfort a policy may provide, many choose to forgo long-term care insurance.

Over Age 75

If you are already over age 75, there is a much lower chance you will qualify for long-term care insurance. There may still be a possibility, but by that age, many people face a health issue that could disqualify them from coverage.

It’s estimated that about 51.5% of people who apply for long-term care insurance who are age 75 or older are denied. Please keep in mind this doesn’t include people who don’t apply because they already know they won’t qualify.

Poor Health

If you are already in poor health with a condition that would disqualify you, it likely doesn’t make sense to apply. Once you have a decline on your insurance record, it makes it very challenging to get a future policy.

This is why it’s important to work with a knowledgeable insurance agent who can help talk to the insurance company anonymously about your health to determine if it makes sense to apply.

Should I Buy Long-Term Care Insurance?

Now that you know more about long-term care insurance, let’s answer the question, “Should I buy long-term care insurance?”

Let me start by saying this is a deeply personal decision. Anecdotally, most of the people I see purchase long-term care insurance are people who have had a family member go through a major health event and needed long-term care. They understand the stress, cost, and burden of caring for another person and how a long-term care insurance policy could help.

The biggest benefit I see in buying a long-term care insurance policy is that paid caregivers are hired sooner. What I often see with couples who don’t have a policy is the other spouse trying to give care for an extended period of time, which lowers their quality of life, emotional well being, and health. Alternatively, a family member steps in to help, such as an adult child, often a daughter. They often reduce work hours, quit their job, or rearrange their life to help.

If a family member has a long-term care insurance policy, people are eager to use the benefits, so they can hire in-home help or transition to an assisted living facility sooner. It alleviates the burden put on other family members.

Besides that benefit, there is the leverage provided by insurance. Although you may be able to invest what you would have paid in insurance premiums over many decades and come out ahead, there is nothing that says you can’t have a major health issue come up at a younger age. If that happens, a long-term care insurance policy can help considerably.

There is also the peace of mind factor. Some people appreciate knowing they have a policy and will not need to spend as much from personal resources if they need long-term care.

As for whether it makes sense financially or emotionally for you, that’s up to you. It’s impossible to say if you would come out ahead by purchasing a policy because nobody knows if or when you will need care, for how long, and what type of care. If we knew what was going to happen in life, we wouldn’t need insurance.

You need to consider what it means for your financial plan with and without a policy, which could include modeling a few different scenarios in your financial plan to see how it could change your probability of success.

What Factors to Consider When Buying a Long-Term Care Insurance Policy

If you decide to purchase a policy, think critically about whether you want a stand-alone long-term care insurance policy, hybrid life insurance with long-term care benefits, or an annuity with long-term care benefits.

Within those, pay special attention to the following categories:

- Benefit amount

- Benefit period

- Elimination period

- Cost of living adjustment

- Indemnity versus reimbursement payments

- What triggers the benefits

- Long-term care partnership status with your state

Benefit Amount

Although you can aim to cover 100% of anticipated long-term care expenses, I often suggest people consider a lower amount and see it as a co-insurance. What I mean by this is that you will plan to have insurance cover part of the long-term care expenses and your personal assets cover the rest.

This can strike a balance between paying too much for insurance you may never need and not getting a policy.

For example, if expenses in most living facilities are $6,000 – $8,000, you could get a policy that covers a $3,000 – $4,000 monthly benefit. It may cover all of the in home care you need initially, but as time goes on and you need more care, it may only cover 50% of the future long-term care expenses.

Benefit Period

The benefit period is another lever you can adjust to customize the policy to your liking.

While you could get a policy that provides benefits for 5 or 6 years, you could get something closer to the average time people need care, such as 2 or 3 years.

You know your family health history, finances, and concern about long-term care expenses. If you were worried about dementia, perhaps you buy a policy with a longer benefit period.

Elimination Period

While 90 days is often a sweet spot for coverage, you could potentially get a policy with a 180 day or 365 day elimination period. If you are worried about the tail end consequences, such as needing long-term care for a long time, you could make the policy more affordable by selecting a longer elimination period.

You could have the insurance agent show you prices for a 90 day, 180 day, and 365 day elimination period to see how it changes the premium.

Lastly, you should ask how the policy measures the elimination period. For example, some policies are based on calendar days, which means you only need to wait 90 calendar days if you had a 90 day elimination period. Other policies are based on service days, which means you have to get care for 90 days before the policy pays, which means it may be much longer than 90 days if you are only receiving care 3 days a week.

Cost of Living Adjustment

Plan carefully with the cost of living adjustment you select. Is it simple interest or compound?

Simple interest is going to provide a lower monthly benefit than compound interest and may not keep up with the rising cost of care.

Even a 3% inflation adjustment may not be enough to keep up with the rising cost of care. If you are younger, you may want to consider a higher cost of living adjustment or monthly benefit to compensate for the fact that it may be two or three decades before you need care.

If the cost of care is $7,000 per month now and increases at 4% per year, the monthly cost would be over $15,000 per month in 20 years. That’s the importance of adding a cost of living adjustment, so your monthly benefit can help keep up with the cost of care.

Indemnity versus Reimbursement Payments

Another aspect to pay attention to is whether the policy pays an indemnity cash benefit or a reimbursement benefit.

An indemnity cash policy will send your benefits as long as you qualify for benefits, and they can be spent on anything you want. You don’t need to provide bills to the insurance company and have more flexibility in how the money is used. You could use the money for prescriptions or home repairs. For example, if your benefit is $5,000 and care is only $3,000, they can send you a check for $5,000, which you can use for anything.

A reimbursement benefit policy requires bills or receipts to be submitted to the insurance company, and it only pays benefits up to the actual cost of services. For example, if your benefit is $5,000 and care is only $3,000, they will only pay $3,000.

What Triggers the Benefits

Although many policies are similar, ask what triggers the benefits. Typically, it’s not being able to perform two out of the six activities of daily living or a severe cognitive impairment.

The activities of daily living often include:

- Bathing

- Dressing

- Eating

- Mobility

- Toileting

- Transferring

You should understand what triggers the benefits in the policy and how the activities of daily living or severe cognitive impairment work in practice.

Long-Term Care Partnership Status with Your State

Lastly, research the long-term care partnership in your state and whether your policy is a partnership-eligible policy.

In some situations, a person can buy a long-term care partnership-eligible policy, which may allow them to spend down fewer assets and still qualify for Medicaid.

For example, if you had a policy that was partnership-eligible and the policy pays out $100,000, you may be eligible to keep an additional $100,000 in assets before being eligible for Medicaid coverage.

In other words, a partnership-eligible policy may allow you to keep more of your assets and still go on Medicaid if you face a scenario where you have to spend down your assets.

Not all policies are partnership-eligible and some require certain cost of living adjustment amounts.

It’s one factor you should consider when buying a long-term care insurance policy.

Should I Keep My Existing Long-Term Care Insurance After My Premium Went Up?

Perhaps you bought a long-term care insurance policy in the past, but have been subject to premium increases. Should you keep it and pay the higher premium?

It depends on your financial situation, but generally, these policies are still much cheaper and more generous in benefits relative to what you can purchase today.

If you don’t want to pay the increased premium, you can usually adjust the monthly benefit, cost of living adjustment, or benefit duration to reduce the premium. If your benefit duration is long, one option could be shortening the benefit duration. This way you still have coverage, but pay less in long-term care insurance premiums.

Before you give up a policy, I’d talk with your insurance agent or a financial planner to determine how the policy fits in your financial picture and whether adjustments can be made before giving it up.

Final Thoughts – My Question for You

Long-term care insurance is a very personal decision.

I’ve met people who disliked that they bought a policy and others who are extremely grateful they had the benefits.

You’ll have to consider what personal resources you have for long-term care, what family members are available to provide care, the possible burden you are putting on family members, and many other factors to determine if long-term care insurance makes sense for you.

After that, ask many questions. Then, ask more questions. You want an insurance agent who will work with you to customize a policy to your liking, makes sure you understand the policy, and considers your health before applying.

I’ll leave you with one question to act on.

What step will you take to determine if long-term care insurance is right for you?