Stock market forecasts are useless.

Despite the amount of money, time, and energy that is spent each year by Wall Street economists, traders, and CEOs on stock market predictions, they are pointless. They provide no value other than to make us feel good by providing a narrative that helps us make sense of situations.

Stock market forecasts tend to come out more after a major decline or an extended period of good returns. The word “uncertainty” is thrown around along with some economic data points to explain what is happening.

Some people react to it, often poorly, while others find it interesting and go on with their day.

Let’s look at why stock market forecasts are useless.

Reason #1: Stock Market Forecasts are Often Wrong

The first reason stock market forecasts are useless is that they are often wrong.

Why rely on something that is usually wrong?

I ask that seriously because I know many people who pay attention to stock market forecasts and think they have predictive power. The interesting part of stock market forecasts is that once they are made, people move on.

There are no accountability scorecards. Nobody wants to show you a historical record of their stock market forecasts because it would look worse than a gambler trying to convince you they only need one more spin at a roulette table to get on their lucky streak.

If stock market forecasts were useful and accurate, you would have an easy time finding past predictions.

If you don’t believe me, try searching for historical stock market predictions from any company or individual. They are nearly impossible to find.

I am continually amazed that an entire industry exists when they are wrong more often than they are right.

Philip Tetlock conducted forecasting tournaments in the 80s, 90s, and early 2000s and found most experts are no better than “a dart-throwing chimpanzee” at predicting events, and people who were more famous had less accurate predictions.

Take that in for a moment.

Experts in their field are often no more right than chance and people who are famous and receive the most attention actually make predictions that are wrong more often than chance.

Perhaps you should think twice before listening to a CEO, media personality, or famous Wall Street person about their stock market or economy forecasts.

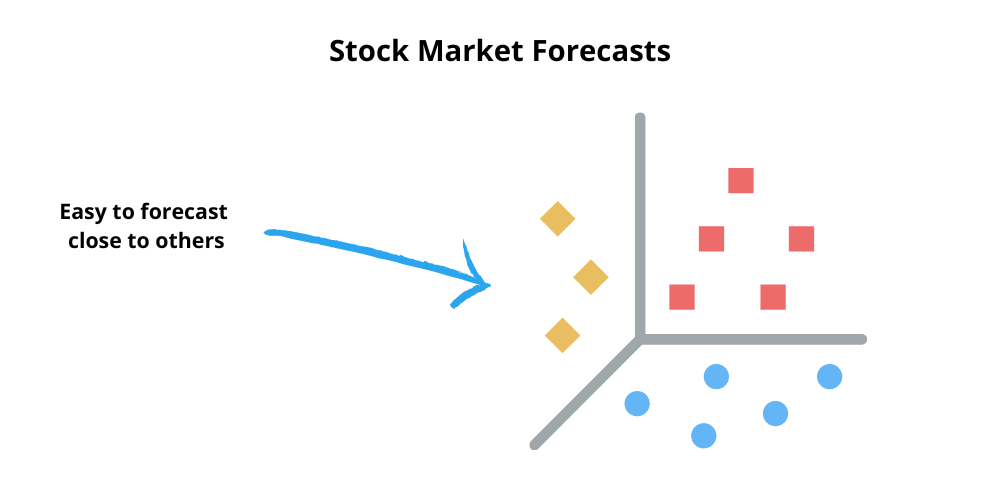

When making stock market forecasts, most people take an average and extrapolate a little from there. You’ll find that most stock market forecasts are clustered around each other.

The S&P 500 as of this writing is around 3,674. If people are predicting the S&P 500 a year from now, you are likely to see many forecasts around 4,041, which is an increase of about 10%. Since the stock market has gained on average about 10% per year, it’s reasonable to assume it goes up 10% from here.

You may get a few people who are more pessimistic and forecast something lower, perhaps around 3,857. You may get a few people who are more optimistic and forecast something higher, perhaps around 4,225.

If you looked at it on a cluster plot, you will likely have quite a few dots around 4,041.

It’s the safe thing to do.

Very few people are going to make a bold prediction and say the stock market is going to be down 20% or up 30%. They would look preposterous compared to the other people making predictions, which is not something they would want.

But, there are a few people who continually make very pessimistic predictions. They are often called “perma bears” because they consistently expect stocks to fall, and when they are finally right (because they likely will be eventually), they get an outsized amount of air time for being “right” even though they were wrong all of the times before.

Again, there is no accountability for being wrong 19 out of 20 times. It’s only the 1 out of 20 that gets rewarded.

The financial media is good at featuring stock market forecasts, despite how wrong they often are.

Check out this title “The Worst of the Global Selloff Isn’t Here Yet, Banks and Investors Warn” in the Wall Street Journal from March 22, 2022, a day before the bottom of the market during the COVID pandemic.

There is tons of fear in that article, complete with quotes from people high up in Wall Street a day before the market turned around. If the people with the most information, who are highly compensated to trade markets and make forecasts can’t accurately predict the stock market, what chance does anybody else have?

Stock market forecasts are useless because they are often wrong. When they are right, look at past predictions if you can find them. They may have been making the same call the past ten times.

I appreciate people who can poke fun at annual forecasts.

If you are tempted to believe a stock market forecast, ask yourself the following questions:

- How accurate are their historical forecasts?

- Does the forecast fit a narrative for what they are selling?

- Am I paying more attention to them because they are famous?

Stock market forecasts are often wrong. You should look at the reason someone is making a forecast and how it fits in line with their own bias or agenda.

Reason #2: Stock Market Forecasts Encourage Bad Reactions

The second reason stock market forecasts are useless is that they encourage bad reactions.

I’m a big believer that anybody investing money should have an investment policy statement. It doesn’t matter whether you are a hedge fund, retiree, or a five-year old granddaughter.

An investment policy statement acts as a rulebook for exactly how you plan to invest so you are not tempted to react to market news or useless stock market forecasts.

Stock market forecasts can encourage bad reactions because they often elicit fear.

Sometimes it is a fund manager defending their strategy, but sometimes it is an investment company trying to sell gold or an investment newsletter.

I’ve received countless emails over the years asking for my opinion about a certain investment strategy, gold, or insurance-based “investment.” What’s tough about these emails is that nearly every investment is going to have its time in the limelight.

It’s problematic because strategies that do well during market declines often attract more attention and dollars after the decline. In other words, people often invest money into strategies that protect them after they need it.

The market often goes up from that point, and then they grow frustrated with the strategy, sell it, and then they don’t have that protection during the next market decline.

The other issue I have with market forecasts is that people often seek forecasts that fit their view.

Worried about the economy? I’ll bet you are searching for articles with doom and gloom.

Confident technology stocks will continue to rise? I’ll bet you are searching articles about how this time is different and higher valuations are justified.

In cash waiting for a stock market drop? I’ll bet you are reading articles about how cash is the right place to be right now.

If a stock market forecast is making you think about selling something outside of your investment policy statement, buying something based on a frenzy, or confirming your current worldview, ask yourself the following questions:

- How does this fit within my overall plan?

- How am I reacting to this forecast and historically, has this been a good long-term strategy?

- How much of this viewpoint is already known and probably reflected in stock prices?

Stock market forecasts often are meant to elicit certain emotions to get you to take action. It could be tuning into the news, buying an insurance product, or subscribing to an investment newsletter with “secrets” people don’t want you to know.

Reacting to stock market forecasts often leads to poor decisions.

Reason #3: It’s Easy to Make Stock Market Forecasts

The third reason stock market forecasts are useless is that it is easy to make them!

You don’t have to be a famous person, work on Wall Street, or be a chief investment officer to start making predictions.

You can make an account on Seeking Alpha, apply to write for The Motley Fool, or start your own blog and start making stock market forecasts.

You can make as many of them as you want. You can make a weekly trader’s outlook or publish daily videos with sound effects.

If you get a forecast wrong, nothing happens. You continue publishing until you get it right and then use that to profit off of it, such as with newsletters, books, or shows.

Although forecasts can be made by anybody, the people who garner the most attention are often famous. People who have prestigious degrees or impressive experience often have large platforms which lend them more credibility.

Bill Gross, a famous bond manager, has made very pessimistic stock market forecasts in the past only to be wrong, but yet, people still listen to him and his predictions.

It’s difficult not to pay attention to stock market predictions because there is glamor behind certain personalities. They have been successful, manage billions of dollars, and speak confidently on television. There is an implied trust based on everything you hear, but remember the study from earlier where more famous people actually do worse at predicting the future.

Imagine if there were consequences to making a wrong prediction or a limited amount of predictions one could make.

You wouldn’t have an entire industry propped up by talking heads that consistently get forecasts wrong.

As you hear stock market forecasts, ask yourself the following questions:

- Is there a public record of the accuracy of their stock market forecasts?

- Do they always make these sorts of calls?

- What are the consequences of this forecast being wrong?

If we looked at stock market forecasts more skeptically, we would likely be far better off.

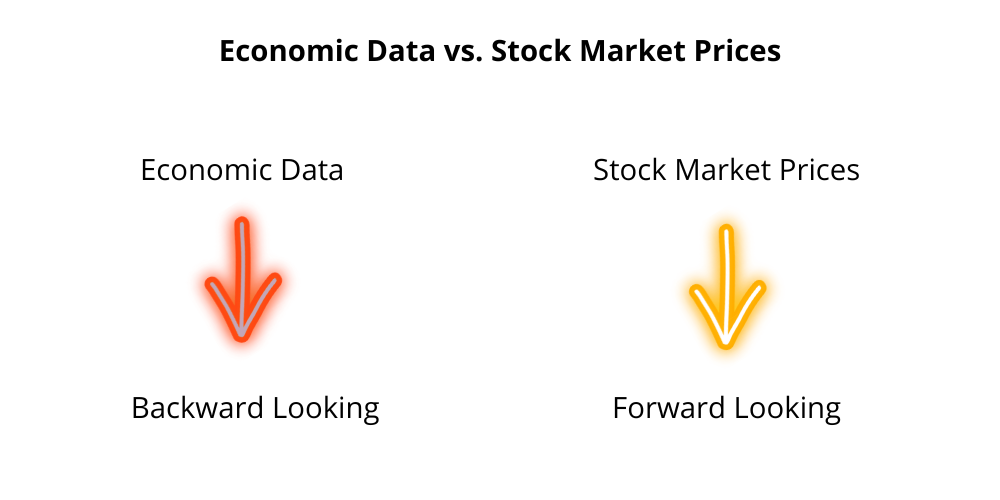

Reason #4: Stock Market Prices and “The Economy” Are Different

Something that catches people off guard in nearly every market cycle is that the stock market and the economy are different.

The economy reports what happened. The stock market is a collective understanding of what might happen.

When economic data is released, it is backwards looking. When unemployment numbers are released, they report unemployment from a month ago. When inflation figures are released, they report inflation from a month ago. GDP changes report what happened a quarter ago.

The stock market is taking everything happening in the world right now and trying to assign a price to each stock. Traders, speculators, and investors are deciding what everything is worth in real time.

That’s why when news is released about a drug potentially getting FDA approval, you often see the pharmaceutical company increase in price.

On a stock market basis, prices are reflecting future expectations – unemployment, inflation, consumer sentiment, new products, war, oil supplies, and more. It’s forward looking.

What often ends up happening before a decline is that very few people will forecast the stock market declining because the world feels good. The economic numbers look good. Consumer sentiment is good. The economy is functioning well, and people feel good about their lives.

You’d look odd forecasting doom and gloom during good times.

Then, the stock market may fall without warning. From there, it’s okay to start saying “things are uncertain right now” or “we are going to need more clarity about XYZ” before we can head into a recovery.

You’d look odd forecasting optimism during bad times.

Then, the stock market may recover without warning. Economic numbers are likely to look awful because they are reporting what already happened, but the stock market is looking ahead. It sees better things on the horizon and prices adjust accordingly.

Rinse and repeat during every market cycle.

Remember, it’s easy to forecast doom and gloom during bad times and optimism during good times. It’s much harder to do the opposite.

The people who do often permanently stay that way. For example, doom and gloom people often permanently predict doom and gloom. They may be right 1 out of 100 times because they guessed the same thing the other 99 times.

It’s important to distinguish between stock market prices and the economy. They measure different things and different time periods.

When you hear a stock market forecast, ask yourself the following questions:

- Is the stock market forecast about stock prices or an economic figure?

- Are they predicting and extrapolating the current scenario into the future?

- How does this compare to their prior stock market forecasts?

News is often already reflected in prices. For stock market prices to change, expectations usually need to get better or worse from the current point.

Reason #5: The Future is Always Uncertain

People are going to say “there is a lot of uncertainty right now.” Guess what?

There is always going to be uncertainty. Always, always, always.

Please, try to tell me a time period where there was certainty.

There are too many variables in life, too many possible reactions, and too many people who can influence decisions based on their own beliefs to have any certainty with the way the world will unfold.

People often like to say if X happens, then Y will happen.

For example, if the world is shut down due to a pandemic, stock prices will fall, and it will take years to recover.

If they raise the minimum wage, businesses will go under, and the local economy will struggle.

If the Fed raises rates, we will go into a recession, and the stock market will collapse.

It’s often a clear route from A to B, but the problem is that the world doesn’t work that way. The world is complicated. The world is messy. It’s incredibly messy.

If A happens, there are billions of people who can influence what happens next. Who had a worldwide pandemic on their 2020 bingo card? Further, who had the largest stimulus response ever on their bingo card?

What about which banks would be saved during the Financial Crisis? Or the Fed starting to buy government-backed bonds to help stabilize the housing market?

The point is that innovation happens. People come up with new ideas. People try something different. Random events happen.

They all impact the economy.

If you can tell me exactly what will happen, how 7 billion plus people will react, how everyone will react to other people reacting, and how that will flow through to a final result…well, I wouldn’t believe you.

When people start saying the word uncertain, it is their way of hedging their statement. They know it’s impossible to know what is ahead. It’s their way of being concerned and nervous.

They can make a guess. It can be a fun exercise. I enjoy it from time-to-time, but I know it is useless.

It’s an educational exercise to try to make sense of the world when nobody can make sense of what is happening.

Final Thoughts – My Question for You

Although stock market forecasts are useless, they can be a fun thought exercise.

If you want to use them as an exercise in what could happen, fully recognizing it may be wrong, that’s okay. I wouldn’t use them as a rationale to invest differently.

It’s been proven stock market forecasts are often wrong.

In a world where there is little to no accountability, it’s easy to make forecast after forecast with no consequence.

It’s easy to say we are in “uncertain” times and make predictions based on current economic data that is backward looking. Most forecasts are not going to go against the grain and make predictions outside of the normal range. Those that do often do it to sell you something.

I’ll leave you with one question to act on.

How will you respond the next time you see a stock market forecast?