Last Updated on January 14, 2025

It’s hard to believe 2021 is coming to a close. With the end of year quickly approaching, it is your last chance to do end of year tax planning.

I recommend doing tax planning earlier in the year as much as possible, but I recognize there might be a few things that require you to wait until the end of the year.

With that in mind, let’s discuss what you should review before the end of the year that could result in penalties if not completed and other ways to strategically think ahead to reduce taxes.

Here is your 7-step 2021 year-end tax planning checklist:

- Complete Required Minimum Distributions

- Analyze Opportunities for Roth Conversions

- Proactively Tax-Gain and Tax-Loss Harvest

- Complete Charitable Giving

- Review Contributions to Tax-Advantaged Retirement Accounts

- Review Tax Withholdings and Estimated Tax Payments

- Decide Whether to Gift to Family

Step 1: Complete Required Minimum Distributions (RMDs)

If you turned age 72 this year and have an IRA, SEP IRA, SIMPLE IRA, or retirement plan account, your first RMD is due by April 1 of 2022; however, if you wait until 2022, you’ll have two RMDs to complete in 2022. Depending on your tax situation, you may want to complete it in 2021.

If you are older than age 72, don’t forget to complete your RMD this year. In 2020, the CARES Act made it so that RMDs were not required, which was a nice relief, but that is not available this year.

The penalty for not completing an RMD is 50% of the amount that should have been distributed. For example, if your RMD is $50,000, the penalty for not distributing your RMD by 12/31/2021 would be $25,000. This makes it a very important step on the checklist because the penalty can be significant!

There are ways to correct a missed RMD and ask for forgiveness, but it is not guaranteed.

If you do not need your RMD for spending, you could reinvest the proceeds into a taxable brokerage account.

If you want to reinvest the money, ask your retirement account custodian to write you a check, deposit the check into your taxable brokerage account, and place the trade to reinvest the money. It’s even easier if your taxable brokerage account and retirement account are with the same custodian because you can usually move the money inside the system and not have to deal with a check or wire.

If you are charitably inclined, you could also do a Qualified Charitable Distribution (QCD). QCDs are one of the best ways to give because for each dollar you give up to $100,000 per year, the distribution is not taxable and can satisfy your RMD.

For example, if your RMD is $20,000 and you distribute $5,000 as a QCD, only $15,000 is taxable to you. If you distribute $20,000 as a QCD, none of it is taxable. You can distribute more than your RMD as a QCD (up to $100k), but it does not carry forward to satisfy your RMD for the following year. If you distribute more, you reduce the balance in your retirement account, which would make future RMDs slightly smaller.

Generally, I favor completing RMDs earlier in the year because it’s one less thing to worry about at the end of the year. Plus, if you are reinvesting the money in your taxable brokerage account, the tax treatment is usually more favorable. You can tax-loss harvest if the reinvested money in the taxable brokerage account goes down in value, and future growth is taxed at capital gains rates. Capital gains rates are generally lower than ordinary income rates that apply to growth in a retirement account. Or, if you are doing a QCD, the charity gets the money sooner, which is a benefit to them.

For those who are not age 72 or older, but have an Inherited IRA or Inherited Roth IRA, don’t forget to complete your RMD. The distribution rules are complicated and vary depending on many factors.

Generally, for account owners who died in 2020 or later, the account needs to be distributed by December 31 of the 10th year after the year in which the account holder died. For example, if someone died in 2020, the account would need to be fully distributed by December 31, 2030. Distributions can be taken earlier, but the account needs to be completely distributed by then.

If the account owner died prior to 2020, distributions can generally be stretched over your lifetime using the Single Life Expectancy table.

Please keep in mind that distribution rules are complicated, and your situation may vary from the normal process. You should consult your tax advisor or financial planner about your individual situation.

Step 2: Analyze Opportunities for Roth Conversions

It’s a great time to consider a Roth conversion before the end of the year. Unlike contributions, which can be contributed until your tax filing deadline (not including extensions), Roth conversions have to be done in the calendar year for them to count in that year’s income.

For many people, there are only a few years left to take advantage of the lower tax rates created by the Tax Cuts and Jobs Act.

The current rates, which are lower and wider, are due to sunset at the end of 2025, which means starting in 2026, we’ll be back to the 2017 tax rates adjusted for inflation. Those tax rates are higher and have a narrower income range within each bracket.

If you are in the 22% or 24% marginal tax bracket, it’s a particularly good time to analyze whether a Roth Conversion makes sense because those tax brackets roughly correspond to the 25%, 28%, or a higher tax bracket under the 2017 tax rates.

Roth conversions don’t make sense for everybody. It depends on your IRA balances, income now and in the future, how your investments are structured, and how willing you are to hedge against higher tax rates in the future.

Generally, if you have more than $750,000 in a retirement account and are 72 or younger, it makes sense to compare your current year tax bracket to a future estimated tax bracket to determine if you should do a Roth conversion. If you can pay a lower tax rate now than you anticipate paying in the future, it likely makes sense to do a Roth conversion.

Step 3: Proactively Tax-Gain and Tax-Loss Harvest

Although many people think a 0% tax bracket is a good thing, it’s actually a missed planning opportunity – one that could cost you thousands of dollars or more.

It’s a little like paying for an all-inclusive vacation, but only staying on one part of the beach and eating the same meal at the same restaurant every day. You should have done more, but you missed out.

What many people don’t understand is that ordinary income tax rates and capital gains tax rates are separate, but connected.

Most people are familiar with ordinary income tax rates because it’s how most of us are taxed while working. If you earn $100 while working, you have $100 of ordinary income. When someone retires or is no longer earning as much ordinary income, they generally fall into a lower income tax bracket, but they also fall into a lower capital gains bracket – sometimes even 0%.

Capital gains are recognized when you sell an investment for more than what you bought it for in a non-retirement account. For example, in a brokerage account, if you bought a stock for $10 and sold it for $30, you would have $20 worth of capital gains.

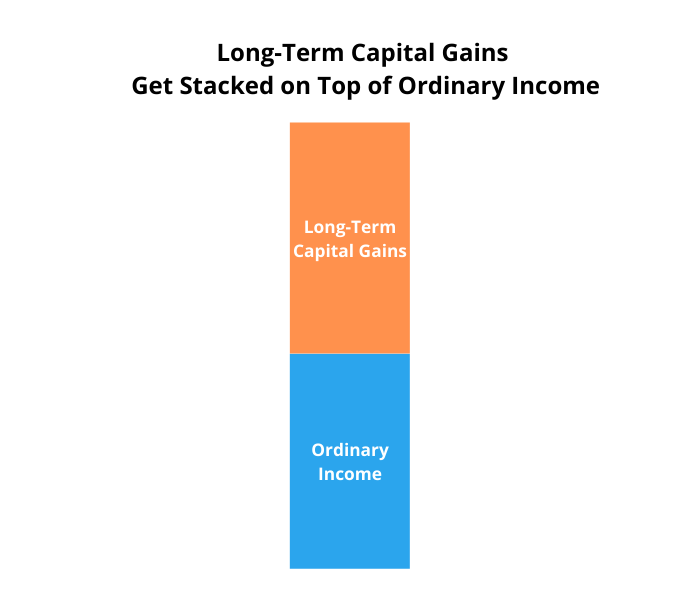

The way ordinary income tax rates and capital gains tax rates are connected is that capital gains are stacked on top of ordinary income.

What this means is that your capital gains tax rate can go up or down depending on your ordinary income, but your capital gains are always taxed at their own capital gains tax rate – not ordinary income tax rates.

Capital gains tax brackets are the following:

| Capital Gains Tax Rate | Married Filing Jointly Taxable Income | Single Taxable Income |

| 0% | $0 – $80,800 | $0 – $40,400 |

| 15% | $80,801 – $501,600 | $40,401 – $445,850 |

| 20% | $501,601 or more | $445,851 or more |

Example 1 of 0% Capital Gains Bracket – No Income

Let’s look at an example to clarify.

Let’s say you retired and for simplicity, you earn no income and take the standard deduction ($25,100) as a married couple.

If you do nothing, you’ll pay $0 in taxes, but you missed out on using your standard deduction. It was wasted. You could have had $25,100 in income and still paid $0 in taxes because it would have been fully offset by your standard deduction.

In the case of capital gains, you could have realized $105,900 in long-term capital gains and paid $0 in taxes. Yes, you heard me right.

You could have realized $105,900 in long-term capital gains and paid nothing in taxes.

How does that work?

Remember, ordinary income has its own tax bracket. Capital gains get stacked on top of ordinary income and are taxed at their own rate.

Example 2 of 0% Capital Gains Bracket – $40,000 Income

Let’s take it a step further and say you have $3,000 of taxable interest and $37,000 of ordinary income from part-time work.

In this case, your gross income is $40,000. Your taxable income is $40,000 minus the $25,100 standard deduction, bringing it to $14,900.

Your total income tax is $1,493.

If you do nothing, you are still missing out on the opportunity to recognize long-term capital gains and pay zero tax on those capital gains.

Example 3 of 0% Capital Gains Bracket – $40,000 Income and $65,900 of Long-Term Capital Gains

You could recognize $65,900 in long-term capital gains and still be in the 0% capital gains tax bracket. Let’s go over the math.

$3,000 of taxable interest

+ $37,000 of ordinary income

+ $65,900 of long-term capital gains

= $105,900 of gross income

– $25,100 standard deduction

= $80,800 taxable income

The $80,800 figure is the top of the 0% capital gains bracket. You can do your own calculations using this calculator.

Now, if you already had taxable income of $80,800 from ordinary income, your capital gains will get stacked on top and be taxed at 15%.

But, as long as you have lower income and can fill up the 0% capital gains tax bracket, you should take every advantage of recognizing income if it results in paying less in taxes.

Importance of Mock Tax Projections

You should be aware that capital gains can affect the taxation of other sources of income, such as Social Security. To ensure you are not raising your taxes while still being in the 0% capital gains bracket, you should do a mock tax projection to see how your tax liabilities change if you recognize capital gains.

The mechanics of tax-gain harvesting are easy. You simply need to sell an investment or part of an investment with a long-term capital gain and then buy it back immediately. You don’t need to wait like with tax-loss harvesting.

Tax-Loss Harvesting

The other thing to double check before year-end is if you have tax-loss harvesting opportunities. If an investment went down in value, you could sell it at a loss to recognize the loss, and use that loss to offset other gains. Ideally, you should proactively be doing this throughout the year and not just at the end of the year. As losses occur, you usually want to take them.

I do this by monitoring losses throughout the year and if a loss is meaningful, I sell the position and replace it with a similar investment. After 31 days, I may swap back to the original investment if there is not a huge gain. If there is a huge gain or the substitute investment is good enough, I keep the similar investment.

Step 4: Complete Charitable Giving

I find most people set out with the intention to give throughout the year, but many wait until the end of the year. If that’s you, review what you have given this year.

Have you supported the charities you intended? Did you give the amounts you wanted?

Although QCDs are a great way to give, you can also give cash before the end of the year. Another option to consider is a Donor-Advised Fund (DAF).

DAFs are a great way to bunch a few years worth of gifting into one year. While you can contribute cash to a DAF, a better method would be to donate highly appreciated investments that have been held longer than a year.

For example, you could contribute $20,000 worth of an individual investment you bought for $5,000. By donating it, you avoid the $15,000 capital gain and still receive a charitable deduction of $20,000. Plus, the funds can be invested in the Donor-Advised Fund and you can request grants to charities you would normally support. A grant is simply a request to the sponsoring organization to write a check from your Donor-Advised Fund to the charity of your choice.

Whether you use a Donor-Advised Fund or another method of giving, don’t forget to review your charitable giving for the year.

Step 5: Review Contributions to Tax-Advantaged Retirement Accounts

If you are still working and want to max out your retirement contributions, check that your last paycheck or two will contribute enough to your retirement account to equal $19,500. If you are over age 50, you can make a $6,500 catch up contribution for a total of $26,000.

Step 6: Review Tax Withholdings and Estimated Tax Payments

After you know your RMD, Roth Conversion, and long-term capital gains amounts, you can do one last check on your tax withholdings.

To avoid underpayment penalties, you need to pay 90% of your current year tax liabilities or 100% of your prior year tax liabilities if your adjusted gross income is $150,000 or less (110% of your prior year tax liabilities if your adjusted gross income is $150,000 or more).

If you have not withheld enough in taxes and have income that can be withheld, that is usually a better method because tax withholdings are treated as being withheld throughout the year. This means if you are underpaid, you can bridge the shortfall late in the year and avoid underpayment penalties.

The same cannot be said for estimated tax payments. If you wait until the last estimated tax payment deadline and make a large estimated tax payment, you may still have an underpayment penalty if more should have been withheld throughout the year.

This is why it’s important to proactively plan for taxes starting when you file your tax return and throughout the year.

Step 7: Decide Whether to Gift to Family

Lastly, this is an excellent time of year to consider gifting money to family.

In 2021, every person can give $15,000 to as many individuals as they want and not need to file a gift tax return. In 2022, that gift tax exclusion amount increases to $16,000 per person.

What this means is if you want to give $15,000 to each child or grandchild, you can do it without any gift tax consequences.

If you give more than $15,000 to any single person, then you would need to file a gift tax return. No gift tax is due, but it does reduce your federal lifetime exemption amount, currently at $11.7 million per person.

If you are looking to superfund a 529 plan, give family extra spending cash, or gift money to a child who is working in order for them to fund a Roth IRA, now is a great time of year to do it. You could gift $16,000 more at the start of 2022.

Summary – Final Thoughts

With everything that’s happened this year, it can be tough to take the time to review what tax planning strategies you should do before the end of the year.

Take 15 minutes and go through this checklist to see if you are missing any opportunities or forgetting something as crucial as completing an RMD.

Not taking advantage of opportunities can cost you thousands of dollars or more, which is the equivalent of saying, “I’m okay paying more in taxes than I am legally obligated.”

Or, as I once heard, “Pay all the taxes you are owed, but don’t leave the IRS a tip.”

Do you want to be the person who leaves the IRS a tip?