Last Updated on October 2, 2023

An investment policy statement is an important document outlining an investor’s goals and the strategies and rules that will be used to manage their investment portfolio.

Another way to think about an investment policy statement is that it is a roadmap or guidebook to get from Point A to Point B because it’s impossible to know what you will encounter along the way. Although you may have a general idea of how fast you will go, what you will encounter along the way, and when you want to get there, sometimes you encounter surprises along the way.

The investment policy statement is a guide outlining how you will handle the bumps in the road, accidents that happen, and what happens if you arrive early.

Instead of making stuff up along the way, you already have predefined ways to handle situations that have been carefully evaluated and decided upon in a non stressful environment.

At its basic level, an investment policy statement will include the following information:

- Goals

- Target asset allocation

- Types of investments

- Framework for how you select investments

- How to monitor your investments

An investment policy statement can be complicated, but it doesn’t need to be.

You can download a free sample investment policy statement in PDF format or free template investment policy statement in Word format.

I’ll talk about what an investment policy statement is, format of an investment policy statement, how an investment policy statement can help you invest, common errors in an investment policy statement, and how to effectively use an investment policy statement. Plus, I’ll include a free example template of investment policy statement you can modify to fit your needs.

What is an Investment Policy Statement?

An investment policy statement (IPS) is an investing plan.

At its core level, the IPS is a guide that includes your goals and how you will invest to achieve them.

Although an investment policy statement can be 20+ pages of jargon and a complicated framework, it doesn’t need to be. You could create an IPS on a napkin while still capturing the most important elements.

If you don’t have an IPS, it’s much like going on a road trip without a map, destination in mind, or rules of the road.

You may get to somewhere nice, but the trip probably won’t be without its problems.

Let’s cover what an investment policy statement includes to give you an idea of how it can help you invest.

Format of an Investment Policy Statement

A successful investment policy statement should include the following sections:

- Goals

- Target asset allocation

- Types of investments

- Framework for how you select investments

- How to monitor your investments

You can follow a checklist or create your own general outline. Let’s dive deeper into each section and what you could include.

Goals/Objectives

I’m not a big fan of the words goals and objectives, but I know they are easily understood words, which is why I use them here.

Instead, think of your goals as what you want the money to accomplish for you. What purpose does the money serve?

Is it to give your grandkids a good education? Is it to never have to work again? Is it to buy back your time and give yourself freedom from imposed obligations?

No matter the reason, reflect mindfully about how your money is going to help you live a more ideal life.

Write down any goals that come to mind. In my experience, below are a few common ones to help get you inspired:

- Live a comfortable retirement without worrying about going back to work

- Gift money to family regularly to help get them started in life

- Support charities in their work to make systemic changes

- Take two trips a year and pay for family

- Not worry about healthcare expenses or paying for long-term care

Now, you may want to more clearly define these goals for your own planning because it will influence how you invest your portfolio, but if you already have a financial plan that defines these goals, it may not be necessary to do so in the investment policy statement.

For example, you may want to put a number on what a comfortable retirement looks like. What amount of money do you need each month to be comfortable? Or, how much do two trips a year cost? When and how much do you want to give to family?

If you haven’t already more clearly defined these goals in a financial plan, consider doing it in your investment policy statement.

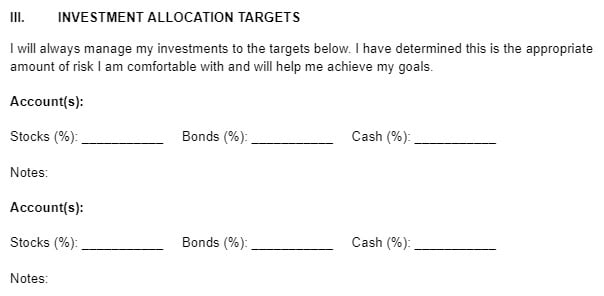

Target Asset Allocation

Picking a target asset allocation is one of the most important steps in creating an investment policy statement.

Your target asset allocation is the mix of aggressive and conservative assets you want in your investment portfolio.

For example, if you want to be 50% stocks and 50% bonds, you could select that as the overall target allocation. If you have cash needs, you can also specify how much cash you’ll own. This in turn will help you decide whether to invest dividends to help with rebalancing or leave them in cash for withdrawals.

If you wanted to be more specific, you could refine it further by saying of the stocks, your target will be:

- 50% US Stocks,

- 30% International

- 15% Emerging

- 5% Real Estate

And of the bonds:

- 40% Government Bonds

- 50% Corporate Bonds

- 10% High-Yield Bonds

You could even refine your target asset allocation to a narrower level by specifying what percentage of large cap stocks and small cap stocks you will own or value versus growth.

You could do the same on the bond side by specifying what types of government and corporate bonds or their duration (how long until they mature).

At a minimum, you want to pick a stock to bond target asset allocation in your investment policy statement to provide yourself with an overall guiding framework.

Types of Investments

Another important element of an investment policy statement is naming the types of investments you will use.

For example, which of the investments will you use below?

- Individual stocks

- Exchange-traded funds (ETFs)

- Mutual funds

- Private real estate

- Individual bonds

- Private loans

- Hedge funds

- Venture capital

- Private equity

- Commodities

- Collectibles

- Art

- Options

- Futures

- Cryptocurrency

- Other alternative investments

It’s a good idea to specify which types of investments you are open to using to get your target allocation exposure. For instance, if you want to be 50% stocks and 50% bonds, will you only use ETFs on both sides of the portfolio? Are you open to using individual stocks or bonds in certain scenarios? Do you feel the need to add exposure to alternative investments?

By naming in your investment policy statement which investments you will include, it will help narrow down your focus and hopefully avoid the fear of missing out if one particular type of investment is doing well and you don’t have exposure to it.

Throughout time, nearly every investment had its time in the limelight and countless investors have poured money into it at its peak not because they understood it or why it belonged in their portfolio, but because other people were doing it.

It’s a good practice to name the types of investments in your IPS that you want to include to achieve your goals.

Framework for How You Select Investments

Once you have identified your target allocation and the types of investments you may include, the next step is to lay out a framework for how you select investments.

It’s important to create the framework because new investments will come out and at some point, you may wonder whether it makes sense to include them. Instead of getting caught up in great marketing, hype, or other influences, you can turn to the rulebook you created for yourself.

For example, many people want low-cost, tax-efficient, and diversified portfolios.

Specify how you pick investments through those lenses.

For low-cost, you could pick from only investments in the bottom quartile of expenses. For tax-efficient, it could mean no historical capital gain distributions above 3%. For diversified, it could mean no individual stock makes up 10% or more of a fund or your portfolio.

Perhaps you also want an index-approach and limit active management to 10% or less of the portfolio.

These are simply ideas to help you think about how you could build a framework for how you select investments.

There are many different factors you could measure, but the point is to pick items that align with your investment philosophy and are easy for you to research and apply.

How to Monitor Your Investments

Lastly, write how you will monitor your investments in your investment policy statement.

Like the other sections, how you monitor your investments doesn’t need to be fancy.

You could say that you will review them once a year and rebalance back to your target allocation.

I prefer an approach where you rebalance based on thresholds, such as 10 percentage points above or below the target or when it is 20% above or below the target position allocation, but that is harder to track.

However you decide to monitor your investments, make it easy to follow and something you feel you will stick with. It’s normally better to make something easy and carry through with it than make something complicated that is better in theory, but is rarely followed.

How an Investment Policy Statement Can Help You Invest

Now that you know how an investment policy statement could be formatted, let’s talk about how it can help you become a better investor.

First, it helps give purpose to your money. If you know why you are investing, you may be more likely to stick with your strategy and feel you are on track.

Second, it aligns your investments with when you will need to use the funds. Having a target asset allocation helps you “bucket” your money. Cash and bonds can be the conservative bucket to support near-term spending (1-10 years) and stocks can be the aggressive bucket to support long-term spending (10+ years).

If you are too aggressive in your target asset allocation and have short-term spending, it may allow you to identify the need to change your allocation mix to reduce risk in your investment portfolio.

Plus, it helps give peace of mind when markets crash. If stocks are down 40% in a year, but you know you have enough money in the conservative short-term bucket to ride out stock market declines, you may feel more at ease sticking with your investment allocation.

Lastly, by selecting the types of investments you will use, writing the framework for how you select investments, and how you will monitor, it may help avoid the fear of missing out when new investments come out or a particular asset class is doing well.

We all have a tendency to want to own what is going up, but asset classes perform differently at different times. Having a plan you create in a less emotional time can help you get through the emotional experiences of investing.

Common Errors in an Investment Policy Statement

The first error in an investment policy statement is not having one!

I know it can seem strange to write an IPS when it feels like it is only for big institutions like pension funds or when you are working with a financial planner, but an IPS is really helpful for individual investors, too.

Another common error is being too vague in the investment policy statement. If you are too vague and leave yourself too much wiggle room, you may be inclined to break the framework you created for yourself.

For instance, when people are vague, they may take action that doesn’t violate the IPS, but it violates the spirit of the IPS.

On the other hand, being too specific can also be bad. If you make the rules complex and difficult to follow, you may be setting yourself up for failure.

Have you ever received complicated instructions from your doctor?

How often do you understand and follow those instructions exactly as written?

If you are like many people, the answer is probably rarely.

There needs to be a balance between being too vague and too specific. It’s different for each person.

The last error I see is the excuse, “this time it’s different.”

Sometimes it truly is different, but that’s rare in investing. There are a few fundamental principles and rules that have stood through many market cycles.

Don’t let the media, investments fads, or fear of missing out influence you to change your investment policy statement if your situation and needs have not changed.

How to Effectively Use an Investment Policy Statement

Once you have written your investment policy statement, what are the best practices?

The first suggestion is to revisit it regularly, at least annually.

Enough usually happens in a year to warrant a review. As life changes, your investment policy statement may need to change.

For example, if you anticipate wanting to buy a new house before selling your existing house, perhaps your target asset allocation needs to change if you anticipate a large withdrawal from your investment portfolio.

Or, maybe your goals have changed and the money serves a different purpose. Perhaps you feel like you have enough and plan to do more regular gifting to family while alive. That may warrant needing more cash each year.

It’s important to note that an investment policy statement should only be changed if your situation has changed. It shouldn’t be changed in response to solely outside factors, such as stock market returns, inflation, unemployment, speculation about federal reserve actions, or what your friend is doing.

The investment policy statement is in place to help you stay invested through uncertain times, and uncertain times are always. Nothing is certain.

The IPS serves as a guidebook and guardrails to help you stay within a range of actions.

Final Thoughts – My Question for You

An investment policy statement is an important document outlining your objectives and how you will manage your investments to achieve those objectives.

I see it as a guidebook.

Much like you wouldn’t hop in the car in an unfamiliar location without a map, you shouldn’t be investing without an investment policy statement.

Not only does it add clarity to your investing, but it gives you a rulebook to fall back on, such as your target asset allocation, types of investments you will use, framework for selecting investments, and how you will monitor your investments.

When creating your IPS, strike a balance. If it’s too vague, it may not be helpful. If it’s too specific, you may not want to follow it.

Although you may be tempted to make changes to your IPS during the ups and downs of the market, remember changes should only be made as your life or financial situation changes.

I’ll leave you with one question to act on.

When will you make your investment policy statement?