Last Updated on February 5, 2025

Deciding how to create a paycheck in retirement is one of the key decisions people often bring up to me in a first meeting.

When you work for thirty or more years and are used to a regular paycheck, it can feel daunting not knowing where your next paycheck will come from. Most people will receive Social Security at some point, a pension in certain circumstances, and the rest will need to be created from the assets they diligently saved over their career.

The question becomes, “How do I create income in retirement from my assets?”

People wonder about dividend stocks, annuities, bucket approaches, total return strategies, CDs, bond ladders, and more.

Let me break down how you can create a paycheck in retirement.

Once you know how to create income in retirement to recreate the feel of a paycheck while working, retiring can feel less stressful.

#1: Determine Expenses in Retirement

The first step to creating a paycheck in retirement is understanding your expenses.

This is the most important step in the process. If your numbers are wrong, they will throw off the rest of the plan.

If you are like most people, determining your expenses may be a challenge. Many people I talk with tell me how they stopped budgeting while they worked because there was always enough.

If that is your situation, it’s okay.

It does mean more effort and time on your part than someone who already knows what they spend.

One way to estimate what you have spent over the past few years is to pull a summary report from your credit card or bank. Most credit cards now have basic reporting tools on how much you spend, but I find they are not great at catching the granular details and certain spending items may be miscategorized.

You can see in the example below, “Merchandise” is a broad category and “Other” is not helpful.

Please make sure to pull the report for every credit card you use.

From there, pull a summary report from your bank for your checking account. If your bank doesn’t have one, you may need to export the CSV file with every transaction and work your spreadsheet magic to determine your total spending for the prior year.

Don’t forget to subtract out your credit card payments from your checking account!

Once you have the totals from your credit cards and checking accounts, you know your historical expenses.

Now, you need to estimate it for the future.

Where I see people go wrong in analyzing their future expenses is the following:

- Thinking something is a one-off cost when, in reality, it isn’t.

- Examples: A large trip, a big home repair, a car repair, etc.

- Not accounting for home maintenance costs.

- Examples: Replacing siding, replacing a roof, replacing appliances, etc.

- Taking a short time frame and annualizing it without considering whether major expenses were in that time frame.

- Example: Only using the last three months of spending, which did not include larger expenses.

I normally tell people to plan on home maintenance costing 1% to 3% of the current market value of the house. You don’t spend it every year, but it’s important to save it for the larger, lumpier expenses, such as replacing a roof. For example, if a new roof is $20,000 and you need to replace it in 10 years, that’s a “cost” of $2,000 per year. You don’t spend it every year for 10 years, but you need it at the end of 10 years.

Once you have your total average expenses for a year, I’d recommend organizing them by year.

Organize by Year

Organizing your expenses by year won’t be perfect.

I’m confident you won’t know exactly when you need to replace a car, when you can remodel your kitchen, or take a huge trip with family, but it’s better to have an outline that can change than not plan for it at all.

You can build this in a spreadsheet, on a piece of paper, or however you best see things visually.

Based on the work you did calculating your total average expenses by year, now you can add in the regular, but less than annual expenses.

For example, think about the following questions:

- How often do you replace cars?

- Do you plan to do a large trip with your family and pay for everyone?

- Is there elective surgery you plan to have?

- Do you want to do a big home remodel?

- Do you plan to gift money to a child or grandchild for a wedding, college, or a down payment on a home?

Think carefully about how you can use this money to live your ideal life. Then, add in the larger expenses that don’t show up every year.

Now you have a better plan for how much of a paycheck in retirement you’ll need.

Estimate Life Expectancy in Retirement

Next, estimate your life expectancy to better plan for how long the expenses will last.

There are a few different calculators you can use:

- Social Security Administration Life Expectancy Calculator

- This calculator is easy to use because you enter your sex and date of birth. The downside is that it doesn’t take into consideration your health.

- Blueprint Income How Long Will I Live?

- This calculator takes into account your gender, race, age, weight, height, education, marital status, whether you are retired, annual income, exercises, and other lifestyle factors, such as alcohol and smoking, to give you an estimate.

- John Hancock Life Expectancy Calculator

- This calculator is similar to the one above in that it asks about health, such as blood pressure and cholesterol, height, weight, and lifestyle factors.

I find many people underestimate their life expectancy. For example, depending on which mortality tables you use, for a married couple who is age 65, there is more than a 50% probability that at least one person makes it to 90.

To be conservative, I often create financial plans with a life expectancy of age 90 to 95.

Plan for Long-Term Care Expenses in Retirement

The last step in planning your expenses during retirement is to consider long-term care expenses.

This is the most challenging expense to estimate because it could be anywhere from $0 to over $1,000,000.

Some people die without ever needing long-term care while others may need to go into a memory care unit for over a decade.

Since this is hard to plan for, I normally suggest a placeholder figure for a couple years worth of expenses simply to see how it affects the overall plan and need for income throughout retirement.

The key aspect to keep in mind is that some expenses drop off when you need long-term care. For example, if you are already spending $120,000 per year, you don’t necessarily need to add $5,000 to $15,000 per month of long-term care expenses to your total spending. Some of the $120,000 will be replaced, such as travel and home expenses, if you move to a facility by the long-term care expenses.

#2: Determine Income in Retirement

Once you have your expenses totaled by year, you need to determine your income in retirement.

Your income sources could be Social Security, pension, annuities, rental income, trust income, or other regular sources of income.

Maximize Social Security Over Joint Lives

Unfortunately, I see many people claim Social Security as early as possible when it is unlikely to be in their best interest.

Social Security is one of the best sources of income. It’s as close to a guaranteed source of income with a cost of living adjustment as you can find.

For married couples and widows, it’s particularly important to plan over your joint lives or consider survivor benefits in the calculation.

It’s important for single people to plan, but the break even analysis is easier than for a married couple or widow.

Since there are many different ways for a married couple to claim Social Security benefits, it’s important to run a comprehensive analysis, use a tool such as https://opensocialsecurity.com/, or work with an advisor to ensure you are planning for your joint life expectancies.

Optimizing Social Security benefits could mean tens of thousands or more dollars in income during retirement.

Please see below as an example of different Social Security claiming strategies for a married couple. The red shows if they claim Social Security benefits early versus the primary strategy that optimizes benefits over different life expectancies.

Choose Pension Withdrawal Options in Retirement Wisely

Although pensions are becoming less common, I regularly meet people who need to choose how to claim their pension.

People often have the choice of the following options:

- Single life only

- 50% survivorship

- 75% survivorship

- 100% survivorship

If you are married, carefully consider what it would mean for you to choose the single life only option because the amount is higher. If you die a year later, your spouse be without the pension income for the rest of their life.

Another feature of your pension you should research is whether you receive a cost of living adjustment. While it’s more common for states and municipalities to give automatic cost of living adjustments, it’s often less than the true inflation people experience in their own spending.

Plus, sometimes states and municipalities don’t automatically give cost of living adjustments. Sometimes it is optional and voted on by a board. You may only receive raises every few years in that situation.

With corporate pensions, it’s common to not receive cost of living adjustments, which means the amount you receive at retirement won’t go as far in 20 years. That requires more planning because withdrawals from your other assets will need to make up for the shortfall as time goes on.

For example, if you receive $4,000 a month starting at retirement and inflation is 3% per year for 20 years, that $4,000 would only buy about $2,214 worth of stuff in 20 years. That’s a difference of over $1,700 per month or about $21,000 per year.

You’ll need income from other sources to make up that difference to maintain the same standard of living.

If you have a pension, it’s a major income source in retirement, and it’s important to plan for it.

Consider Annuities for Income in Retirement

Another option for retirement income is an annuity.

Some people have older annuities they bought that they choose to annuitize, some have older annuities that they choose to 1035 exchange into another annuity product, or some choose to buy an annuity outright with funds earmarked for retirement.

Although the rates of returns on lifetime income annuities tend to be low unless you live a long time, it is a way to hedge against longevity.

For people who are afraid of running out of money, may not stay invested through the ups and downs in the stock market, and want the security of a monthly income, a lifetime income annuity can be one source of income in retirement.

Please keep in mind that the more complicated the annuity, the worse it tends to be. You’ll want to work with an experienced financial planner, ask many questions, and make sure you understand how the annuity works before making a purchase.

Unfortunately, I’ve worked with many people to understand and undo annuities that may not have been in their best interest.

#3: Calculate How Much You Need to Withdraw from Your Investment Accounts

Once you know your expenses by year and what income sources are available throughout retirement, it’s time to calculate approximately how much you’ll need to withdraw from your investment accounts.

Determine Withdrawals by Year

The best way to determine your withdrawals is to approximate it by year until your estimated life expectancy age.

The reason for this is because if you retire in your 50s or 60s before you start Social Security, your withdrawal may feel large. For example, I know some people who have an 8% withdrawal rate for a few years when they are living off of their assets, but once they start Social Security, their withdrawal rate may go down to 3%.

The 8% withdrawal rate can feel like too much, when in reality, they will be fine. It’s common for people to create a bigger paycheck in retirement from their assets the first few years of retiring before other income sources start.

You can use financial planning software, a spreadsheet, or even a piece of paper to model your withdrawals.

Write out by year your income sources:

- Social Security

- Pensions

- Rental Income

- Part-Time Income

- Annuity Income

- Royalty Income

- Required Minimum Distributions (RMDs)

- Other Sources of Income

Then, write out your expenses:

- Regular Spending

- Home Spending (property taxes, homeowners insurance, and budget 1% to 3% for home maintenance)

- Healthcare Expenses

- Car Purchases (such as one every 7 years)

- Gifts to Family Members (if employing a gifting strategy)

- Gifts to Charities

- Taxes (Federal, State, etc.)

Now you can visually see your shortfall and how much of a paycheck you’ll need to create from your assets.

For example, if you need to spend $100,000 the first year and you receive $30,000 from Social Security and $20,000 from a pension, you’ll need to create $50,000 from your assets in that year.

What is Your Withdrawal Rate?

After you know how much you need from your assets, you can start to estimate your withdrawal rate.

As I mentioned earlier, your withdrawal rate may be high in the early part of retirement, but then go down to a more manageable level once you start receiving other sources of income.

The withdrawal rate can provide a gut check to see if the paycheck you need to create in retirement is sustainable.

You may have heard of the “4% rule” (though it’s not a rule!). The Trinity Study researched withdrawal rates over a 30-year retirement horizon and determined that withdrawing 4% of the portfolio’s initial value at retirement and adjusting by inflation each year gave retirees a good chance of their portfolio lasting through their lifetimes.

For example, if you had $2,000,000, you could spend $80,000 the first year of retirement. If inflation was 3% the first year, you could spend $82,400 the next year ($80,000 x 1.03).

The withdrawal rate is important because if your withdrawal rate is high, you may need to adjust your spending, find ways to increase income in retirement, or choose a later retirement date.

#4: Choose Which Accounts to Take Withdrawals From

Once you know how much you need to withdraw by year, you need to choose from which accounts to take the withdrawals.

Types of Accounts

“Which account should I take a withdrawal from to create a paycheck in retirement?” is a common question from retirees.

Sometimes they have a smorgasbord to choose from: Traditional 401(k), IRA, Roth IRA, Brokerage Account, Annuities, and Health Savings Account (HSA).

Each has their own taxation rules.

Traditional 401(k)s are taxable as ordinary income. It’s the same for IRAs, unless you have after-tax cost basis, which means less of it would be taxable.

The Roth IRA is tax-free, so that’s often a bucket you want to touch last, though there are situations where it can make sense to take a withdrawal sooner.

Then you have a brokerage account with capital gains treatment and the availability of tax-loss harvesting.

Annuities have different taxation based on how you take funds, such as annuitizing or taking withdrawals. If you choose to take a withdrawal, the first money taken out is considered a gain and taxed as ordinary income — similar to a Traditional 401(k). Once you withdraw all of the gains in the policy, your cost basis, or what you put into the annuity, is not taxed.

If you choose to annuitize the annuity and take a stream of income, a portion of each annuity payment won’t be taxed (your cost basis) while a portion may be taxable.

Finally, you may have an HSA that can be used tax-free for qualified medical expenses.

As you can see, if you have a variety of accounts with different tax treatment, how you take withdrawals to create a paycheck in retirement is critical.

Withdraw from Accounts That Optimize Taxes

This is where it becomes important to run a multi-year tax projection to see how your tax bracket may change throughout retirement.

Many retirees believe they will be in a lower bracket throughout retirement, but many people I meet did such a great job saving that their future Required Minimum Distributions, Social Security, and pension can bump them into a higher tax bracket similar to when they were working.

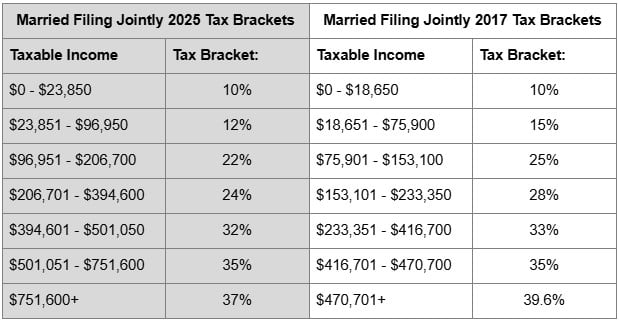

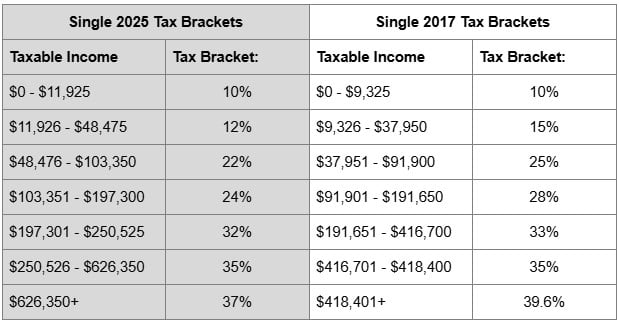

Plus, the current tax rates for 2025 are lower than the tax rates we may have in 2026 if the Tax Cuts and Jobs Act sunsets at the end of 2025. In other words, politicians would have to come together and agree on a tax change, otherwise, the default trajectory is higher tax rates in 2026 for many people.

This is the step where many people get analysis paralysis and simply decide to take a withdrawal from somewhere. In my experience, it is often a Traditional 401(k).

Unfortunately, this might be a missed opportunity.

I’ve seen people take withdrawals when they could recognize long-term capital gains and not pay anything in taxes. I’ve seen others who take a withdrawal from an IRA when they may have been better off doing a partial Roth conversion.

Others may be able to take HSA withdrawals for qualified medical expenses, which may leave them more room to do Roth conversions instead of taking IRA withdrawals.

Optimizing taxes in order to pay the least amount of tax that you are legally obligated is one way to have a more successful retirement. If you don’t optimize taxes by choosing which accounts to take withdrawals to create a paycheck in retirement, you are voluntarily giving the government more money.

Most people I meet don’t want to do that.

#5: Create Your Own Monthly Withdrawal for a Paycheck in Retirement

Finally, once you decide from which accounts you’ll take withdrawals, it’s important to actually create the paycheck in retirement so it can work as much on autopilot as possible.

Decide on Withdrawal Frequency

The first step is deciding on a withdrawal frequency for your paycheck in retirement.

I’m partial to monthly withdrawals.

Monthly withdrawals often line up well with bills, feel similar to a paycheck, and strike a good balance between being hands on and enjoying retirement.

You could choose to take withdrawals twice a month, but I find that is unnecessarily complicated.

I’ve also met people who take quarterly withdrawals and annual withdrawals. The downside to those is that it is harder for people to budget their spending every 3 to 12 months.

Once you decide on a withdrawal frequency, set it up to complete automatically.

For example, if you need $60,000 per year, set up a $5,000 monthly withdrawal from the accounts to which you plan to take withdrawals.

You could decide to create enough cash for a couple months of withdrawals and replenish it every few months.

You can use rebalancing as a way to naturally create cash for yourself.

For instance, if your portfolio is $2,000,000 and stocks are normally 50% of your portfolio ($1,000,000) and they are currently 55% of the portfolio ($1,100,000), you may decide to sell down stocks because they have done well recently (buy low and sell high).

They are “overweight” $100,000 from their target, so if you are creating $15,000 for the next few months of withdrawals, you could sell that amount from stocks. That would be a natural way to rebalance because after selling, stocks would be worth about $1,085,000 (54% of the portfolio). It’s a minor adjustment, but it’s one way to choose what to sell based on rules that are in your investment policy statement.

This method of withdrawal focuses on total return, which is my preferred method of creating a paycheck in retirement. Your portfolio may produce dividends and interest to help with the withdrawals, but any shortfall is covered by selling down a portion of the portfolio.

Avoid Dividend Investing and Reaching for Yield

If I had a dollar for every time I read about someone on the internet focusing on dividend investing or reaching for yield simply to create income so they don’t have to sell a part of their portfolio, I could be retired.

Total return is more important than yield.

Total return is dividends plus appreciation in the portfolio.

If you are focused on only dividend investing, you are excluding a large portion of available investments. There are many problems with dividend investing.

I also see people “reach for yield” by focusing on higher dividend paying stocks or investments, such as MLPs, REITs, and energy producers. I find these people often have concentrated investments in one or two sectors of the economy and fail to account for the fact that if their investments go down 20%, it doesn’t matter if the yield was 7%, you are still down overall.

I remember meeting someone once who claimed they were getting phenomenal returns on their real estate investments. They told me, “It’s 10% guaranteed!”

When I looked at their tax return, they had losses of over $1,000,000 due to bad real estate investments.

Apparently, that 10% wasn’t guaranteed.

If you need to create a paycheck in retirement, I’d caution against focusing only on dividend investments. You can create your own paycheck by focusing on total return and selling off a portion of your portfolio.

For example, if your portfolio goes up 7%, you could sell a portion of that appreciation to create a paycheck.

Keep Your Retirement Paycheck Simple

Another key to creating a paycheck in retirement is to keep it simple.

I see people ask in forums about CD ladders, optimizing money market funds to get 0.1% more return, and other strategies that might increase the return slightly, but it has a huge hassle factor.

For example, you could create a CD ladder with a CD maturing every month to create your retirement paycheck. If you have the time and want to spend it that way, that’s okay.

Personally, I think simplifying what you do is a better strategy.

You could have one or two CDs mature every year and use that for your paycheck. You could own bond funds and sell a portion of them off a few times a year to replenish your cash buckets.

There are many options to how you create a paycheck in retirement, but a theme I talk about with people frequently is simplicity.

The simpler something is, the less analysis paralysis and fewer mistakes you are likely to make.

Adjust Withdrawals as Needed

Once you establish your system, you’ll need to adjust your withdrawals as needed.

Although many retirement programs model cost of living adjustments every single year, I find most people don’t actually spend that way in retirement.

For example, if you start a $5,000 monthly withdrawal from the portfolio, a retirement model might assume you spend $5,150 per month the following year (3% inflation). In reality, some people make no adjustment for a year or two and then bump it up. Some spend slightly more than anticipated in the first part of retirement while healthy and then scale back.

The key is to model inflation adjustments in your analysis and then adjust in real life as needed.

As someone once told me, “All illustrations lie. We just don’t know in which way and by how much.”

Example of a Couple Creating a Paycheck in Retirement

Let’s go through an example of a married couple, Amy and Josh, who are both age 60, retired, and needing to create a paycheck in retirement.

They have the following assets:

- Brokerage account: $1,000,000 (with a cost basis of $500,000)

- Roth IRA: $200,000

- Traditional IRA: $1,800,000

- Home: $1,500,000 (no mortgage)

Step 1: Determine Expenses in Retirement

After carefully reviewing their expenses the past few years, they calculate their total expenses to be $150,000 per year.

This includes car payments, health insurance, home maintenance, foods, groceries, travel, and any other spending.

They want to plan on longevity and plan to spend $12,500 a month adjusted for inflation until age 90.

Their plan is to sell their home once one of them needs long-term care.

Step 2: Determine Income in Retirement

They have the following sources of income, and they have determined this will maximize benefits given their estimated life expectancies:

- Amy Social Security: $40,000 annually starting at age 70

- Josh Social Security: $30,000 annually starting at age 67

They decide they don’t want to annuitize any of their assets and would prefer for them to be liquid.

They also don’t receive a pension in retirement.

Step 3: Calculate How Much to Withdraw From Investment Accounts By Year

Since Social Security won’t start for 7 years and their full amount won’t be available for 10 years, they will need to use their investment accounts to create a larger paycheck in the first part of retirement and then adjust the paycheck to a lower amount once Social Security starts.

Although the withdrawal rate will be higher in the first part of retirement, it may go down once Social Security starts.

For example, spending $150,000 from their total investments of $3,000,000 is a withdrawal rate of 5% to start. Depending on market returns, that withdrawal rate may go up the first few years as they withdraw from their portfolio, but once Social Security starts, the withdrawal rate may be lower.

Although the portfolio value at age 70 is unknown, let’s say it is $2,500,000 at that time. If they need approximately $80,000 from the investments ($150,000 annual spending minus $70,000 of Social Security), that is a 3.2% withdrawal rate.

I’ve ignored cost of living adjustments for spending and Social Security for simplicity to illustrate the concept.

They have determined they are comfortable with the starting withdrawal rate and the possibility of it dropping long-term once Social Security starts.

Step 4: Choose Which Accounts to Take Withdrawals From

Since they have a mix of accounts (brokerage, Roth IRA, and Traditional IRA), they decide to run a tax projection to see how their income will change over time.

Although they could use the 0% long-term capital gains bracket to create withdrawals (either every year or employ a strategy doing it every other year), they are more concerned about rising tax rates.

Although they thought about alternating years between using the 0% long-term capital gains bracket and focusing on Roth conversions, they decide to focus on Roth conversions between now and collecting Social Security. They decide paying 15% on long-term capital gains is reasonable to get more money growing tax-free in their Roth IRAs.

They will be withdrawing for spending purposes from the brokerage account, but will also be moving money from their IRA to Roth IRA each year to take advantage of lower income years for Roth conversions.

Step 5: Create Monthly Withdrawal for a Paycheck in Retirement

They set up a $12,500 monthly ACH withdrawal from their brokerage account directly to their checking account.

They decide to create cash about once a quarter to support the monthly withdrawals.

They do this by creating an investment policy statement and rebalance about once a quarter for the monthly withdrawals.

For the Roth conversions, they do a tax projection near the beginning of the year to determine how much they can convert to the Roth IRA within the 24% tax bracket and how the capital gains in the brokerage account may impact their taxes.

They carefully monitor their estimated tax payments and plan to avoid underpayment penalties each year.

After a year, or as needed, they will update the monthly withdrawal. Once Social Security starts, they plan to lower the withdrawals as Social Security will replace some of the paycheck they had been creating for themselves.

Final Thoughts – My Question for You

While you are working and saving for retirement, it’s easy to get on autopilot.

The moment you need to flip the switch and start withdrawals for retirement, it can be more complicated knowing how to invest your portfolio, take tax-efficient withdrawals, and set up the withdrawals that work best for you.

Hopefully you spend the time calculating your expenses in retirement, including those that don’t show up every year, such as a car purchase.

From there, determine how you want to receive regular income through Social Security, pensions, and annuities.

Then, you can calculate how much you need to withdraw and from which accounts.

Finally, you can set up your own paycheck in retirement.

I’ll leave you with one question to act on.

Where do you need to start to create your own paycheck in retirement?