Last Updated on February 14, 2024

Who would have thought a government bond would be one of the most talked about investments in 2022? Now, how do I bonds look in 2024?

When the annual inflation rate was 8.5% in March 2022, investors were wondering how best to keep up with inflation.

The answer?

Many were turning to I bonds.

Let’s look at what a Series I savings bond is, the details, such as the maturity date, how the yield is calculated, liquidity, how they are taxed, where you can buy them, and when it might make sense to buy I bonds.

If you’d prefer a video version, click below:

What is a Series I Savings Bond?

Series I savings bonds are bonds issued by the federal government that are inflation-protected. They were first introduced in 1998.

Since they are backed by the full faith and credit of the United States government, they are considered lower risk than other types of bonds.

I Bonds – The Details (Maturity, Yield, and Liquidity)

How Long Do Bonds Earn Interest?

I Bonds earn interest for 30 years unless you cash them out before the end of 30 years.

Interest is earned every month, but compounded semiannually. What this means is that twice a year, interest from the prior six months is added to the bond’s principal value and then interest over the next six months is earned on that adjusted principal value.

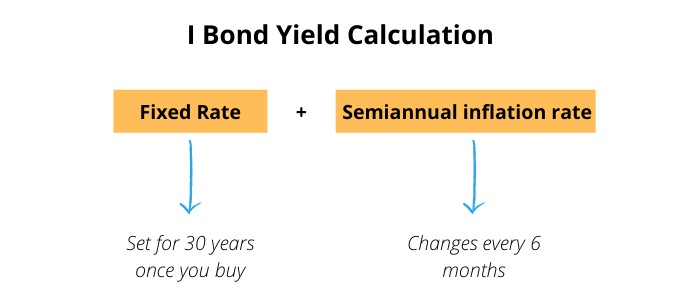

The interest earned is based on two rates:

- Fixed rate

- Variable inflation rate

How is the I Bond Yield Calculated?

The fixed rate is the same throughout the entire 30 years. For example, if the fixed rate is 0% when you buy it, the fixed rate will still be 0% for that bond in 29 years.

The variable inflation rate is calculated and changes twice a year. If you want to get technical, it’s based on changes in the nonseasonally adjusted Consumer Price Index for all Urban Consumers (CPI-U) for all items, including food and energy.

Even if the inflation rate component goes negative, the bond has a floor, meaning the interest rate on the bond will not go below 0%. In other words, the redemption value of your bond won’t decline unless the United States government didn’t pay their debt.

Currently, the fixed rate is 1.30% and the variable semiannual inflation rate is 1.97% for bonds purchased between November 2023 and April 2024.

What this means is that if you purchased an I bond within that time frame, for the life of the bond, you will earn 1.30% as a fixed rate and the rest of your return is going to come from changes based on the CPI-U.

You can look up historical I bond fixed rates and see that when they were first introduced, the fixed rate was 3.4%, but since 2008, the fixed rate component hasn’t been above 0.50% very often.

The variable inflation rate has been higher in the recent past because inflation has been high. There is no telling what the variable inflation rate will be for bonds purchased between May 2024 and October 2024. If you annualize the current 1.30% fixed rate and the 1.97% variable rate for six months, that will match the 5.27% annual composite rate you see in headlines, but please keep in mind that the interest you earn resets after six months for the semiannual inflation rate.

The annual composite rate is calculated by doing the following:

(0.0130 + (2 x 0.0197) + (0.0130 x 0.0197) = 5.27%

For example, if you buy an I Bond in November 2023, you will earn 2.635% through April 2024, but from May 2024 through October 2024, you will earn a different rate of interest based on the change in the CPI-U.

A trick to know the yield over 12 months: If you buy an I bond in April or October, you know the variable interest rate over the past 6 months that you can earn for the next 6 months, but you also will have a good idea of what the variable interest rate will be for the 6 month period after.

For example, if you buy an I bond in April 2024, you will earn 2.635% over the next six months (April 2024 through September 2024) because that has already been announced. But, you also will have a general idea of what the inflation rate was over the prior six months, which affects the next six month period.

What this means is that you will have a general idea of what you will earn between October 2024 and March 2025 in April 2024.

Looking at a past example, in April 2022, you knew if you bought an I bond, you would earn 3.56% over the next 6 months (April 2022 through September 2022), but you also knew the general inflation numbers and estimated that the I bonds would pay 4.81% for bonds purchased between May 2022 and October 2022. This is the new interest rate that would get tacked on to your bond between October 2022 and March 2023.

If you are close to the end of a six month period where the interest rate resets, sometimes it is worthwhile to wait to decide if you want to buy at the old rate or wait until the following month to buy at the new rate.

When Can You Get Money Out of the I Bond?

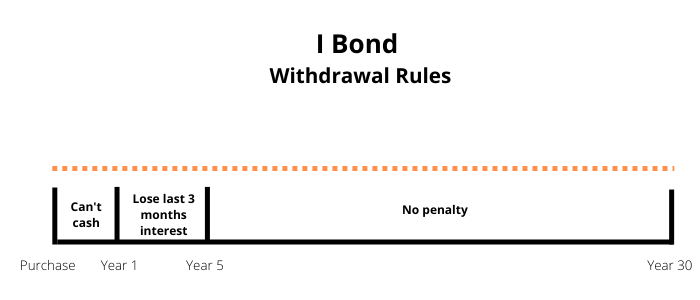

I bonds pay interest for 30 years, but that doesn’t mean you need to keep them for 30 years; however, you do have to keep them for at least a year.

You cannot cash your I bond before one year.

This means you should not use I bonds as an emergency fund. Since you have no access to your money within a year of purchase, there is no liquidity even if an emergency arises.

If you cash in your I bond within five years of owning it, you give up the last 3 months of interest. For example, if you cash in an I bond after 24 months, you would earn interest for the first 21 months and give up interest from months 22, 23, and 24.

After five years, you can cash them out at any time and not lose interest.

How Are I Bonds Taxed?

I bonds are subject to federal income tax, but not state or local income tax.

You can report the interest every year from the bond or wait to report all the interest for the year in which the first of these events occur:

- You cash the bond

- You give up ownership and the bond is reissued

- The bond matures

If you choose to report the interest every year, you must continue doing that for all savings bonds in the future.

I bonds can also be used tax-free for education.

The education tax exclusion allows certain individuals to exclude the interest paid upon the redemption of I bonds from gross income under certain conditions.

I see quite a bit of talk on the internet about using I bonds for saving for college. In many situations, particularly for younger children, using a 529 plan may be a better option. For those going to college in the next couple of years, an I bond can make more sense as it’s a lower risk investment with a higher rate of return than can be found in many 529 plans.

How to Buy I Bonds

I bonds can be bought electronically using the TreasuryDirect website. You can also buy them in paper form using your federal income tax refund.

You can’t use a brokerage account or other custodian to buy them, which means you’ll have another account with the clunky TreasuryDirect website.

Electronic bonds can be purchased in any amount, down to the penny, from $25 to $10,000.

Paper bonds are only available for $50, $100, $200, $500, or $1,000.

TreasuryDirect has a video about how to purchase I bonds, but the process is clunky.

If you are one of the unfortunate people who have to verify their identity when first creating an account on TreasuryDirect, you could be in for quite the process. Some people report that they have to verify their identity before they can make a purchase, which requires them filling out a form and getting a signature guarantee from a bank or credit union.

How Much Can I Purchase in I Bonds?

A major downside to I bonds is how much you can purchase.

You are limited to buying $10,000 through the TreasuryDirect and up to $5,000 in paper I bonds via your federal tax refund. If you wanted to purchase I bonds via a federal tax refund and don’t have enough in withholdings to result in a tax refund, you could make an estimated tax payment that results in a refund.

You can buy $10,000 per person, so a married couple filing jointly could purchase $25,000 per year between them ($10,000 each plus $5,000 via a tax refund).

I bond limits are by entity, which means if you have a revocable trust, you can buy $10,000 worth of additional I bonds in it. If you have a business account with a separate EIN, you can buy $10,000 worth of I bonds for it.

You will need to create a separate TreasuryDirect account for each entity wanting to buy I bonds.

The other option is to buy I bonds as gifts, but those will count against the other person’s $10,000 per year limit.

When Does it Make Sense to Buy I Bonds?

I bonds are reasonable investments for people who have a cash need in one to five years from now.

As I mentioned earlier, I bonds should not be an emergency fund because you can’t gain access to them within the first year.

However, if you need to buy a home in three years and have money in cash earmarked for that purchase, I bonds are a reasonable place to park the money. You can earn a fairly high rate of return with little risk, while still retaining the option to cash them out after a year.

If you have extra cash after your spouse passes away and you become a widow, you may want to wait on coming up with a long-term plan for the money. I bonds are a reasonable place to put $10,000 while you grieve and decide what comes next.

If you have extra cash because of upcoming life changes and are unsure how much cash you’ll need, I bonds could be a solution for $10,000.

Overall, I’m not a huge fan of I bonds for most people, unless they have a multi-year plan to add money to I bonds as a key component of their investment portfolio or have cash needs in the next few years.

The interest rate is attractive, but historically, the rate of return on these bonds has been low. The only reason they would have a high rate of return going forward is if inflation continues to be extremely high.

Plus, for people with millions of dollars, a $10,000 investment, isn’t going to move the needle on their financial plan. For example, if you have $2,000,000 invested, a $10,000 investment is only 0.5% of the portfolio. It’s not going to change your financial future.

Even if you earn 9.62% over the next year, that $689. For two people investing $20,000, that would be $1,378. It’s not nothing, but it is another account you need to track, another account heirs may need to track down, and it doesn’t simplify your financial life.

Also, if someone has significant cash on hand, but it isn’t for an upcoming expense, I would question what purpose that cash is serving. Would it be better to invest it in a diversified portfolio of stocks and bonds for long-term growth?

I feel like some people are using cash on hand to invest in I bonds because they have too much, but are not seeing the overall picture or creating a long-term plan. Are people too busy looking at the trees to admire the forest?

Many people are excited about I bonds because of the yield relative to other interest rates in today’s lower rate environment, but the $10,000 per year limitation means people with larger investment portfolios may see limited impact to their bottom line.

I personally bought $10,000 worth of I bonds to see what the experience was like during 2022. If I wasn’t a financial planner, I wouldn’t have bothered buying the bonds because I dislike having another account on a clunky website. As soon as I bought them, I regretted it because it’s another account I need to keep track of, and I am a huge fan of simplicity. I much prefer spending my time with family, outside, or doing other things rather than complicating my financial life for a little extra interest.

In January 2024, I decided to cash out the I Bonds I purchased in 2022 to simplify the numbers of accounts I have.

Ultimately, it’s up to you to decide whether it’s worth your time and where it fits in your long-term investment plan.

Final Thoughts – My Question for You

I bonds are the flashy investment right now, which is strange to say out loud considering they are a bond!

They offer a very attractive interest rate for the next six months, but it’s unknown whether in the six months following they will have a high interest rate or it will drop to 0% – or somewhere in between.

With the $10,000 limit per year in purchases, I bonds likely won’t move the needle much for people with larger investment portfolios, but it can be a reasonable place to park cash for anything needed in one to five years.

I’ll leave you with one question to act on.

Where do I bonds fit in your financial and investment plan?