Last Updated on July 7, 2024

Losing a spouse and becoming a widow is a life changing and emotional experience.

Emotions come and go: anger, fear, sadness, grief, loneliness, pain, shock, guilt, worry, and more.

Brain fog, or “widow brain” can appear, causing even more frustration.

Let me begin by saying everyone experiences grief differently. Widow brain affects people differently. There is no uniform grieving process with a step-by-step timeline of what will happen.

It’s a mish mash of time and emotions. Each person’s experience is unique. At the same time, there are commonalities people share that resonate with others.

Let’s look at what widow brain is, what you could experience, how long it may last, ideas to help with widow brain, and wrap up with a few financial planning ideas to help make your financial life easier.

Helpful Tip: If you need help organizing your finances, join me for a complimentary 45 minute webinar. You can register for How to Organize Your Finances as a Widow.

What is “Widow Brain”?

Widow brain, often referred to as widow fog or brain fog, is the fuzziness or fogginess that can be experienced after a spouse dies.

It can cause you to forget things, lose focus, and have trouble concentrating. Widows describe it as not being able to think straight. Some have said it feels like “I am losing my mind.”

What Will I Experience with Widow Brain?

Although people can experience widow brain differently, people often describe being:

- Forgetful

- Exhausted

- Irritable

- Nauseous

- Incapable of finishing basic tasks

Below are a few examples:

- You forget to pay bills on time even though you never had trouble with it before.

- You “lose” your cell phone while talking on it.

- You schedule an appointment, write it down in your calendar, but you get the day wrong and show up on the wrong day.

- You stop speaking mid-sentence because you forget what you are talking about.

- You skip lunch because you didn’t realize the day passed.

- You host a get together, but don’t remember any of it.

Widow brain is difficult to experience because many widows recognize and feel like they should be able to do something, but can’t. I’ve had widows tell me that something they have been doing their entire life, they can’t do anymore.

People who are always punctual may show up late or on the wrong day. Someone who was responsible for paying bills may consistently miss payments while having widow brain.

They may have a great vocabulary and be well spoken, but may have a hard time describing a recent experience or stop talking when they experience a sudden loss of finding the right words.

Many of these experiences are accompanied by frustration, and rightfully so. Imagine being able to do something your entire life and then not being able to do it. Something you could do yesterday, you can’t do today.

That’s widow brain.

It’s emotional, physical, and neurological.

How Long Does Widow Brain Last?

Although widow brain lasts different amounts of time in different people, many widows say that it normally lasts 12 to 18 months.

Depending on your situation, it may not last longer than a few months.

Personally, I usually see a change around the 12 month mark, and then by 18 months, it’s almost completely gone. Many widows describe a similar process.

The key is to recognize it will likely happen, accept it is a lousy experience, and know it is temporary.

Ideas to Help with Widow Brain

At this point, you may be wondering, “If widow brain is going to happen, how can I minimize the effects?”

There are a few steps you can take, but also know that this is a normal experience and no steps will help mitigate it entirely.

Idea 1: Write Things Down

Since many widows report forgetting conversations, appointment times, and other important things, one of the best things you can do is write down everything.

Similar to when you are advocating for someone in the hospital, I recommend buying a journal and using it extensively. You can use it to write down appointment times, key parts of a conversation, next steps you need to take, and more.

When you write something down, I suggest writing down the date, time, who you spoke with, and what was discussed. It’s important to note the date and time in case you have any question about when something was discussed.

As a widow, you are going to have many items on your to-do list and organizing it in a notebook will be helpful.

Idea 2: Ask Family and Friends for Help

It’s always interesting to me how willing people are to help someone else, but struggle asking for help, myself included.

People are going to want to help you.

You should take them up on their kind offers. You are likely going to have a task list a mile long after your loved one dies. It’s okay to enlist a small army of helpful friends and family through this tough experience.

You may feel like you are losing your sense of independence and that you should be able to do everything on your to-do list, but please remember that your brain and your body are likely not functioning at their baseline.

Whether it is shopping for groceries, cooking, paying your bills, taking your car in to be serviced, doing your laundry, or helping with other household tasks, please don’t hesitate to ask others.

You can say something along the lines of, “Ever since (insert loved one’s name) died, I’ve been experiencing widow brain and grief. I’m not able to do (insert task), even though I used to be able to do it. This is a normal experience for people in my similar situation. I know I’ll be able to do it in the future, but I could use your help right now. Would you be willing to help with (insert task)?”

If you are not sure what needs to be done, you can ask someone to help you figure it out.

Idea 3: Be Kind to Yourself While You Grieve

Grieving is a process.

If you try to squish it down into your being and act like everything is normal, your journey out of widow brain may be slower.

Although it’s uncomfortable and you may want to try to suppress your grief, you will start to feel better if you allow yourself the space to grieve.

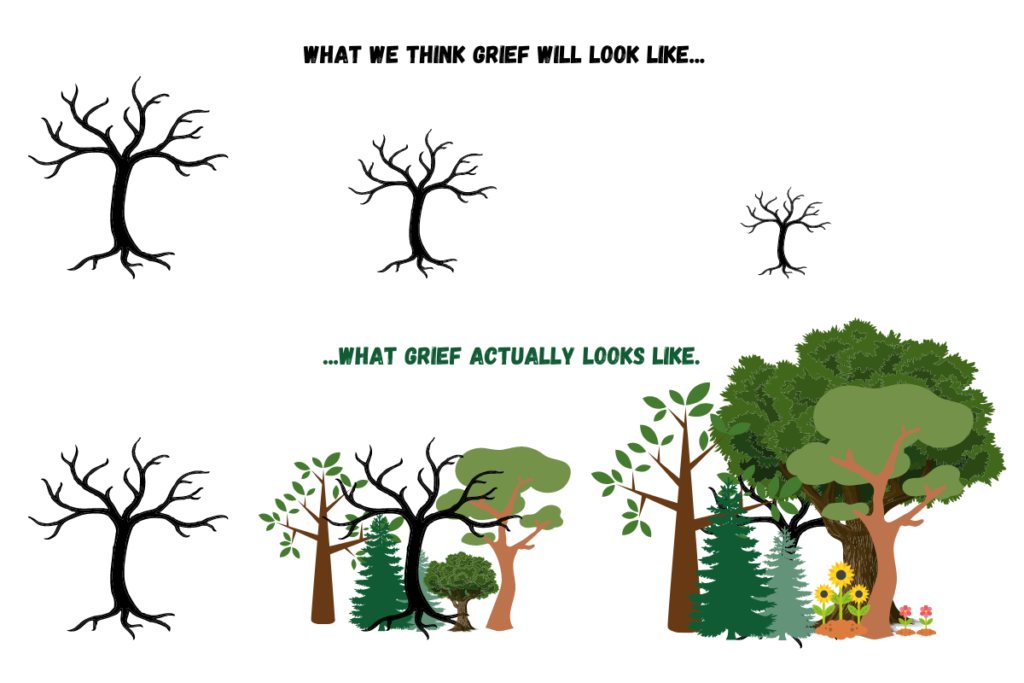

There are different models of grief, but I really like Tonkin’s model of grief. It says that your grief doesn’t shrink over time. It stays the same, but your life grows around it.

Below is a visual representation where we may think grief will grow smaller, but it actually stays the same size, and life grows around it.

Idea 4: Rest

You should take time to rest. Please note I didn’t say sleep. If you can sleep, wonderful. If you can’t, it’s okay.

Many other widows say it’s challenging to sleep while grieving.

It’s okay to lay on the couch and close your eyes, listen to music, or watch the world go by out your window.

Taking a few minutes for yourself can help you unwind and destress from everything that you are experiencing.

If you struggle with taking the time to rest, try committing to rest for 2 minutes. That’s it. Rest for 2 minutes and see how you feel.

You don’t have to rest for 5 minutes or even 30 minutes. Try 2 minutes and see what your body needs at that point.

You may find that after 2 minutes, you are more willing to rest for 10 minutes or longer. It’s okay to work your way up to a longer rest.

Idea 5: Journal

Something else you may find helpful is journaling. Write down how you are feeling, what you experienced each day, and anything else on your mind or in your heart.

By writing everything down, you can clear your brain of those thoughts, particularly the ones that are hard to get rid of, and see what else comes up.

Idea 6: See a Therapist

When your spouse dies, your world is turned upside down. You may be hard on yourself for the smallest, most inconsequential things.

A therapist can help remind you that everything you are experiencing is normal. It’s normal to find your key lost in a kitchen cabinet. It’s normal to cry when someone says a word that makes you recall a distant memory. It’s normal to not remember gaps of time.

A therapist may help you experience your grief and be part of your support system as you process everything that is happening.

Idea 7: Join a Widow Support Group

Some of the best support can come from people who are going through something similar. Consider joining a community, such as Modern Widows Club.

You may feel broken and incompetent at times. You aren’t. Your brain simply isn’t functioning at its best.

Hearing from others who are experiencing something similar may be helpful. You may be able to lean on others and others may be able to lean on you.

Idea 8: Bring Friends or Family to Events

You’ve probably been to a million events with your loved one. It may be weird to go to future events without them.

When people invite you to birthdays, celebrations, dinners, and more, you don’t have to go alone or skip it.

You can bring a friend or family member to the event. I’ve seen this work really well for other widows.

Many people are tempted to skip events (and there is a time and place for it), and I’ve seen widows lean on friends and family to enjoy events with them.

It’s not the same as your spouse, but it is a great way to stay engaged and connected with your world.

Idea 9: Celebrate Milestones with Friends and Family

Each person wants to celebrate milestones differently. You may want to listen to what feels best for you.

Do you want a big party to celebrate what would have been a wedding anniversary? Do you want to light a candle at home to honor that occasion? Do you want to gather with family on a beach to celebrate their birthday?

Life will continue on in a different form, and it’s okay to honor and celebrate special days.

Financial Planning with Widow Brain

Since widow brain can affect every area of your life, the question becomes, “what financial decisions should I make with widow brain?”

As with any financial planning decision, the answer is unique and personal, but there are some general guidelines most people should be aware of that help in most situations.

Work with a Fee-Only, Fiduciary Financial Planner

If you do not feel comfortable making choices on your own and want a thinking partner, consider working with a fee-only, fiduciary financial planner.

I specifically focus on working with widows and created a free 45 minute webinar to talk about the planning items you may want to consider after death. It includes questions, such as, “Should I sell my house?”, “What are the tax consequences of selling my house?”, and actionable steps you can take to feel more organized and confident.

If you cannot afford a financial planner, consider free resources, such as Wings for Widows. I am a volunteer financial coach with them.

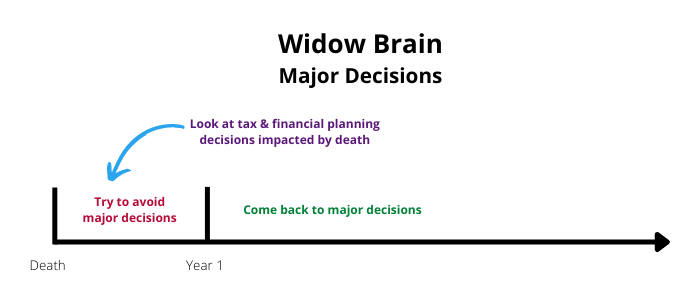

Try to Avoid Major Decisions in the First Year

I usually suggest avoiding making major decisions in the first year of death.

There are exceptions, such as if you are living in a home you can’t afford or maintain. You may need to make a decision as quickly as possible, but when possible, it’s usually better to wait.

Major decisions might include moving, changing jobs, getting rid of photos, clothes, or other personal items.

When you are grieving, you may be tempted to make a decision now, but a few months from now, you may feel very differently.

Many major decisions can often wait.

Consider Tax Ramifications

There are key actions to consider from a tax perspective in the year of death.

Instead of two Social Security benefits, you’ll receive only one. It’s the last year you can file married filing jointly. A pension may continue at the full amount, a reduced amount, or not at all.

There may be life insurance proceeds or decisions to make about annuities.

In the year of death, a lot changes financially.

Since it’s the last year you can file taxes as married filing jointly, it’s a critical year to do a tax projection to see how things may change the next year. You may have the opportunity to do a Roth conversion and pay less tax than in the future.

Although it’s a tough time to make decisions, you may end up paying the IRS more if you wait on tax planning decisions.

Step Up Cost Basis and Diversify

If you’ve been waiting to diversify a portfolio because of capital gains, you may have an opportunity after death to diversify with little tax consequences.

Since many assets, such as a brokerage account, receive a step up in cost basis as of the date of death, you could sell those assets and pay very little in taxes.

For example, in Community Property states, such as Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin, surviving spouses often receive a step up in cost basis on the full value of the account.

For example, if you had a brokerage account with a cost basis of $500,000 and it was worth $1,000,000 at death, the new cost basis would likely be $1,000,000.

If you live in another state, jointly held assets may only receive half the step-up in cost basis. For example, in the previous example, the new cost basis would be $750,000 because half of the $500,000 received a step up in cost basis.

There are a few exceptions for people living in Alaska, Kentucky, South Dakota, and Tennessee, which allow them to create community property trusts that can fall under community property treatment.

As with any tax or estate planning situation, you will want to speak with your accountant and attorney to confirm what rules apply in your situation.

The key point is that if you are holding a concentrated stock position and have wanted to diversify, but have worried about the taxes, selling after death may be an opportunity to pay less in taxes than prior to death.

Final Thoughts – My Question for You

Widow brain is the fogginess that can occur after losing a spouse.

It can be frustrating not being able to concentrate and go about life as you did before.

For many people, it lasts between 6 and 12 months, but not everybody experiences it, and sometimes it goes on for longer.

There are many ways to help reduce the negative consequences of widow brain. Some of the best ways are to write things down as often as possible, rest, and lean on friends and family, as well as a therapist or widow support group.

It’s usually best not to make major decisions in the year after death, but when it comes to tax and financial planning, you may want to do a tax projection to see if there are actions you should be taking in the year of death to help reduce the taxes you owe over time.

I’ll leave you with one question to act on.

Which idea to help with widow brain do you find most helpful?