The stock market is down, and it feels awful – truly awful. You’ve watched a 20% decline in stocks, and may be wondering, “what should I do now that I am in a bear market?”

You are watching your hard earned money fall in value and depending on what is going on in the world, you may feel like it will be a really long time before it recovers, if ever.

Does that sound familiar?

Every investor is likely to face multiple bear markets during their lifetimes. Let’s talk about what a bear market is, review statistics about bear markets to put them in context, see what the headlines might be saying, what you might experience, and finally, actions you can take to survive a bear market.

What is a Bear Market?

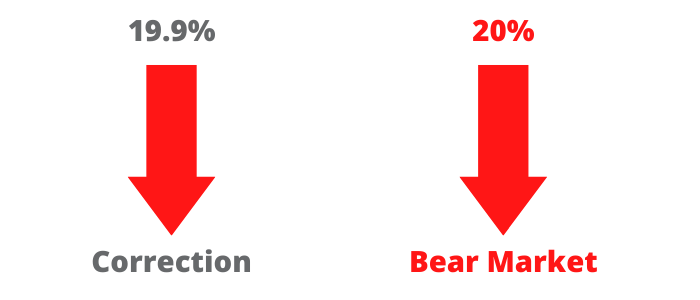

The definition of a bear market is when the stock market declines by 20% or more from the previous high.

Before you get to a bear market, you’ll have a stock market correction. A correction is when the stock market declines by 10% or more from the previous high.

Depending on the time period, you might read about a correction in one stock market and a bear market in another.

For example, the NASDAQ could be in a bear market while the S&P 500 is in a correction. When someone says the stock market is in a bear market, it’s important to understand which stock market they are talking about.

While technical definitions are important, it’s equally as important to remember these are arbitrary names with arbitrary numbers. If the stock market is down 19.9%, it’s technically still a correction, but it’s probably not going to feel much different than if the stock market is down 20%. I point that out because the news headlines tend to get much scarier as soon as the stock market flirts with the 20% figure or crosses it.

Statistics of a Bear Market

If you are going into a bear market without any understanding of market history or haven’t reviewed it in some time, you may be setting yourself up for surprises. Although history doesn’t repeat exactly, it’s important to know what’s happened in prior bear markets to help give you a framework and context for what you might experience during the bear market.

- There have been 26 bear markets in the S&P 500 between 1928 and 2021.

- There have only been 15 recessions between 1928 and 2021. A bear market doesn’t always mean a recession.

- The average length of a bear market is just shy of 10 months.

- Bear markets occur about every 3.6 years.

- Bear markets occurred about once every 1.4 years between 1928 and 1945. Between 1945 and 2021, bear markets occurred about once every 5.4 years.

- If you invest for 60 years, you can expect to see about 17 bear markets in your lifetime if they continue to happen about every 3.6 years.

- The worst bear market was between 1929 and 1932. The stock market dropped nearly 90% and took 25 years to recover.

- The stock market dropped around 57% during the bear market in 2009 and took nearly 4 years to recover.

In summary, it’s normal to experience a bear market every few years. They are normally less than a year, but some can go on for a number of years.

What Might the Headlines Say?

When bear markets happen, the media wants to grab your attention. Normally, the headlines aren’t good for mental health.

Let’s look at a few historical headlines to give you an idea of what you might see.

- “Traders panic; stocks fall 508 points” – Bangor Daily News – October 20, 1987

- “Dow, Nasdaq take a tumble” – Sarasota Herald-Tribune – October 18, 2000

- “It’s a Depression, Expert Says” – Ludington Daily News – March 1, 1975

- “The Financial Crisis in America. Trade Still Paralysed.” – The Age – August 10, 1893

- “New financial crisis hits at the worst possible time” – Kentucky New Era – July 17, 2008

These are tame compared to some of the headlines you’ll see on blogs and internet articles today, but they give you a feel for how they are intended to draw you in as a reader. What’s interesting is that it doesn’t matter the time period. These span more than 100 years and are still very similar and meant to evoke fear.

A few tricks to pay attention to:

- The media loves to tell you how many points the stock market tumbled. For example, 1,000 points can feel like a huge drop, but if it’s out of 33,000, that’s only 3%. Pay attention to the percentage decline.

- There will always be an expert to support someone’s story. Even though someone may have an extensive educational background and professional experience does not mean their prediction will be right.

- People love stories and comparisons. It’s really easy for the media to compare a current time period to a prior time period to justify a guess. You saw many people use the decline in March of 2020 during the COVID pandemic to draw parallels to other stock market declines, but the stock market quickly recovered.

- Websites and television love to use color. Pay attention to any flashing numbers, red, and chart crimes. They are meant to elevate your sensory experience, which may add stress and lead to the wrong conclusions.

Something to keep in mind is that by the time the internet and newspapers are reporting on a bear market, a good portion of the stock market decline may be behind you. The media usually reports what already happened – not what is going to happen.

What Kind of Emotions Might You Experience?

Now that you have statistics about bear markets and what the headlines might look like, let’s normalize how it may feel.

Bear markets feel awful. There is no getting around it.

Nobody likes to see the stock side of their portfolio down 20% or more. If you have $1,000,000 in stocks, that means you have $800,000 or less.

Besides the numbers, something else happened in the world for stocks to go down.

It could have been the potential collapse of the banking system, a World War, the threat of nuclear war, a long period of speculation, high inflation, high unemployment, supply chain worries, unsustainable debt levels, a loss in confidence, the promise of new technology not materializing, rising interest rates, or something else.

People often view bear markets in a vacuum, but it’s important to remember that besides your portfolio value, you may not feel great about the world either.

It’s okay to feel sad, angry, frustrated, scared, confused, nervous, worried, frightened, resentful, jealous, annoyed, skeptical, hesitant, nauseous, and powerless.

You may feel some other emotion.

They are all okay.

It’s normal to wonder when the market is going to stop falling in value (you may feel this multiple times). It’s normal to feel like it’s going to take forever for it to recover (historically, that has not been the case). It’s normal to want to make a drastic change (you probably shouldn’t).

Bear markets are uncomfortable. You may watch the market fall. Then, fall again. Then, again. Maybe, even again.

As soon as you feel like it can’t go lower, it may go lower. Historically, at some point, markets rebound – usually before it feels like it should.

It’s important to remember the market is a leading indicator, which means it usually falls before the world feels bad, and it usually goes up before the world feels good again.

It may create a cognitive dissonance because during the recovery, the world is likely going to have horrible headlines and economic data, but the market may be rising. It leaves many people wondering, “Why is the market going up when everything feels awful?”

That’s the way it works.

How to Handle a Bear Market

Now that you know how you might feel during a bear market, let’s talk about proactive steps you can take to handle a bear market.

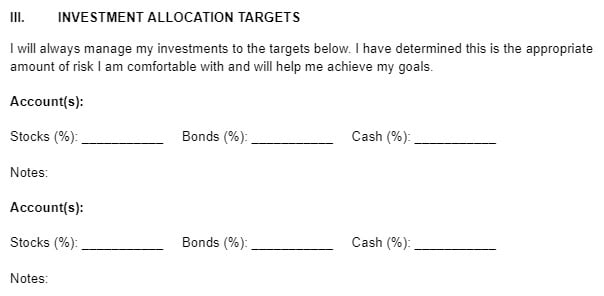

Revisit Your Investment Policy Statement (IPS)

Your investment policy statement was built exactly for these moments!

Please review your investment policy statement and read what it says to do during these times. If you don’t have one, now is a good time to create it, but I’d also recommend revisiting it in a less stressful time.

Maybe it says to rebalance by selling assets that have held up fine to buy assets that have declined in value. Maybe it says to tax-loss harvest to reduce your future tax bill. Maybe it says to do Roth conversions at a low point so that the recovery happens in the tax-free account.

Your investment policy statement might even say that if something is significantly undervalued, you can buy more than you normally would. For example, if 10% is your normal target weight, maybe it says your new target weight is 15% when it’s undervalued by a certain metric, such as a price-to-earnings or price-to-book ratio.

Perhaps it reminds you why you are diversified and the benefit of safer, more conservative assets in the portfolio.

The investment policy statement is your guidebook for investing. If you created it properly in advance, it should outline everything you need to do right now and remind you of why you created the guidelines you did.

Tune Out the Noise

Tuning out the noise is easier said than done. If you can, turn off the television, stop reading the headlines, avoid reading the doomsday investment newsletters, and talk about something else with friends and family.

When you are in a bear market, it’s easy and tempting to feed your brain dopamine hits by reading scary headlines. I’ve been there. I’ve done it.

It feels like a rabbit hole you must continue going down, wondering about all of the possibilities of what might happen, and feeding your brain constant noise.

It’s garbage. It truly is garbage for your brain.

If you can, take a walk, watch your favorite show, or read a book instead. Those are activities that will nourish your brain and help you handle stress levels in better ways.

The problem with tuning into multiple sources during a bear market is that people who are gloom and doom will get more air time. The people who have been calling for a bear market for years or even decades will finally be right. Unfortunately, all you will hear is they are right and this was knowable.

What isn’t said is that they have been saying this for a very long time. Even a broken clock is right twice a day. If I say the market will decline 1,000 times, I might be wrong 999 of those times, but the one time I am right, I may be featured in the media.

The other problem with listening to noise is that everybody is going to have a different perspective. If you ask 10 people for their opinion about the economy, stock market, unemployment rate, inflation, and more, you are likely going to receive more than 10 different opinions.

What do you do with that information? How do you make a decision? How helpful is it?

I often see people search out additional information during bear markets to see if there is a better strategy or a more sound idea of what to do, but the problem is that everybody will share more information leading to decision paralysis. The more options we have, the harder it is to make a choice.

The other potential problem is that people will only share their wins. It’s much easier to say, “XYZ stock is doing well right now. I’m really glad I bought it.” It’s harder to admit, “A part of my portfolio is doing well, but I’m still down 25% overall.”

If a family member or friend is sharing a successful investment, I’d ask to see their statements and look at past performance. I’ve seen people claim they are getting a certain rate of return, but when I dig into a tax return or statement, they have lost money.

If you are looking for advice, take it from someone who is familiar with your situation, knows what you want to accomplish, and is knowledgeable.

Journal Your Thoughts and Feelings

One of the best activities you can do during a bear market is journal about your thoughts and feelings.

I did this during the COVID pandemic, and it helped clarify my thoughts and how I was thinking about the world during a stressful time.

It’s helpful to have a written record in real time of what you are feeling to be able to go back to it in the future. It’s particularly helpful during future declines to go back and read how you were feeling in the past and see how the world and stock market recovered.

The journaling doesn’t need to be anything fancy. Grab a spare notebook and start writing whatever comes to your mind. Aim to write for at least five minutes each day. In a bear market, things change quickly. By writing each day for at least a few minutes, you can see how your beliefs and attitudes change by the day. Not only can it be therapeutic, but it can serve as a reminder in your next bear market that you’ve made it through them in the past.

Recognize Market Timing Usually Doesn’t Work

New strategies and products often come out during bear markets. You also see existing products that perform well during bear markets have a huge increase in interest and deposits. In other words, people usually invest money in strategies that would have protected them better during a bear market after the market bear market has occurred.

It’s usually the wrong time to do it!

People are most tempted to time markets during bear markets. The market is going down, and they want to avoid it. Research has shown it’s nearly impossible to consistently time markets.

Even more important, research has shown you don’t need to time markets to have a successful investing experience with good long-term returns.

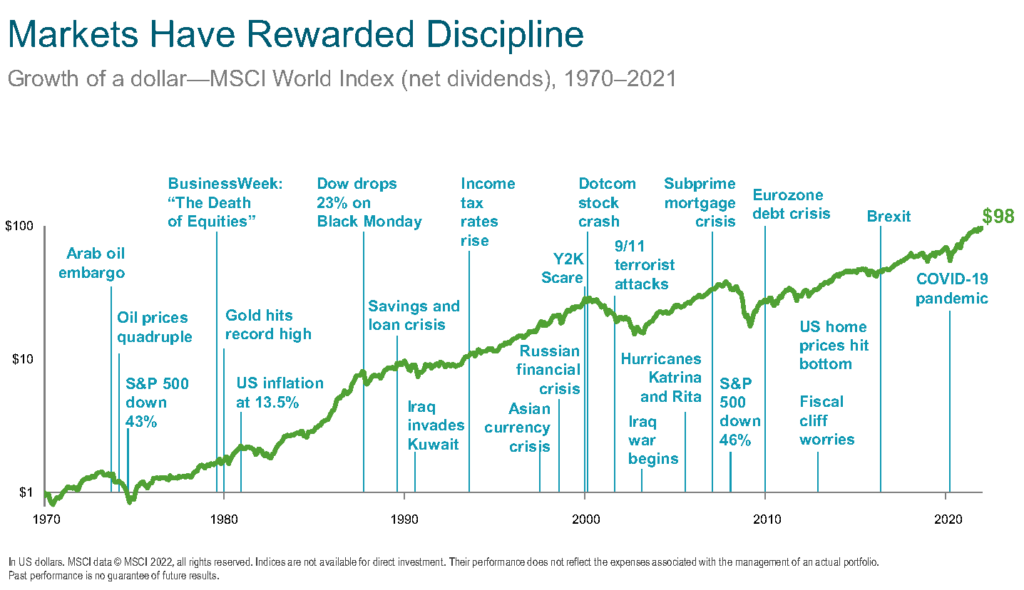

Look at the chart below. There are many bear markets and market declines, but the market has ended higher.

It wasn’t always a pleasant investing experience, but investors who held on were rewarded. It’s important to zoom out and look at long-term growth.

There is no perfect portfolio. There is always going to be a strategy that looks more attractive during certain times in the market cycle. It will be labeled as protection from a market decline and inevitably, people will add money to it after a bear market when the market may be more likely to go up than it is to go down. It’s important to avoid getting sucked into financial products that pop up and make headlines.

If market timing worked, people would retire and go enjoy life rather than selling you their financial product.

Take Time For Yourself

Although it’s never easy during bear markets, it is important to make time for yourself.

Taking time can look different for each person, but generally, it’s hard to go wrong by exercising, sleeping, and eating well.

Unplugging with a book may also help take your mind off things.

If you enjoy walking, pick a new part of town or a different park and enjoy the outdoors. If you enjoy cooking, pick a new recipe to try.

Bear markets can come with significant stress and similar to tuning out the noise, it’s important to take time for yourself.

Make a Small Change

If you’ve tried everything and you feel like you still need to do something, you could consider making a small change.

I say small because it’s usually better to make a small change with a limited part of your portfolio rather than the whole in case you are wrong.

It’s the same reason people go to a casino with cash in an envelope and commit to only gambling with it. When you start making wholesale changes to your investment strategy, you are gambling.

I think it’s okay to gamble with a small amount you don’t mind losing. I don’t think it’s okay to gamble with your entire life savings.

Contact Your Financial Planner or Get a Second Opinion

If you are navigating a bear market with a financial planner, reach out to them. As a financial planner, I always want to hear from my clients when they are anxious or concerned. A simple phone call can go a long way in revisiting why the money is invested in the way that it is and if any changes are warranted.

If you are not working with a fee-only, fiduciary financial planner, perhaps now is a good time for a second opinion, particularly if a bear market is causing you significant stress. Maybe you need a little reassurance that you are doing the right thing. On the other hand, maybe you want more than a short-term engagement and want to outsource investment management entirely.

Everybody needs different things during a bear market and talking with a fee-only, fiduciary financial planner might give you more peace of mind.

Final Thoughts – My Question for You

Bear markets are tough.

A 20% or more drop in the market often occurs before you realize what is happening. By that time, the financial media often produces scary headlines meant to evoke fear. They may bring on “experts” that profit off doom and gloom.

All of these things may make you feel stressed and anxious. It’s normal.

Watching your money decline during a bear market is not enjoyable. It’s normal to want to try to make changes and think “we should have seen this coming”, but research has shown market timing doesn’t work consistently.

It’s important to review your investment policy statement, tune out the noise, journal about what is happening and how you are feeling, take time for yourself, and potentially contact a fee-only financial planner during a bear market.

If you really feel like you need to make a change, consider a small one instead of a large one.

I’ll leave you with one question to act on.

What steps will you take during a bear market?