Last Updated on February 25, 2023

When someone dies, they often leave behind a mess that needs to be sorted through. There is a web of personal belongings, bills, and financial accounts that need to be handled.

You may be the widow, executor, a family member, or a friend that is tasked with picking up the pieces. After the death of a loved one, it often takes more than a year to navigate the bureaucratic nightmare left behind. Unfortunately, you have to do this while grieving.

I always try to set the expectation that there is a ton of paperwork after someone dies. There is paperwork for every financial account, becoming an executor, engaging with professionals to help you through the process, canceling subscriptions, and closing out someone’s life.

Here is a guide to help you determine what needs to be done when your loved one dies. You can also download the accompanying checklist. Click here to download the checklist of what to do when your loved one dies.

Immediately After Death

These are the steps you should consider immediately after your loved one dies.

Organ Donation

You’ll likely make arrangements before they die, but if your loved one is an organ donor, you should understand what is involved.

Something that may catch you off guard is that medical staff may need to keep your loved one alive a few hours or even days longer than you anticipated to have a successful donation. For someone who is ready to grieve and say goodbye, this process may be stretched out longer than anticipated.

Get a Legal Pronouncement of Death

If you are not at a hospital or under hospice where medical providers can legally make a pronouncement of death, you may need to call 911. If you do, let them know it’s not an emergency, the death was expected (assuming it was), and they have a DNR. They should be able to provide next steps to you.

When the emergency response team arrives, make sure to have the DNR ready to show them.

Take Care of Dependents and Pets

Although your loved one is dead, the rest of life continues on around them.

If they had dependents, such as kids or older adults that they were taking care of, you may need to arrange care for them. You may need to stay at their house or pack a bag for them to come stay with you.

If they had pets, you may need to take the pet temporarily to make sure they have companionship, food, and water.

Keep Journal of What is Happening

Although not something you need to do, I highly recommend keeping a journal of what is happening. You can keep this electronically, such as in a spreadsheet, or in a bound notebook.

After the death of a loved one, it can feel like endless moving parts. Right after you complete a mountain of paperwork, you may be given another.

It’s tough to keep track of what is happening, what you are waiting for, and when you expect to hear from organizations.

A notebook is a good way to keep track of any phone calls or in-person meetings, who they were with, what was discussed, and next steps.

You may want to reference this notebook as you receive refund checks, subscription notices, and other notices in the mail.

I’ve seen checks show up for unknown reasons, notices with the wrong information, and other communication that didn’t make sense until prior notes were reviewed.

Notify Friends, Family, and Employer

Not every person needs to be notified immediately after death, but you may want to notify close friends, family, and their employer.

The benefit of doing this early is that you can get help from people. After a death, many people feel like they must do something to help. This is an excellent opportunity to have them notify other friends and family, so you don’t have to call everybody. You can make a list of 5-10 people and start providing those lists to people who want to help. If there is someone you don’t want to call or have a bad relationship with, it’s okay to put them on someone else’s list.

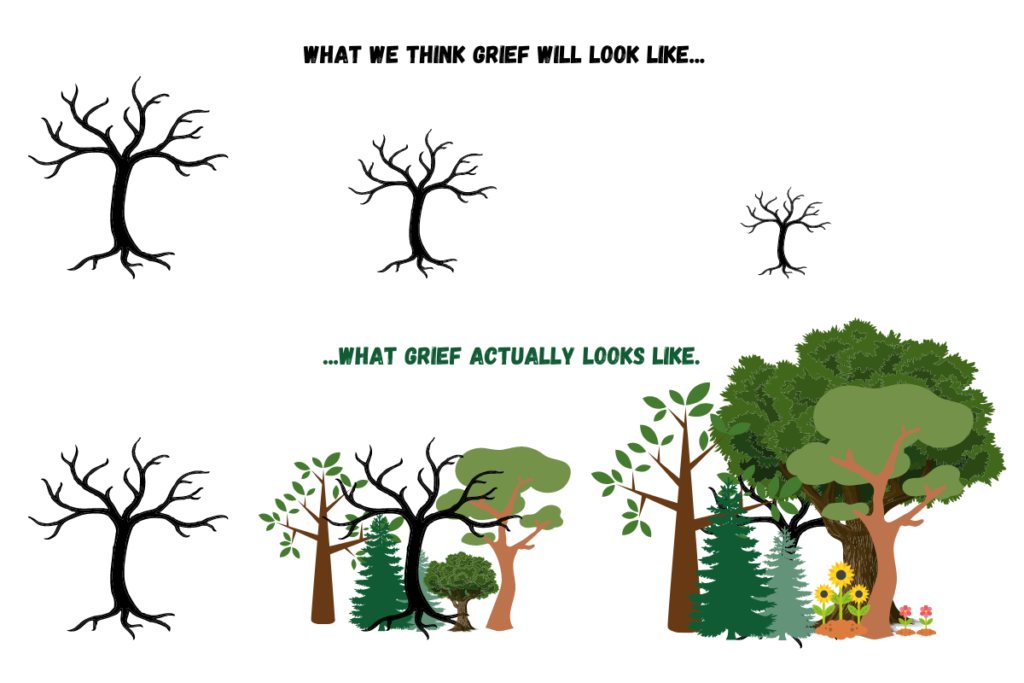

Grieve

Your brain and emotions may be on overdrive right after a death. It’s okay to take time to grieve. You don’t have to do everything immediately.

It’s okay to just be.

Sit on the couch. Go for a walk. Listen to music.

It’s okay to take time for yourself. Everything will wait. You need to take care of yourself first.

Within a Few Days of Death

Although not everything has to be done within a few days of death, this may be helpful to do sooner rather than later after your loved one dies.

Enlist Friends and Family to Help

As you start notifying friends and family, don’t hesitate to ask them for help. Most people will volunteer, but even if they don’t, you can still ask. They may be shocked or processing and forget to offer.

You can ask people to:

- Write an obituary

- Help with funeral arrangements

- Bring food by your house

- Organize bills

- Start making lists of what services need to be canceled

- Anything else that comes up

It takes a village after a death to do everything. You shouldn’t need to go through it alone.

Make Funeral or Cremation Arrangements

Hopefully, the person already arranged for or documented what they wanted.

If not, you’ll need to decide, possibly with the help of friends and family, what your loved one would have wanted.

There are many funeral and cremation options. I recommend bringing a family member or friend to help you sort through them if they haven’t already been arranged. It can be a difficult time to make those decisions. It can be confusing deciding between cremation services, scattering remains options, containers, caskets, ceremony options, hair styling, and restorative arts.

If your loved one served in the military, you may want to contact the Department of Veterans Affairs (VA) to see if they were eligible for burial benefits.

Take Care of Loved One’s Home

If nobody will be at your loved one’s home, make sure somebody locks and maintains it. You may need to secure any valuables, such as jewelry, instruments, or other expensive items.

You may need to throw out food in the refrigerator, turn on the heat if it’s winter to prevent the pipes from cracking, and pick up delivered packages or newspapers to maintain the impression someone is still at home.

The home could become the target of vandalism or theft if the outside and the inside of the home are not maintained.

Handle the Mail

You’ll want to regularly pick up their mail or contact USPS to forward it to a different address, such as the executor’s.

Similar to taking care of the person’s home, you want to give the impression that someone is living at the house. A pile of mail is a good sign to thieves that nobody is watching the property.

The mail is also useful in figuring out the deceased’s bills, credit cards, and other subscriptions.

As you receive mail, you can make a list of the different financial accounts. You can also use credit card and bank statements to see which subscriptions or other payments need to be canceled.

Up to 4 Weeks After Death

Some of this can be done after four weeks, but you usually want to at least start doing some of the items on this list. It’s often easier to continue making progress while you have more help from friends and family after your loved one dies.

Get Certified Copies of Death Certificate

While many people recommend buying 10-15 copies, it depends on the number of accounts your loved one has and who requires a certified original copy.

Death certificates can cost $10-30, so if you are ordering 10 of them, it can be a few hundred dollars. Many institutions are willing to take copies. I recommend scanning in a copy when you first receive them and trying to submit them electronically to anybody who needs one.

If they need an original, then you can send it. I usually aim for at least 10 copies for most people because it can be a pain to order more copies later. You have enough on your plate. If you spend additional money and end up with extras, that’s probably better than needing to order more, waiting, and potentially forgetting to submit something.

Find the Will

Some people have the original copy of their will at home, while others keep it on file with their attorney. Hopefully your loved one told you where it is located, and you have an easy way to access it.

Ideally, a will is not located in a safe-deposit box because unless you are an authorized person on the box, you may have a hard time accessing the box after death.

Inside the will, you will find the executor, who is responsible for settling the estate.

Meet with an Estate Attorney

Although you don’t need to hire an attorney to settle an estate, it can be complicated if you don’t. Estate attorneys are experienced professionals who know the process and can save you time.

They can tell you what sort of notices you need to provide creditors, when you can make distributions from the estate, and how to make the distributions according to the will.

If you need to go through probate, they can help with that process. Even if you don’t, they may be able to help you open trusts, if needed or suggested within the will, and help keep you on track.

Even as a financial planner, I wouldn’t try to settle an estate without an attorney. They are very helpful navigating the complex rules.

Meet with a Financial Planner

If your loved one had a financial planner, I recommend meeting with them. They may be aware of what assets exist, beneficiaries, current holdings, and what your loved one’s plan was in the event of death.

They may also be able to help process the distributions and tell you what accounts need to be opened.

If they didn’t have a financial planner, you can decide whether it is worthwhile to meet with one for yourself, particularly if you are inheriting assets. New assets could mean new tax consequences, new financial options, and different options of inheriting the assets.

Meet with an Accountant

If your loved one had an accountant, I recommend meeting with them. They may be able to help with the final income tax return.

Although you don’t need to hire an accountant, you may want to hire one to help you with the final income tax return and determine if an estate tax return needs to be done.

If you are a widow, the year of death is the last year you can file married filing jointly, which presents a few tax planning opportunities because tax brackets often compress and are higher for single filers.

Taxes are important and unfortunately, sometimes complicated, which means having an expert by your side to navigate the process can be helpful.

Notify Financial Institutions

After a death, you’ll want to notify financial institutions.

Since the account agreement was with the deceased, the moment you notify them of a death, they will likely freeze the account, which means no transactions can take place.

That means no trades, deposits, or withdrawals can likely take place until you open an estate account or make distributions to beneficiaries.

When you notify the financial institution, ask them what paperwork is required to settle the accounts.

This is the part that catches many people off guard. They usually require a death certificate and mountains of paperwork. Sometimes, they need the forms notarized or a medallion signature guarantee. It can be a slog to get through it.

Before you notify the financial institutions, such as banks, custodians, and credit card companies, mentally prepare yourself for an administrative headache.

Having helped people process paperwork after a death for more than a decade, it’s always tedious, and each institution has their own rules of what they need. You may even want to call twice to confirm what you need because I’ve seen many situations where not everything was mentioned the first time.

Notify Insurance Companies

There are many different insurance companies you may need to contact.

If your loved one had life insurance or burial insurance, you’ll want to contact them to collect benefits. When you call, ask them what forms you need to complete and whether they need an original or a copy of the death certificate.

You should also contact your loved one’s home, auto, and umbrella insurance companies to ask about removing them from the policy or canceling it. You may also need to contact their health insurance company to cancel the policy.

Cancel Services and Organize Bills

Whether it is cable TV, newspapers, or other subscriptions, you’ll want to make a list and start contacting service providers about canceling.

You may want to hold off canceling your loved one’s cell phone. You may need it to gain access to accounts.

The easiest way to determine what needs to be canceled is to go through credit card and bank statements. If they were not enrolled in auto pay, you may need to go through the mail for a couple months before you catch everything.

Notify Social Security Adminstration

Although the funeral home should contact the Social Security Administration (SSA), I’ve seen situations where they haven’t.

To make sure it is done, I recommend contacting SSA to notify them of your loved one’s passing.

Any Social Security benefits received after death will need to be repaid.

If you were married, you may be eligible to collect survivor benefits, depending on your ages and benefit amounts. Depending on whether you are receiving benefits, they may automatically change your monthly benefits or you may need to apply for survivors benefits.

Notify Pension Company

If your loved one was receiving a pension, you’ll want to contact the company to stop benefits or collect survivor benefits.

Survivor benefits are normally selected when the person starts collecting the pensions and is set for life. If you are eligible for survivor benefits, you may want to ask what percentage of the benefit you will receive and if there is a cost of living adjustment.

Notify Credit Bureau Agencies

Identity theft can occur after death.

To help prevent identity theft from happening, you may want to contact each credit bureau to let them know your loved one is deceased. You’ll also want to include a copy of the death certificate. Although the credit bureaus may notify each other, you may want to notify each one instead of relying on them to talk to each other.

I’ve provided links below to articles from each of the three main credit bureaus about what else is needed to report a death.

Below are the address for the three main credit bureaus:

- Equifax P.O. Box 105139, Atlanta, GA 30348-5139

- Experian P.O. Box 9701, Allen, TX 75013

- TransUnion P.O. Box 2000, Chester, PA 19016

Notify IRS

Besides the credit bureaus, you may also want to contact the IRS to let them know about your loved one’s death.

Identity theft can happen with taxes. You want to protect your loved one’s estate.

You’ll want to send the IRS a copy of the death certificate to the office where your loved one would normally file their tax return. If you are unsure, you can view the IRS offices by state.

Notify DMV

Notifying the DMV is another step to help prevent identity theft. If you cancel the driver’s license, your loved one’s name should be removed from the department of motor vehicles records.

Each DMV is different about what they require, so you should contact them to ask what is needed.

Up to 6 Months After Death

You may want to do these sooner than a few months after your loved one dies, but it depends on the time of year and what is happening in your life.

Update Your Documents

When a loved one dies, it’s a good time to review your own documents.

Does your will, trust or other beneficiary documents need to be updated? Are your life insurance beneficiaries up to date? Do any contingent beneficiaries need to be changed to primary beneficiaries?

Do you want to change your executor?

Do you need to change the percentages of your own estate to have it reflect your wishes going forward?

Does your durable power of attorney or health care power of attorney need to be changed?

Whenever there is a death, it’s a good opportunity to review what you have in place, whether it reflects your current wishes, and potentially change your documents if the deceased was named in them.

Remove from Financial Accounts and Property

If your loved one had retirement accounts with beneficiaries, such as an IRA, Roth IRA, or 401(k), those will be distributed according to the beneficiary percentages. You’ll likely need to supply a death certificate, letter of instruction, and a few other forms to make those distributions. You’ll want to contact the custodian of the account to see what is needed.

If you had brokerage or bank accounts with your loved one, you may need to remove them from the financial accounts.

With some financial institutions, if you are listed first and the account is reporting taxes under your Social Security number, you may not need to open a new account. Sometimes, you only need to remove the second person.

If you are listed second and the account is reporting taxes under the deceased’s Social Security number, you may need to open a new account entirely and transfer the funds into it.

This can be a huge hassle if you have bill pay, check writing, and automatic payments setup on the account that you’ll need to update with other providers.

I often suggest couples open joint accounts in the name of the younger, healthier spouse to help make it an easier process at death. Sometimes, we’ll open new accounts prior to death if someone is diagnosed with a terminal illness to help make the financial clean up easier later.

In addition to financial accounts, you may need to transfer the car title and have the deceased’s name removed from the deed of their home.

It depends on how the Will is structured, whether the property was held in trust, and how the asset was titled.

It’s important to handle the financial accounts and property after death to help avoid creating tax headaches for yourself later.

Complete Required Minimum Distributions (RMDs)

If your loved one was already taking required minimum distributions, and it was not completed for the year, the beneficiary is going to need to take the RMD for the year. This means if they died December 2, the beneficiary is still responsible for taking the required minimum distribution by December 31 of that year. This is one good reason, among many, to take RMDs earlier in the year

Sometimes, non-spouse beneficiaries will open an inherited IRA and distribute their portion of the RMD from the new inherited IRA.

If the RMD was already completed and the IRA has a named beneficiary, it’s often favorable to split the IRA into the inherited IRA before December 31 of the year following death. For example, if your loved one died in 2022, it’s often more favorable to open an inherited IRA, move the IRA funds into it, and take the RMD by December 31, 2023.

If you are the spouse, you may have the option to move the funds into an IRA in your name instead of an inherited IRA.

The tax rules around distributions are complex, which is why it’s important to meet with a financial planner or accountant.

Obtain Date of Death Valuation and Step Up Cost Basis

Your attorney and accountant should help guide you through this step, but I am mentioning it as a separate step in case it was missed after death and because they may recommend using an alternate valuation date .

When someone dies, their estate often needs to go through probate, where a list of assets is prepared to estimate the net worth of the deceased.

This would include assets, such as:

- Real estate

- Brokerage accounts

- Retirement accounts

- Bank accounts

- Other real property

Assets like brokerage accounts are usually easy to value because stocks trade on a public exchange. You know the value because stocks trade almost every day – hence you know the value as of the date of death.

It’s easy to get a date of death valuation for investment accounts. You can usually ask them for a date of death valuation and to step up the cost basis as to the date of death. The extent to which you can step up the cost basis will depend on your state. For example, jointly held assets in community property states may receive a 100% step up in cost basis while jointly held assets in separate property states may only receive a 50% step up in cost basis.

After someone dies, make sure you get property date of death valuations and step up the cost basis when applicable.

Key Tip: People often forget to get a real estate appraisal of their home or other property to determine the fair market value of the real estate on the date of death. If the surviving spouse continues living in the home for 10 more years and then sells, it can be challenging to determine their cost basis. It’s normally best to get a real estate appraisal shortly after death.

Cancel Appointments and Trips

If you can locate your loved one’s calendar, you may want to track down upcoming appointments and trips to cancel them.

They may have scheduled a haircut, doctor’s appointment, or vacation.

If you can give them notice, that’s helpful, particularly if you can get a refund, such as with a vacation.

Change Social Media

Social media accounts can be handled in a variety of different ways. Some platforms allow you to deactivate an account while others allow you to “memorialize” them.

For example, Facebook, Instagram, and LinkedIn allow you to submit a request to “memorialize” an account, which allows it to stay on the platform, but nobody can make changes to it.

Platforms like Twitter allow authorized persons to request they remove your loved one’s profile.

Notify Voter Registration

Although voter registration rolls might eventually be updated, you may want to contact your county or search online for a voter registration cancellation form.

Continue Monitoring Bank and Credit Card Accounts

Inevitably, a subscription or charge may happen that you forget to cancel. It’s okay. It happens.

Continue monitoring bank and credit card accounts to catch anything else that needs to be canceled. There may be annual subscription fees for a service that won’t show up on a monthly statement. If it goes through, call the company and ask them for a refund.

You’ll also want to monitor accounts for fraudulent charges. Identity thieves and hackers are on the lookout after a death, which is why it’s important to monitor your loved one’s account closely.

Final Thoughts – My Question for You

When a loved one dies, it’s often like a hurricane came to town and tore up the foundation of life.

It’s confusing, messy, and takes time to rebuild.

There often is what feels like endless paperwork, tax rules, estate planning, and people to navigate. Just when you get something done, something else is added to the list.

It’s really important to take it one step at a time. You should prioritize what needs to get done today and what can wait. If you try to tackle it all at once, you may become overwhelmed. It’s a lot.

Hopefully this guide can serve you well as you figure out what to do when your loved one dies.

I’ll leave you with one question to act on.

What step on this list will you take first?