A common question I receive from prospective families that are planning to work with me is, “How do I fire my financial advisor?”

Let’s talk about how you can fire your existing financial advisor.

Some have worked with their financial advisor for decades. Some are family friends. Some were their parent’s financial planners.

If you are unsure how to fire your financial advisor, it can be uncomfortable.

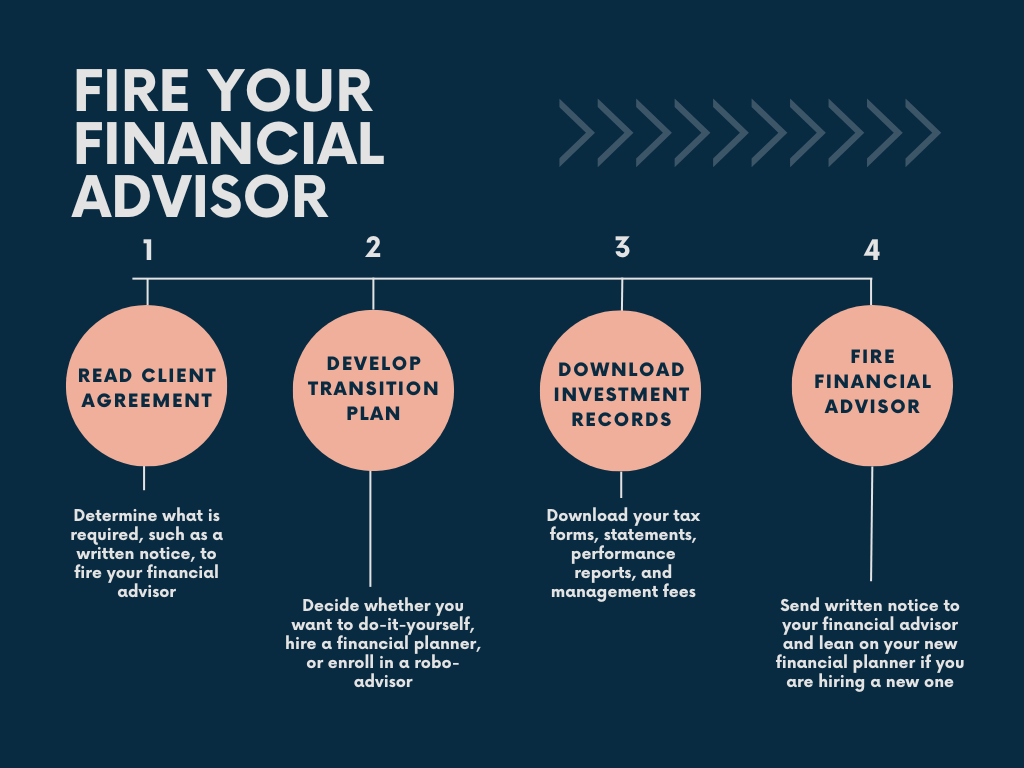

Let’s talk about the steps you’ll need to take and how to make the transition as smooth as possible.

Read Your Client Agreement/Contract

The first step to firing your financial advisor is to read your client agreement or contract.

It details exactly what is needed.

For example, it might say something along the lines of:

This agreement shall be in effect until either party gives written notice to the other party of its intention to terminate the agreement. Advisor’s services will terminate upon receipt of written notice of termination from Client. Advisor will promptly calculate and deduct the prorated final fee from Client’s account before notifying the custodian to remove Advisor’s authorization over Client’s account. This agreement may be terminated, without penalty…

As you can see, the only notice required is a written notice, which can often be via email. I provide a sample letter you can use to fire your financial advisor in another section.

Although it’s possible a client agreement may have a termination fee, it’s rare. Most agreements allow you to fire your financial advisor at any point.

If you don’t have a copy of your client agreement, you can call the company to ask for a copy.

Once you have your client agreement and know what is needed to fire your financial advisor, you can follow the instructions.

Have a Transition Plan

Next, have a transition plan before firing your financial advisor. The first step in your transition plan is to know why you are firing your financial advisor to help decide next steps.

Know Why You Are Firing Your Financial Advisor

Before deciding what you are going to do next, you need to know why you are firing your financial advisor.

Is it because of the fees, lack of transparency, poor communication, performance, or something else?

If it’s because of poor communication or lack of connection, you may simply need a different financial advisor that fits your communication style better.

If it’s because of performance, there could be a variety of reasons. It could be you started at a bad time when markets went down and all portfolios could be down. It could be that you are in expensive, tax-inefficient funds that are leading to lower performance. It could be that you have a financial advisor that attempts to time the market and has underperformed (note: research has shown this is nearly impossible to do consistently. Most people underperform – even the smartest PhDs and investors in the world). It’s important to know why the performance isn’t where you want it to be.

It could be because your financial advisor is expensive. They may be selling annuities with huge commissions, putting you in mutual funds with loads, or charging you 1% or more for simply investment management with no financial planning, which is common at larger brokerage firms.

Once you figure out why you are firing your financial advisor, you can decide your next steps.

It’s important to know what you are going to do with your money after your financial advisor is no longer helping you. I’ve heard many stories about people firing their financial advisor, but then doing nothing.

There can be significant opportunity costs with doing nothing, particularly when it comes to tax planning and managing your investments.

The three main options are:

- Do-It-Yourself (DIY)

- Find a new fee-only, fiduciary financial planner

- Robo-Advisor

Do-It-Yourself (DIY)

If you decide to go the DIY route, make sure you have the time, temperament, and expertise to manage your financial life.

For example, do you know how you will handle the following?

- How you will manage your investments

- If not, consider creating an investment policy statement.

- How you will proactively reduce taxes over your lifetime

- If not, read more about Roth conversions and the 0% long-term capital gains bracket.

- How you will feel comfortable during the next major market decline

- How you will take tax-efficient withdrawals or create retirement income

- How you will take the time to make sure you are living your ideal life and that your money is connected to that vision

You should have a plan to manage your investments, do your own financial planning, tax planning, review insurance coverages, and more.

If you don’t, you should educate yourself and spend time figuring out how to DIY your finances. I’ve seen many people want to DIY their finances to save on costs, but end up costing themselves more by not working with a financial advisor because they don’t know what they don’t know.

When people don’t know what they don’t know, a seemingly small inaction or action they thought would help can end up with significant opportunity costs.

Choosing a Custodian

When you DIY, you’ll need to choose a custodian. A custodian is the company who will hold the money.

Custodians perform very similar roles. They hold assets, produce statements, and send you your tax forms, such as 1099 and 1099-R.

Whether you choose Charles Schwab over Fidelity is a minor decision.

Both can hold most types of funds, have inexpensive or free trades, and good customer service.

It’s possible that you can continue using the same custodian your advisor used; however, if it’s a custodian that charges for trades or has an account fee, I’d recommend looking for another custodian.

There are plenty of custodians with $0 minimums and no fees.

Checking Which Investments Can Transfer

Once you decide which custodian you will use, you need to determine which investments can transfer to the custodian.

Most ETFs and mutual funds can be held at any custodian. For example, if you have a Vanguard mutual fund or ETF, you don’t have to keep it at Vanguard. You could likely transfer it to Charles Schwab.

The exception is for proprietary investments. Some mutual funds, illiquid investments, and annuities may only be held with certain custodians.

Tip for Annuities: If you have to keep your annuity with your current custodian, but don’t want to work with the financial advisor you are firing, you can usually request a new representative or have it be assigned to the “house account”, which means it is served by the company’s support team.

If that’s the case, you may need to leave the investment with the current custodian or sell it (and bear the tax consequences, if any) and move the proceeds.

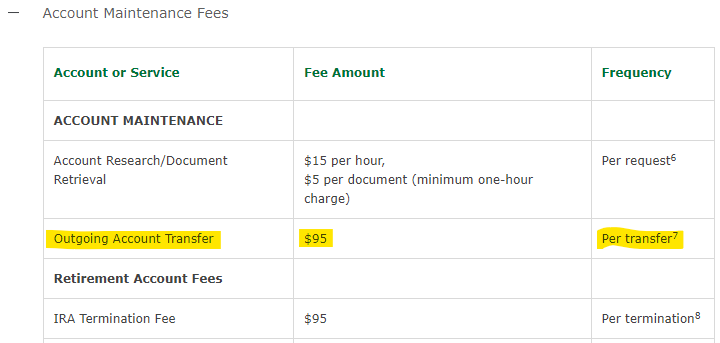

When you transfer the accounts to another custodian, there may be fees, but they are usually relatively minor.

For example, most custodians charge a fee if you want to transfer your accounts to another custodian, such as from Wells Fargo to Charles Schwab. I often see transfer fees of $50 to $150 per account, which is often minimal compared to the account size.

For example, here is an image of Wells Fargo outgoing account transfer fee as of February 2023.

There also may be fees if you want to sell or get out of the investments you are in, which I’ll explain in more detail.

Personally, I never use investments for clients that have a termination fee or lock up period.

Illiquid Investments, Proprietary Funds, and Annuities

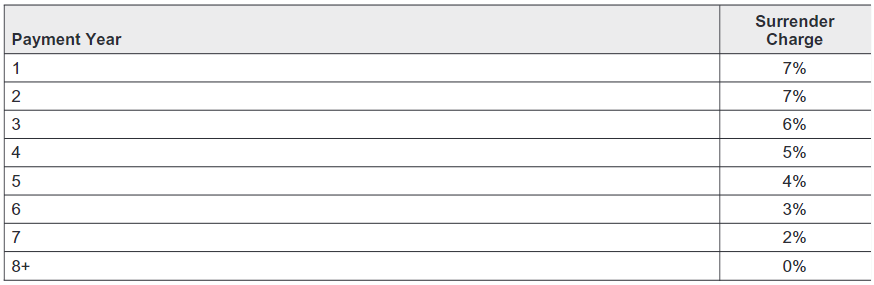

For illiquid investments, proprietary funds, and annuities, you need to make careful decisions about what to do.

For example, if you have an illiquid investment, such as a non-traded REIT, you may need to hold it until a specific liquidity event or make a regular withdrawal request if it allows you to get a certain percentage out per year.

With a proprietary fund, you may be stuck in it until you decide to sell.

With an annuity, you may want to keep it as-is until the surrender schedule is down to 0%, 1%, or 2%, depending on the other fees. At that point, it may make sense to surrender it (be careful of the tax consequences!) or do a 1035 exchange to a different type of annuity that serves your financial goals better.

Although not all funds can be transferred immediately, you can usually design a transition plan to consolidate and simplify the number of accounts you have if you decide to DIY your finances.

Hiring a New Fee-Only, Fiduciary Financial Planner

If you decide you find value in working with a financial planner, you’ll need to interview multiple fee-only fiduciary financial planners and decide who you would like to work with.

Although you could search in your local area for someone close to you, a better approach is to look across the United States to find someone who has the expertise to work with people like you and who is a good personality fit.

Three great resources to find advisors include:

I’m linking to resources that allow you to search for fee-only, fiduciary financial advisors. While you can work with people who are not fee-only, fiduciary financial advisors, I generally do not recommend it.

There are plenty of great advisors who are not fee-only, but it’s much harder to explain the nuance of how to find those advisors.

Although there are firms like Smart Asset, Zoe Financial, and other firms that offer to connect you with advisors on their platform, I’d personally shy away from these platforms. Those platforms work by charging an advisor per referral or a portion of their revenue if a person signs up (sometimes one quarter of the revenue indefinitely!). You are going to limit yourself to financial advisors who are willing to pay these fees if you rely on these services. Many good advisors are not willing to pay these fees.

If you are willing to spend time researching, you may find someone who is a better fit that isn’t on one of those types of platforms.

You may come across “fee-only” vs. “fee-based” terms in the marketing of advisors. Fee-based means advisors may still earn a commission from selling an investment or insurance product. Fee-only means an advisor is only compensated by what you pay them directly.

I’m a fee-only fiduciary financial advisor because I never want clients wondering in the back of their head if the recommendation I am making is based on the compensation I am receiving for it. Clients pay me to look out for their best interest – always, in every scenario. You deserve the same.

Unfortunately, the term “financial advisor” or “financial planner” has no legal protection. This is why you have insurance salespeople and financial consultants at big custodians or brokerage firms wearing the title of “financial advisor” when they really only have a limited menu of investment options to offer you and each one pays them a different amount.

It’s a dirty little secret that financial advisors at big brokerage firms can even be compensated differently based on how you invest your accounts, whether you have a pledged asset line open, and referrals to other parts of the business, such as mortgages, insurance, and trust services.

I’ve seen ongoing pay for those financial advisors be three times more if a client chooses a certain investment service over another.

Lastly, if you find an advisor who claims to do free planning, it will often be accompanied by a product pitch. People don’t work for free. Find out how they get paid so that you can make better decisions.

I designed a list of 10 questions you can ask a financial advisor to help in your decision making process, including how to look up their experience and whether they have any disclosures on their record.

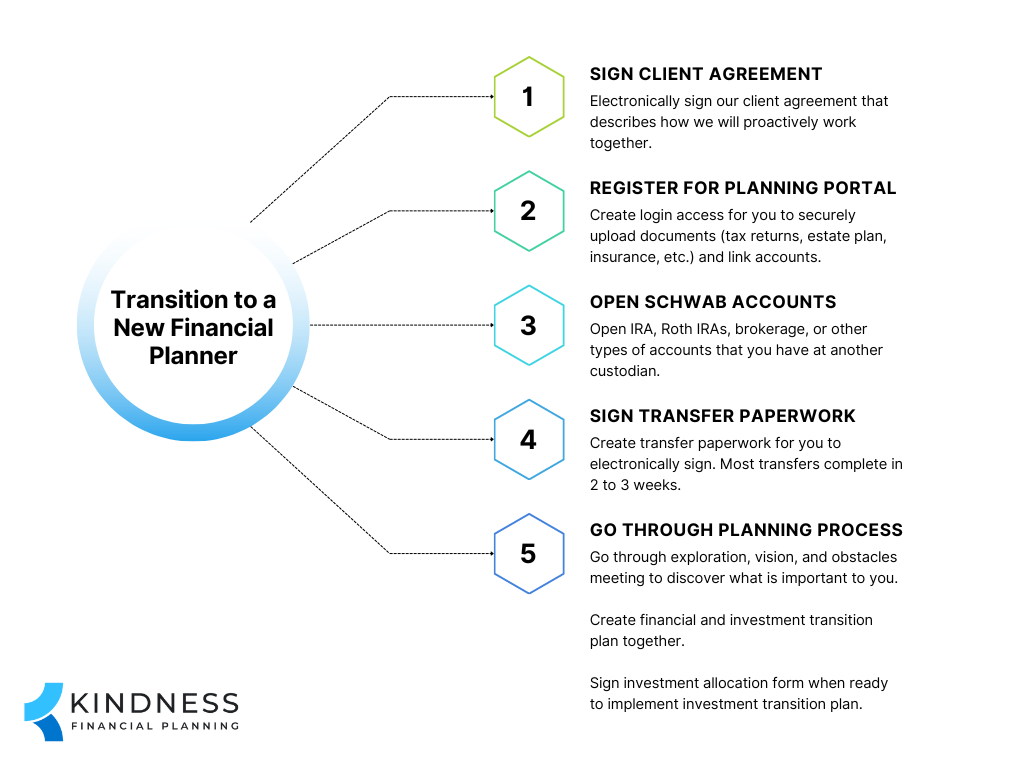

Transitioning Custodians

A common point of confusion is how a financial advisor relationship works when assets are at another custodian.

With many financial advisors, they will have one or more custodians they have a relationship with through which they can connect to your accounts with limited authorization.

For example, I use Charles Schwab as a custodian for clients. I connect to client accounts via a limited power of attorney, which allows me to trade the accounts (once we agree on an investment plan) and to withdraw my management fee.

If you need to transition custodians, it’s not challenging. I custody assets with Charles Schwab and it’s as simple as:

- Opening new accounts to receive assets from the other custodian

- Submitting a transfer request

- Waiting 2 to 3 weeks

I can prepare the paperwork for a transfer request. All clients need to do is sign it and normally wait 2 to 3 weeks for the assets to come over. Most are transferred electronically, “in-kind”, meaning they are not sold and come over as the same fund.

The only transfer fees are typically what the other custodian charges. Often, it’s $50 to $150 per account.

Your new financial advisor should be able to help with the transition. Lean on them and their expertise to guide you through the process.

Robo-Advisor

Another option is to go with a robo-advisor service.

Robo advisors tend to be a middle ground between DIY and hiring a financial planner. You often can get automated trading, so you don’t have to worry about the investments.

Fees are generally lower, such as 0.25%, or “free”, but it has a cash drag.

For example, robo-advisors that offer services for free, but force you to allocate a higher percentage to cash are going to have opportunity costs. For example, if it forces you to have 10% of your portfolio in cash that earns 0% and your portfolio goes up 10%, that equates to a fee of 1% in opportunity costs.

Other robo-advisors may force you into certain proprietary funds with higher expenses, which is how the robo-advisor may be making additional money.

The advice provided by robo-advisors is often minimal. I’ve often been told the financial advice is general in nature instead of specific recommendations, and rarely do they ever talk about tax planning, estate planning, or insurance.

Plus, you may have the same person for the first few meetings, but the financial advisor positions at robo-advisors are often stepping stones into other positions. If you are okay with turnover and general financial advice, a robo-advisor may be a good middle ground.

Tip for using a robo-advisor: Research how the robo-advisor handles existing investments. For example, if you have capital gains in a taxable account, you may not want them to manage it because they may sell every position, recognize the gains, and invest the proceeds into their model portfolios. Also, research the investments they may use. Cheaper robo-advisors may use funds with higher expense ratios, which raise the overall cost.

Download the Investment Records

Before firing your financial advisor, download all the records you may need.

Tax Forms

If you are switching custodians and they produce the 1099-R, 1099, or any other tax forms, download historical records in case you ever need them.

If you close an account and the custodian removes access later, you may no longer be able to access historical tax forms.

You should still be able to access the current year tax information when tax season comes around. For example, if you switch mid-year, don’t forget that you may have tax forms from two custodians.

Statements

If you have statements with the custodian, download them. It’s rare that you will need to review an old statement, but it doesn’t hurt to download a big batch of them and save them to a secure location.

Performance Reports

If your financial planner or custodian produces performance reports, I’d recommend downloading them.

Although you may not need them in the future, you may want to revisit them later to remember good and bad time periods in the market, as well as what investments you held. Your new financial planner may find them helpful in seeing how your investments changed over time. This may also help open the door to a conversation with your advisor about why it changed.

Management Fees

I’d also suggest downloading any management fee files. These are often included on a statement or performance report, but if they are separate, download them.

You may not need them, but I always operate from the mindset that it only takes a few minutes to download them, and that way, I have them if I ever need them.

Fire Your Financial Advisor

Once you have everything in place, it’s time to fire your financial advisor. You don’t have to follow these steps exactly, but having been fired by clients and having started new relationships with clients after they’ve fired their financial advisor, this is what I’ve found most helpful.

Lean on Your New Financial Advisor to Help With the Transition

If you are hiring a new financial planner, lean on them to help with the transition. Your new advisor should help with account opening, transferring of accounts, and any questions you have.

For example, I always provide specific instructions about how to open accounts, prepare transfer paperwork, join conference calls if needed with the existing custodian, and lay out a timeline of what to expect.

Final Management Fees with Your Financial Advisor

Depending on how your current advisor charges management fees, you may be owed a refund or a final management fee may need to be charged.

For example, if a financial advisor charges fees in advance, and you quit in the middle of a billing cycle, they may need to refund fees on a pro-rata basis for the time you were not with them. It comes down to your agreement and how billing is set up.

If your financial advisor charges fees in arrears, meaning after the fact, they may need to charge you for the time they spent working with you since the last billing period.

When you notify them you are leaving, you can inquire about the final steps and the timeline for any billing to be finished.

Sample Email Template to Fire Your Financial Advisor

You don’t have to tell your financial advisor you are firing them. You could open new accounts and submit transfer paperwork without ever talking to them, but I don’t consider this a very kind way to end a relationship.

Remember the golden rule – treat others how you would want to be treated.

I imagine you would want to hear you are being let go from your job from your boss or colleagues instead of a random electronic notification. You may also want an explanation.

When I’ve been fired by clients in the past, I’ve always appreciated the truth because I want to learn what I could have done to make it a better experience and improve how I work with people in the future.

If you are leaving, I encourage you to tell them why. Below is a sample email template you can use to fire your financial advisor.

Hello Financial Planner Name,

Thank you for the time and guidance you’ve provided over the years.

I wanted to let you know I am terminating your services, effective today. Please do not make any trades in my account.

Please charge/refund my final management fee as soon as possible and let me know when it’s complete.

Once that’s complete, I’ll submit transfer requests for a new custodian. (Or, if you plan to stay with the same custodian, you can say, “I plan to stay with the current custodian. Please remove yourselves from the management of my accounts.”)

While I’ve appreciated your help, my reasons for moving on include:

- Lack of proactive communication

- Lack of holistic planning

- No tax planning

- Lower performance and lack of explanation about why

I’ve found a solution that works better for me going forward and really appreciate all you have done.

Thanks,

Your Name Here

As I mentioned, you don’t have to include reasons, but I almost always ask why. If I’ve had a relationship with someone for months or years, I feel it’s the respectful way to end a relationship.

Firing a Financial Salesperson

If you are firing a financial salesperson as opposed to a financial planner, you may need to adjust how you end the relationship.

There are certain insurance companies and brokerage firms that make it challenging to leave them.

They may require notarized or medallion signature guarantees on paperwork to move your accounts. They may say you have to speak with your financial representative. They may belittle you.

I’ve seen these instances and worse happen.

In those cases, it’s okay to simply move your accounts. If someone is being disrespectful, you don’t owe them an explanation.

Also, if a financial salesperson is dragging their feet in answering questions and you’ve made numerous attempts to try to resolve an issue, you can always call to ask for their manager or compliance department.

If after numerous attempts that doesn’t work, you email them and say something along the following:

For Financial Salespeople Who Are Insurance Licensed:

If you don’t respond within 72 hours, I plan to file a complaint with the state insurance commissioner. Please consider this a formal complaint. [Describe the complaint, what happened, and your desired resolution.]

You can look up your state insurance commissioner to learn about their process. For example, Washington state has a video and links about how to file a complaint.

For Financial Salespeople Who Work for a Brokerage Firm

If you don’t respond within 72 hours, I plan to file a complaint with FINRA. Please consider this a formal complaint. [Describe the complaint, what happened, and your desired resolution.]

For Financial Salespeople Who Work for a State or SEC-Registered Firm

If you don’t respond within 72 hours, I plan to file a complaint with the state department of financial institutions/SEC. Please consider this a formal complaint. [Describe the complaint, what happened, and your desired resolution.]

If the investment advisor is registered with the state, you can look up your state department of financial institutions and what their complaint process recommends.

If the investment advisor is registered with the SEC, you can go the SEC route.

Please keep in mind that filing a complaint is a very serious process and can stay on someone’s record for their entire life, affecting their ability to earn a living. It should only be used when you’ve exhausted every other avenue.

Final Thoughts – My Question for You

Firing a financial advisor is not an easy task, particularly if you’ve had a relationship with them.

Having a plan in place before firing them is important. You should know how you plan to manage your financial life going forward, develop a transition plan, and download old records.

If you are hiring a new financial planner, lean on them for their support and guidance. They can make the process as easy as possible for you.

I’ll leave you with one question to act on.

What steps have you not prepared for to fire your financial advisor?