Last Updated on June 17, 2025

Do you feel confident you are minimizing taxes over your lifetime?

If you are like many people, the answer is no.

Most people are focused on today. They want to reduce taxes today, but fail to consider how much in taxes they may pay in the future.

Roth IRA conversions can be an excellent strategy to optimize your tax situation and pay less in taxes over your lifetime.

It’s particularly appealing before 2026 because we are in a lower tax rate environment than we may be in the future.

The Tax Cuts and Jobs Act of 2017 temporarily lowered tax rates. If no tax legislation is passed changing tax rates, we will revert back to the 2017 tax rates, adjusted for inflation, in 2026. Those tax rates were higher and narrower, meaning you generally progressed into higher tax brackets at less income than today.

“Should I do a Roth conversion?” is one of the most frequently asked questions.

I’ll cover what a Roth conversion is, when it makes sense to do a Roth conversion, how to handle taxes on a Roth conversion, the mechanics of a Roth conversion, and the timing of a Roth conversion.

What is a Roth Conversion?

A Roth conversion is where you move money from a tax-deferred account, such as an IRA, SEP IRA, or employer plan, to a Roth IRA.

With tax-deferred accounts, you normally receive a tax deduction when you contribute money, growth is tax-deferred, and then withdrawals are taxed as ordinary income.

A Roth IRA allows for tax-free growth and tax-free withdrawals, assuming you are age 59 ½ or older, and the account has been open more than five years.

Tax-deferred accounts have Uncle Sam investing alongside you as a partner, waiting for his share of your gains.

Tax-free accounts have already paid Uncle Sam. They cut him out of future gains and taxation. You get to keep 100% of the growth.

For simplicity, I’m going to talk about moving money from an IRA to a Roth IRA for the rest of the article, but you can do it from a SEP or other tax-deferred accounts, too.

When you move pre-tax money from a tax-deferred account, you are creating ordinary income today. Said another way, you are voluntarily choosing to pay taxes today on the money you move from an IRA to a Roth IRA.

For example, if you choose to convert $1,000 from your IRA to your Roth IRA and you are in the 24% marginal tax bracket, your estimated tax from the Roth conversion would be $240, assuming it does not affect the taxation of any other income. However, going forward, the amount converted to the Roth IRA grows tax-free.

There is no 10% penalty on the Roth conversion amount, even if you are under age 59 ½, unless you decide to withhold taxes from the Roth conversion. If you are under age 59 ½, the tax withholding would count as an early withdrawal and be subject to a 10% penalty. I’ll cover tax withholding in more detail later.

A Roth conversion is a good way to diversify your tax buckets. It’s a way to move money from a tax-deferred account to a tax-free account.

“Okay, but why would I want to pay taxes today?”, you may be wondering. “I’ve been taught to defer taxes as long and as much as possible.”

Yes, and that is a common misconception.

When Does It Make Sense to Do a Roth Conversion?

It generally makes sense to do a Roth conversion when you can pay a lower tax rate today than you or your heirs will be in the future.

It’s that simple.

Before I go on, one of the most common questions I receive is, “What about the years of tax-deferred growth I lose when doing a Roth conversion? How does that factor into the statement above? You are ignoring it.”

No, it’s already factored into the original statement. Let me highlight it with a simple example and then a more complicated one.

Simple Example of a Roth Conversion

Gale has $100 in an IRA and decides to convert the entire amount to a Roth IRA and pay an effective tax rate of 20%. Gale pays $20 in taxes by withholding the money from the Roth IRA conversion. The remaining $80 goes in the Roth IRA and earns 5% in a year, bringing her IRA balance to $84. Let’s assume she has met other Roth IRA rules for withdrawals and can spend the entire $84.

Bruce also has $100 in an IRA. Instead of converting it to a Roth IRA, he leaves it in the IRA and earns 5% in a year, bringing his IRA balance to $105. If Bruce pays an effective tax rate of 20%, he could distribute his entire IRA, pay $21 in taxes, and spend $84.

Gale and Bruce can spend the same $84 amount even though Gale paid taxes and had less invested to start.

This is why you need to compare your tax rate today to your anticipated tax rate in the future. If you can pay tax at a lower rate today, it’s generally better to do a Roth conversion.

Complicated Example of a Roth Conversion

Let’s say you have two people who each have $1,000,000 in an IRA today. They have the choice to leave it in the IRA or convert the entire amount to a Roth IRA. In reality, you can convert only a partial amount, but for the analysis, I am doing the full amount to demonstrate my point.

Gale decides to convert her entire IRA to a Roth IRA and pay an effective tax rate of 20%. I am using 20% as an example. If she converted the entire amount, she would be subject to a much higher tax rate. She decides to have taxes withheld from the IRA, meaning $800,000 is converted to the Roth IRA and $200,000 goes to the IRS.

If Gale had brokerage assets or cash at the bank, she likely would have been better off paying the taxes outside of her IRA assets, but for simplicity and to highlight the point, I am assuming taxes are withheld.

Bruce decides to leave his IRA as-is. He starts with $1,000,000 invested.

Let’s say they both earn the same exact rate of return over 10 years: 5% compounded annually.

After 10 years, Gale will have $1,241,063, and Bruce will have $1,551,328.

While Bruce technically has more on paper, Uncle Sam has been investing alongside Bruce. Now, Uncle Sam wants his cut.

If they both distribute 100% of their balance, Gale can withdraw the full $1,241,063. Let’s assume Bruce pays the same effective rate of 20% that Gale paid at the beginning, meaning Bruce pays $310,266 in taxes, leaving him with $1,241,063.

Gale and Bruce have the same amount of money that can be spent. Below is a chart that helps highlight it.

Again, I am using 20% as an effective tax rate because the math is cleaner and it’s easy to track. Normally, you would do partial Roth conversions each year to fill up certain income tax brackets. This is only to demonstrate that the rate of tax you pay today versus the tax rate you pay in the future is the deciding factor about whether to convert.

With an IRA, the money you see in the account isn’t 100% yours. Part of it is the government’s money – it just hasn’t been collected yet. Unfortunately, you don’t see a “taxes” line item when viewing your account balances.

Since Gale paid 20% at the start and Bruce paid 20% at the end, the Roth conversion didn’t matter.

This is why the key factor is the rate of tax you pay. If you can pay less today than you anticipate paying in the future, a Roth conversion usually makes sense.

Common Scenarios Where a Roth Conversion May Make Sense

There are a few scenarios where a Roth conversion may make sense.

Below is a list:

- Your spouse was diagnosed with a terminal illness and there may only be a limited number of years to file taxes jointly as a couple.

- Your spouse died, and it’s the last year you can file taxes jointly as a couple.

- You just retired and have less income.

- You are taking time off work and have less income.

- You haven’t started taking Required Minimum Distributions (RMDs).

- You are in the 22% or 24% tax bracket today.

Deciding whether to do a Roth conversion is not a simple decision. It requires:

- Doing a tax analysis to estimate your marginal and effective tax rate today

- Seeing how additional income might affect the taxation of other income, such as Social Security benefits

- Comparing your tax rate today to a future estimated tax rate

- Deciding how much you want to hedge the possibility of higher tax rates in the future

The examples mentioned above are common situations where people find themselves in a lower tax bracket today than they may be in the future.

Spouse Diagnosed with a Terminal Illness or Died This Year

For example, if your spouse is diagnosed with a terminal illness or just passed away, many survivors find that they have a similar level of income after their spouse dies, but tax brackets compress for them. This means they pay a higher rate.

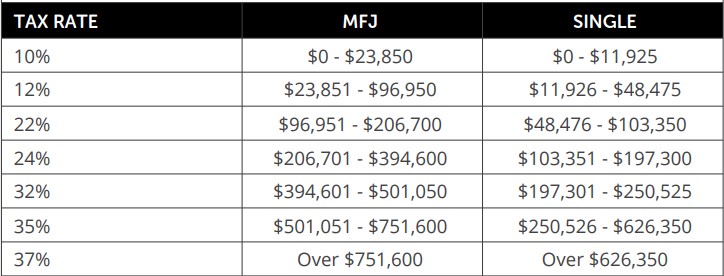

You can see that in the chart below.

If a married couple filing jointly had $300,000 of income in 2024, their marginal tax rate would be 24%.

If one spouse passed away a year prior and the remaining survivor had a similar level of income, they would be in the 35% marginal tax bracket.

You’ll also notice tax brackets are compressed for single filers. For example, the 24% married filing jointly tax bracket allows for $187,899 of taxable income, whereas the 24% tax bracket for single filers only allows $92,949 of taxable income.

The difference in taxes is quite large!

The couple with $300,000 of income filing jointly would pay about $50,944 in total taxes, which is an effective tax rate of about 18.9%. If the surviving spouse had to file single in 2025, they would pay about $70,197 in total taxes, which is an effective tax rate of about 24.6%. That’s $19,253 more in taxes for the same level of income!

In many situations, it would be better to accelerate income by doing a Roth conversion while terminally ill or in the same year as death because you can still file taxes as married filing jointly. By accelerating income, you can reduce your IRA balance, which will potentially reduce your future Required Minimum Distributions and the taxes you pay later.

Lower Income

If you have lower income due to recently retiring, taking time off of work to be a caregiver, or for any reason at all, you may find yourself in a lower tax bracket than you have been in for a very long time.

You should take advantage of lower income years by doing a Roth conversion analysis.

You can also create lower income for yourself by donating to charity or using a Donor-Advised Fund.

For example, if you were in the 32% tax bracket while working, but because you took time off, you will be in the 12% tax bracket, it may make sense to purposefully recognize income to fill up the 12% tax bracket. You may even want to fill up the 22% and 24% tax bracket, too.

In the 22% or 24% Marginal Tax Bracket

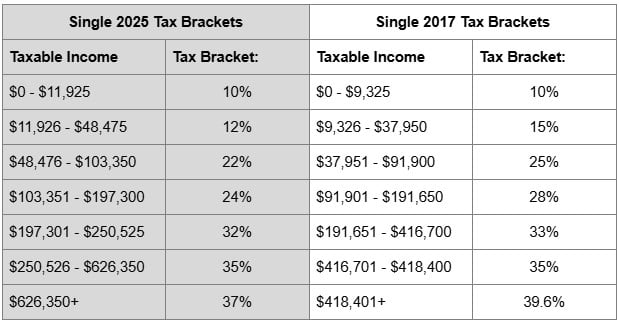

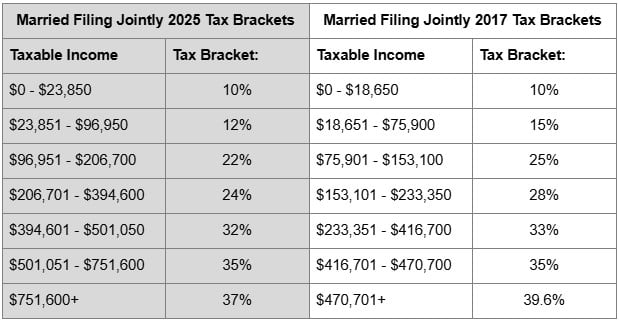

If you are in the 22% or 24% marginal tax bracket, you may be in the 25%, 28% or even higher tax bracket in 2026 and later.

As I mentioned earlier, the tax brackets today are temporary unless congress makes changes to the tax code.

In 2026, we will revert to the 2017 tax rates, adjusted for inflation.

Below are the 2017 tax rates that you can compare to today’s tax rates.

As you can see, many people who are in the 22% or 24% tax bracket may find themselves in the 25% or 28% tax bracket in a few years.

If that materializes, it may make sense for them to recognize income in the 22% and 24% tax bracket through a Roth conversion today to help lower the amount of taxes they pay in the future.

I’d much rather pay 22% or 24% today than 25%, 28%, or more in the future.

Medicare Premiums

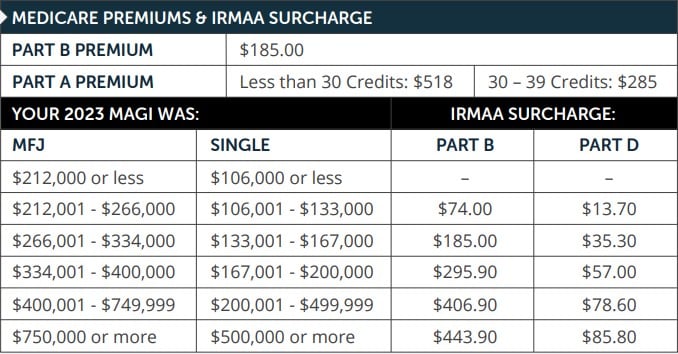

Something to be aware of is that as your income increases, your Medicare premium can also increase, reducing the amount you receive in Social Security benefits.

Your Medicare premium is based on your Modified Adjusted Gross Income from two years ago, which means if you had larger income in 2023, your Medicare premium may be higher in 2025, but then if your income went down again in 2024, your Medicare premium would also adjust back down in 2026.

In other words, it’s not a permanent change. It changes it for one year based on your MAGI from two years prior. Below is a chart showing your Medicare premium in 2025 based on your MAGI in 2023.

This can catch people off guard, but in most situations, the increase in Medicare premium may only add roughly one percentage point to the overall effective rate of the Roth conversion. For example, if your effective rate was 20% without factoring in the increase in Medicare premium, it is usually about a 21% effective rate after factoring in the increased Medicare premium.

I look at the increase in Medicare premium as an additional tax and going from paying $185.00 per month to $259.00 per month is only $74.00 per month. Over the course of a year, that is only $888.00.

From a cash flow perspective on a monthly basis, it can feel like a substantial amount, but when you add it to the increase in taxes from the Roth conversion, $888.00 is minimal.

It’s something to consider when doing a Roth conversion analysis, but in most situations an increase in Medicare premiums should not prevent you from doing a Roth conversion.

Hypothetical Roth Conversion Scenario

Below is a hypothetical example of a married couple who are both age 66, recently retired, and have $1,000,000 in a brokerage account and $2,000,000 in an IRA.

Since they have no other income early in retirement, they are in the 0% tax bracket. If they do nothing, they are likely missing the opportunity to recognize income in a lower tax bracket to reduce the amount of income that is taxed at a higher bracket later.

If they start Roth conversions by filling up the 12% tax bracket and 15% tax bracket in a few years, they will pay about $17,513 to $20,825 each year; however, this smooths out their tax experience later in life.

No Benefit Early

You can see in the image below how the Roth conversion is filling up the 12%/15% tax bracket early in retirement with the green shading on the left. You can see in the box how the green dot shows the taxable income at age 72 with the conversion as $94,303 and the blue dot as $79,966 without the Roth conversion.

In other words, they are paying taxes early in retirement to avoid more income being taxed at higher rates later.

None of the benefit has been realized yet. The Roth conversion is causing higher taxable income than not doing the Roth conversion.

Benefit by Age 85

By age 85, the taxable income with the Roth conversion is only $129,998 while the taxable income without the Roth conversion is $179,616. You can start to see how doing the Roth conversion early in retirement and voluntarily paying the tax before you had to reduced taxable income later.

Plus, you can see how the purple line, representing taxable income without the Roth conversion, continues to grow and be taxed at a higher rate while the green line stays below.

Said another way, allowing money to accumulate in the IRA meant paying more in taxes later. Not only do the Required Minimum Distributions (RMDs) increase later in life causing more income to be taxed, but tax rates also went up.

Cumulative Benefit: $505,941

What’s the end result?

Assuming they live until age 95, the Roth conversion added an estimated $505,941 to their combined wealth. You can see how large of a difference there is in their taxable income, too.

Each person’s situation is unique. This assumes certain rates of return, withdrawal strategies, tax rates of heirs, and other factors that may or may not apply to your situation. It’s meant to illustrate how a Roth conversion can potentially help.

Each individual should do their own Roth conversion analysis and make their own assumptions about rates of return, tax rates, and other factors to decide if a Roth conversion makes sense for them.

Should I Withhold Taxes on a Roth Conversion?

Normally, it’s best not to withhold taxes on a Roth conversion if you have money in savings or a taxable brokerage account you can use to pay the taxes.

For example, if you did a $100,000 Roth conversion and estimated that you would owe $20,000 in taxes, it is normally better to make estimated tax payments to cover that tax balance.

If you structure it that way, the full $100,000 goes into the Roth IRA to grow tax-free.

If you withhold $20,000 from the conversion, then only $80,000 makes it into the Roth IRA to grow tax-free.

If you don’t have money in savings or a taxable brokerage account to pay the taxes, then I would normally withhold money on the Roth conversion.

How Do I Do a Roth Conversion?

Now that you have decided how much of a Roth conversion to do and how to pay the taxes, how do you actually do it?

Most brokerages allow you to do a Roth conversion online.

I normally move investment positions instead of cash because it’s better to stay invested. You could sell an investment, sit in cash waiting a day or two for it to settle, do the Roth conversion, and then reinvest the cash in the Roth IRA, but I normally move investment positions.

For example, if you decide you want to do a $75,000 Roth conversion, you could move around $75,000 of an investment position or combination of investment positions. Since you can’t always move partial shares, you can always convert around $75,000. It doesn’t need to add up to exactly $75,000. If you feel it does, you can always do most of it using an investment position and true it up with cash.

Once you do the Roth conversion, don’t forget to make estimated tax payments to help avoid underpayment penalties. Or, if you are withholding tax on the Roth conversion, you’ll need to create cash in advance to allow the cash time to settle. Mutual funds settle a day after your trade date and ETFs/stocks settle two days after your trade date.

When in the Year Should I do a Roth Conversion?

One of the most frequently asked questions once you know the amount, tax withholding, and what you want to move, is “when should I do the Roth conversion?”

As with most financial questions, it depends!

Early in the Year

In a perfect world, I would do it at the start of the year, sometime in January.

The reason for this is because markets tend to go up more than they go down. If you convert earlier in the year and the market goes up, you get tax-free growth as opposed to tax-deferred growth.

The downside to converting earlier in the year is if the market goes down, you convert and pay tax on an amount that you may not have later in the year.

For example, if you do a $100,000 Roth conversion amount in January and the amount you convert goes down 20%, you will still pay tax on the $100,000 amount, but it is worth far less.

Emotionally, that can feel lousy, but long-term, it usually doesn’t matter.

Variable or Uncertain Income

The other challenge is knowing your income level earlier in the year. For some people, their income is very stable, and they can estimate their final income for the year within a few thousand dollars.

Other individuals have variable income and don’t know how capital gains distributions, bonuses, stock awards, or other income will affect their final income for the year.

For some people, it’s prudent to wait until November to do a tax projection when the income is better known to determine how much to convert to a Roth IRA. You can do the conversion analysis earlier in the year if you want to have an estimate, but you may want to only do a partial Roth conversion or none until later in the year in case your income is higher than you expected.

Dollar Cost Average Approach

The other option is to do a dollar cost average approach by converting a few times throughout the year. For example, if you want to convert $100,000, you may regret converting early in the year if the market goes down. Instead, you could convert $25,000 each quarter.

For instance, you could convert $25,000 in February, May, August, and November. You still convert $100,000 total, but you get four different price points for the conversion.

It’s similar to saving into a retirement account. Instead of a large lump sum, you can spread it out throughout the year.

Over time, I would expect this approach to work out worse than doing it early in the year, but this strategy is more about regret minimization.

In summary,

- Earlier in the year is usually better

- Later in the year is okay, particularly if you are uncertain of your income

- Convert multiple times throughout the year to minimize the regret of one conversion

Final Thoughts – My Question for You

A Roth IRA conversion strategy can be an effective way to reduce the taxes you pay over your life.

Although many people believe reducing taxes in the current year is the most prudent approach, most fail to see how their tax situation may change in the future – sometimes for the worse.

Moving money from an IRA to a Roth IRA is one way to potentially reduce your future taxes. It’s particularly effective in years where you recently lost a spouse, have lower income, and right now while tax rates are lower than they have been historically.

With tax rates set to rise in 2026 unless legislation is passed, many people in the 22% and 24% tax bracket today may find themselves paying 25%, 28%, or higher in the future.

As you do Roth conversions, don’t forget to account for the taxes, either through withholding or through estimated tax payments.

Although many people want to try to time their Roth conversion, studies have shown it’s nearly impossible to consistently time the market. It’s best to pick a strategy for your conversion and stick with it.

I’ll leave you with one question to act on.

How will you decide how much of a Roth conversion to do this year?