My path to becoming a financial planner is boring compared to many others. This isn’t my second or third career like it is for many others. I know financial planners who started as musicians, served in the military, and worked in sales before transitioning to this wonderful career.

My story involves a family member helping me invest when I was young, the process of elimination in college, a little hard work, and a tremendous amount of luck to become a financial planner.

Let me take you back to my younger days and bring you on my journey to help explain why I became a financial planner.

Younger Days

When I was little, I didn’t enjoy reading. It wasn’t until I was older that I discovered I did like reading – I just didn’t like reading fiction.

As my mom said many years later, “I guess we shouldn’t have given you books about mysteries and adventures. We should have given you books about money.”

I can’t fault the school system or my mom. Many kids like fiction books. I just wasn’t one of them.

That became very clear as I started reading books about investing.

My uncle introduced me to investing in high school when he opened a custodial account for me and allowed me to make some of the investment decisions.

Like most seasoned investors, my uncle had already made purchases in the custodial account. He bought boring mutual funds. What teenager wants to own a diversified basket of stocks? It’s not fun or interesting!

Like most teenagers, I decided I wanted to buy a few individual stocks. I started reading. I started learning about different investment metrics, how to screen for stocks, and investment philosophies of experienced investors.

I bought a few individual stocks to complement my uncle’s mutual fund purchases. Most did poorly. Then again, almost everything did as we headed into the Financial Crisis of 2008 and 2009. Stocks dropped 50%+ and the system was on the verge of a total collapse.

Although it was an awful time for people across the world, I’m thankful I had that experience at the start of my investing career. I learned the importance of diversification, stocks don’t always go up, and you need to align the time frame of your investment with when you expect to use the funds.

Better to learn those lessons early with limited dollars and time to make up for mistakes than later with significant dollars and little time to recover from poor decision making.

Still, I was hooked.

I loved the idea of my money working for me. Dividends felt like free money (hint: they are not!). The miracle of compounding looked like magic. My money could work for me even when I wasn’t working.

When I turned 18, the custodial account turned into an account in my name only. It felt like the guardrails had come off.

I wanted more, so I kept reading, playing around with my investment strategy, and learning from others.

College Years

When I went to college, I knew I wanted to be within the business school. I didn’t know exactly what I wanted to do within the business school, but I knew it was the right place for me.

Side note: If money didn’t exist, my back up career would have been a photojournalist. I was an amateur photographer and loved the idea of traveling the world. I had an idea of how tough it would be to make a living as a photojournalist though and decided keeping it as a passion was better.

When I attended Seattle University, I remember having the option of the following majors:

- Accounting

- Economics

- Finance

- Management

- Marketing

As I went through my introductory classes, I went through the process of elimination.

My first accounting course was a blast, but that was primarily due to the professor. If you did something “illegal” in the world of accounting on an exam, he would let you know. I remember getting a good grade on one of his exams, but he still wrote “Go directly to jail” on the top because of a mistake I had made that was illegal in the accounting world.

After I took cost accounting, I knew accounting wasn’t a career for me. It’s the only class I received less than an A in throughout my entire undergraduate coursework.

I also knew I would be out-of-this-world bored doing accounting for the rest of my life. Some people love it, but it was not for me.

Economics was fine, but it felt a little nebulous. I would learn about a model, we would solve for that model, but it wouldn’t actually be how the world works. It never made much sense. It wasn’t for me.

Management was okay. It’s where I learned how to write in a businessy way. It was extremely helpful in teaching me how to communicate in an efficient, straightforward way, but it also killed any personal voice I had. I also knew the thought of managing people for the next 30+ years sounded awful. It wasn’t until later that I realized people in management roles are rarely given the tools or leeway they need to be good managers. Disaster avoided.

Marketing was great. I enjoyed my classes and projects, but I never saw myself as creative, and it felt like I needed to be creative to go into marketing.

Then, I took my intro finance course. I was in love. Well, as much as one can be with a subject.

It was the only class where I would do the assignment and then nerd out by spending extra hours on it. I remember where we had to create an Excel spreadsheet to model a car buy vs. lease decision and thinking “Wow, finally, something applicable to everyday life!”

I loved that finance was hands on. It had models, but there was also a recognition that the inputs could result in dramatically different outcomes. You could work semi-alone in finance or in small teams. I also knew I could earn a good living from it. Money is important. I knew I wanted a career with a high income potential.

Finance had the best of all worlds. I was sold.

Then, I needed to decide if I should go the corporate finance or personal finance route.

Most people went the corporate finance route because most classes offered leaned that way and most jobs we heard about were in corporate finance.

To help balance what I had exposure to, I joined the investment club, which was sponsored by D.A. Davidson. They gave about 25 universities $50,000 every school year for an investment gambling competition. We competed against other universities to see who could earn the most money in a year. It wasn’t investing, but it did teach us how to research stocks, present investment pitches, and make decisions as a team.

Then, I joined Seattle University’s Redhawk Fund, which was a small portion of the university’s endowment. A few students had started with $250,000, but with a long-term mandate to diversify away from the S&P 500 into individual stocks. I was a portfolio manager for a few years. We heard pitches from our analysts, researched on Bloomberg terminals, and chose when to buy and sell individual stocks. We had to justify our positions regularly to the university investment committee.

After some soul searching and experience with the two investment teams, I decided I didn’t want to be a cog in a wheel at a major corporation. Yes, there was a bit of “what if” in my late 20s when my friends in the corporate world started receiving sizable stock grants in the tech run up, but I knew I had chosen wisely.

Personal finance was right for me. It had the technical, analytical, and economic side of things, but it also had the human, emotional, and personal elements. It blended them perfectly.

I could nerd out in spreadsheets with numbers while hearing someone’s life story, what was important to them, and what they were concerned about. I could present the ideal economic solution, but that might not be the best choice for them because of their feelings or personal preferences.

Personal finance felt like a giant puzzle with hundreds of ways each person’s puzzle could be put together. None of them were right or wrong. They simply prioritized different elements.

As I continued taking courses, it only became clearer I made the right choice.

Charles Schwab Internship

I was in a somewhat awkward spot during what would have been my sophomore year of college because I had college credits from high school that meant I could graduate about two quarters early.

This meant during my sophomore year, I had junior standing, but I wasn’t certain I would graduate early because I could add a second major or minor. When I was in school, very few companies wanted summer interns after their sophomore year. Most wanted juniors, and a few accepted seniors because they wanted to build a pipeline of candidates they could hire after graduation.

After submitting my resume and applying to 10+ internships, I was fortunate enough that a Charles Schwab branch manager took a chance on me as a sophomore. I’m forever grateful for him.

I spent 10 weeks during the summer between two branches learning more about Charles Schwab and what financial consultants did.

I loved it!

I had the privilege of doing a little bit of everything. I had the opportunity to help organize a private moving screening for clients, listen to client calls, attend client meetings, listen to wholesalers explain investment strategies, attend sales trainings, and more.

It gave me a really good feel for what the life of a financial consultant would be like.

Throughout the internship, I loved it, but I also recognized that wasn’t the life for me. Many financial consultants were responsible for regularly getting in contact with 300-400 people and often had “practices” where 1,000+ clients could reach out to you for help. That sounded exhausting. How could one keep track of that many people?

They also did not do much financial planning. Although they held the title of financial consultant and some could do financial planning, they weren’t compensated for financial planning. The primary way they were compensated was by selling a solution or product. Their goal was to get clients into an internal or external managed solution. When clients enrolled into a solution, they were compensated. There were other ways they were compensated, too.

I knew I didn’t want my compensation structure to vary based on what the company wanted to sell, which is common with big brokerage companies. I also knew I wanted deeper relationships and the time to go into depth with families to do real financial planning – not financial planning that ends with a solution or product sale.

During my internship, by chance, I met the partner of a financial advisory firm on my second to last day.

We connected shortly after, and I offered to take him to lunch, which somehow ended in an internship opportunity.

My First Job Lasted 10 Years

After my internship, I started full time with the firm. I liked this model of serving clients better.

We worked with fewer clients, met regularly with families, and had the opportunity to go into detail about taxes, investments, estate planning, insurance, retirement planning, withdrawal strategies, and anything else that touched their lives.

I started as a portfolio manager because that’s what this quickly growing company needed at the time. I knew it wasn’t where I wanted to be long-term, but it was a way to get in the door. After a year of trading client accounts, I moved to an associate advisor position. I worked with one of the partner’s of the firm for a few years supporting him and his clients.

I learned as much as possible. I passed the CFP® exam and had to wait a couple years before I could use the marks because it had an experience requirement I hadn’t yet fulfilled.

After a few years of being an associate, I began taking on my own clients.

I still loved it.

People shared the most intimate parts of their lives. Babies are born. Parents die. Inheritances are received. New job offers open up exciting opportunities. Spouses pass away, and the pieces need to be picked up. Couples divorce. Trusts are set up to care for a child that can’t handle money. People remarry and wonder how to handle finances as a couple.

I had the privilege of being allowed into the most emotional and trying parts of peoples’ lives. Then, financially, we developed a plan that worked for them. It involved conversations, financial projections, spreadsheets, more conversations, and the opportunity to change it as life changed.

That’s why I became a financial planner.

I became a financial planner to help people navigate the uncertainty of life, to marry the economic side of things with the emotional, and be a thinking and accountability partner as life changes.

As I became more experienced, I worked less and less with the partner I did previously. I took on more of my own clients, trained new associates at the firm, and was the point person for life and disability insurance.

After a decade and a tremendous amount of growth, I became burned out. I was working with 115 clients and about $200 million of assets doing my own financial planning and most of my own administrative work. The firm had grown from about $500 million of assets under management when I joined to just over $4 billion when I left.

After 10 years, the growth and model of doings things wasn’t sustainable for me, and I had a different idea of what I wanted the future to hold.

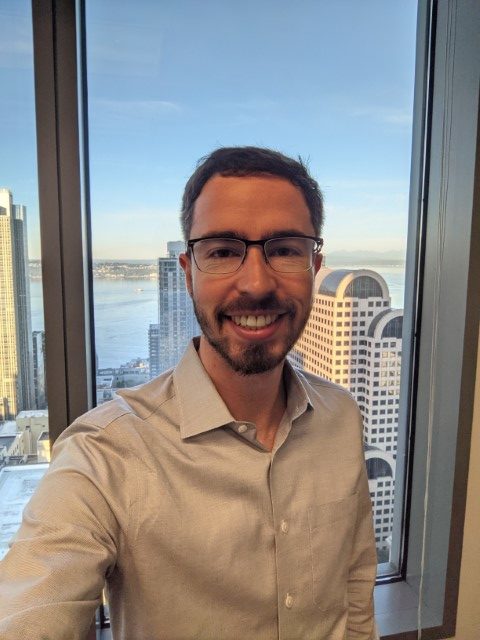

Starting My Own Firm

In September of 2021, I took a leap of faith and quit my job.

My fiancée at the time, now wife, had graduated medical school and secured a residency spot at her top choice program in Internal Medicine in Madison, Wisconsin. I can’t begin to describe how difficult it is to leave wonderful clients, good coworkers, and a well paying job to move across the country away from our entire social circle, have no employment income, and live off savings. Physicians in residency are not paid well, either. It often works out to less than minimum wage.

But, I decided to take this as an opportunity to quit and start my self-employment journey to build the type of practice I wanted. Her residency program is three years, and it didn’t make sense to try to start over with another financial firm if we might move again. Unfortunately, many financial firms haven’t caught on, even in the pandemic world, that virtual practices are an effective way of engaging with clients.

When starting a firm, most practice management consultants and successful advisors preach picking a niche. After all, if you are marketing to everybody, you really are marketing to nobody.

I decided to go from a generalist financial planner working with people in tech, people approaching retirement, people in retirement, small business owners, lawyers, physicians, and more to a financial planner focusing on widows, caregivers, and people affected by major health events.

I can still work with others who don’t fit my niche. I have clients who don’t (my messaging or something else appeals to them), but my marketing is geared towards my niche.

Now, I have the opportunity to grow at a sustainable pace, work from where I want to work, and engage with clients the way I see it working best.

As I see it, I have 50 spots for ongoing clients on the proverbial bus, and once they are filled, I can decide whether I want to get a bigger bus (hire) or keep it the same (remain solo). Right now, I’m leaning towards the latter.

I like that I can develop lifelong relationships with my clients. There is no 800 number, associate advisor, or a corporation removed from client conversations deciding what happens.

While starting a firm from scratch is tough, it’s been incredibly rewarding. I’m glad I took that leap of faith.

It’s better for my clients, and it’s better for me.

Final Thoughts

From investing as a teenger to a firm owner, it’s been quite the experience! I’ve seen more than I would have ever anticipated as a financial planner.

I feel grateful that I was lucky to identify early on what I wanted to do and had the support to continue down that path.

I’m also lucky I have a supportive wife who encouraged me to do what’s best for me and supported me in the decision to quit my job.

When I meet with clients, analyze statements, and prepare financial plans, I am constantly reminded I made one of the best life decisions becoming a financial planner.

I can’t imagine doing anything else. I often play the lottery game in my head, which goes something like this, “If I won $100 million tomorrow, would I still show up for work?”

The answer is “yes, absolutely.”

I can’t imagine not hearing about my client’s lives and helping them design a financial, tax, and investment plan that works for them.