I’m a financial advisor, and I’m going to share 7 reasons why you shouldn’t hire a financial advisor.

It’s not a trick.

There are situations where it doesn’t make sense to hire a financial planner. Although most people filter themselves out prior to contacting a financial planner, I’ve told people they are doing a good job, it didn’t make sense to hire me, and provided a few resources for them to use instead.

If you’ve been on the fence about hiring a financial advisor, this article should help clarify whether it makes sense.

Let’s dig into 7 situations where you shouldn’t hire a financial advisor.

Reason #1: You Enjoy Being a Do-It-Yourselfer (DIY)

If you enjoy managing your own finances, you may not need to hire a financial advisor.

Almost every question imaginable can be answered using a search engine.

Have a tax question? The IRS has FAQ pages, tax code, and other guidance on their website.

Have a financial planning question? Bogleheads has a wiki page, forum, and there are other websites with free information.

Have an investment question? Morningstar has extensive articles and Bogleheads has a start up kit.

There is a ton of information on the internet, podcasts, and in books. There is really good information available to everyone with an internet connection, but the key is to wade through the information to decide what is relevant to you.

If you enjoy researching investments, creating your own investment policy statement, tax-loss harvesting, navigating bear markets, developing your own tax projections, and creating your own financial independence plan, then you may not need to hire a financial advisor.

I’ve met people who enjoy the DIY aspect of investments, financial planning, and tax planning. They do their own Roth conversion projections, design low-cost, tax-sensitive portfolios, step up the cost basis after death, know how to take distributions from inherited accounts, and even give to charity efficiently.

For some people, it’s a fun way to spend their free time or retirement. They don’t get caught in analysis paralysis and are good about making decisions for themselves.

If you have a handle on your financial life, feel confident in navigating the material available to you, and enjoy doing it yourself, there is no point in hiring a financial advisor. You already have it well under control!

Reason #2: You are Not Worried or Stressed About Your Financial Future

Many people stress about their financial future, but if that isn’t you, that is a reason not to hire a financial advisor.

I’ve met plenty of people who know they did a good job saving, used free online resources to run their own retirement projections (sometimes many!), and feel confident they have their investments set up in a way to minimize the chance that they will ever need to change their level of spending.

They feel they have enough for long-term care costs, actively give to family members, and are doing everything possible to minimize taxes over their lives.

If you are not worried or stressed about your financial future, why hire a financial advisor?

Most people seek out a financial advisor when they are worried about a transition in their life, such as retirement, death, or inheritance. New options became available, and they are unsure how to make the most of the situation.

Like many others, I hire people when I am worried about a decision. For example, I hired an attorney to help with a rental property question, a handyperson to replace a shower mixing valve, and landscapers to take out bamboo.

In each of these scenarios, I could have researched and done a DIY job, but I would have been worried about the outcome.

There have been other times where I wasn’t worried about a decision. I have not hired an attorney when I could decide something related to a rental property, fixed something in my home myself, and done some of my own landscaping.

If you are not worried about a decision related to your financial future, that is a good reason not to hire a financial advisor.

Reason #3: You Have The Time to Manage Investments and Stay Up To Date on Financial Planning and Tax Legislation

This is one where I see many people go wrong because they think they are staying up to date on things, but actually are not.

I have met a few people in my career who do stay up to date. Out of all the reasons not to hire a financial planner, this is the one where most people don’t check the box.

Investment, financial planning, and tax planning are not usually one time events. It’s an ongoing process with rules and regulations that tend to change over time.

People don’t know what they don’t know.

I know that seems obvious, but not knowing something and taking action can lead to costly mistakes.

If you have seriously reflected and decided you have the time to manage your investments and stay up to date on changing financial planning and tax legislation, that’s an excellent reason to not hire a financial advisor.

Since the Secure Act passed in 2019 and throughout the pandemic, there were many changes that affected tax and financial planning. For those who stayed up to date, there was no reason to hire a financial planner.

While tax reforms don’t happen every year, they do change over time. If you are still operating off the old rules, you may miss significant opportunities to reduce your taxes or potentially worse, make a mistake that causes penalties and interest.

If you can stay up to date on legislation changes that will affect your finances and design an investment process that works for you, you likely are on top of everything else and don’t need to hire a financial advisor.

Reason #4: You and Your Significant Other Are Involved In The Finances

If you and your spouse or significant other do your finances together, that may be another reason to not hire a financial advisor.

Where people often go wrong is when only one of them manages the household finances, and the other person is in the dark.

I’ve seen huge problems occur if the person who is managing the household finances becomes disabled or dies. Then, the other spouse is left picking up the pieces without a clear idea about where the assets are located, investment strategy, and how to pay the bills. Worst, it happens when they are trying to grieve, arrange a funeral, and figure out what the new normal will look like.

At a minimum, you and your significant other should know where the assets are located and how to access them.

Ideally, they are more involved in the daily management of finances, which would make it easier to pick up the pieces after a major health event.

I’ve seen families hire financial planners as a “just in case something happens to me” plan. They felt it was better to vet and establish a relationship early to make sure their spouse was in good hands because their spouse had never been involved in the finances or did not want to manage them going forward.

If a spouse is involved in the finances and wants to manage them going forward, there is already continuity and a financial advisor may not be needed.

Reason #5: You are Not Ready to Engage in the Process

The financial planning process can be time intensive, and some people are simply not ready for it.

I’ve been in situations where one spouse wanted to hire an advisor and another didn’t. That tends to be a recipe for a bad relationship.

I’ve been in situations where someone wants advice, but they don’t want to share tax returns, estate plans, investment statements, insurance documents, and other intimate details about their finances. If you aren’t ready to trust them, you shouldn’t hire a financial advisor.

I’ve been in situations where a widow needed help, but they weren’t quite ready to hire someone because they weren’t in a space where they had the time and energy to gather everything.

A good financial planning process is going to take at least a few hours of your time, often more. It requires sharing documents you may have never shared with someone before. If you engage a good financial planner, it should involve opening up about what’s important to you and how you want your money to work for your future.

For my hourly engagements, it’s often at least two hours of meetings, gathering documents, uploading documents, reviewing the analysis and recommendations together, implementing the advice, and asking questions as needed.

For my ongoing engagements, it’s normally a three part series of meetings to discover what is important to you, narrowing down to the most essential elements, and then a “what could possibly get in the way?” meeting to tackle obstacles that may arise. From there, we move to the more traditional side of financial planning by creating a financial independence plan (aka a retirement plan) and discuss an investment transition to align with what was discussed in the previous meetings. Then, we regularly meet to tackle other financial planning topics, such as tax strategies, insurance review, estate plan analysis, and anything else that comes up.

People often share very intimate and sensitive parts of their lives with a financial planner. Some people are not ready to engage in that process, and that’s okay.

If you aren’t, you shouldn’t hire a financial advisor because you won’t get as much out of it as you should.

Reason #6: Money is Tight

I’m hesitant to mention this one because when money is tight, it can sometimes still make sense to hire a financial planner.

Generally, if money is tight, it’s more important to use free resources online to try to increase your income and/or decrease your expenses to get to a more stable financial footing.

The exception tends to be if hiring someone could lead to significant savings or avoiding a costly mistake. For example, people with significant student loans may benefit from working with a financial planner even if their income was low and their net worth was negative because there are student loan repayment programs they could help identify that might provide thousands, tens of thousands, or even hundreds of thousands of dollars in savings.

Many people think financial advice is expensive, and it can be, but there are many planners that work on an hourly or ongoing basis you can consult for specific questions. If you paid someone a few thousand dollars and that led to more than a few thousands of dollars worth of value, it may make sense to hire a financial planner.

If money is tight and you are barely surviving financially, hiring a financial planner may not be the most efficient use of your time or money.

Reason #7: They Aren’t Really a Financial Planner

The last reason you shouldn’t hire a financial advisor is if they aren’t really a financial advisor.

You may be thinking, “But they have the title of ‘financial advisor’ or ‘vice president’ on their business card. Why wouldn’t I want to hire them? Why wouldn’t they be considered a financial advisor?”

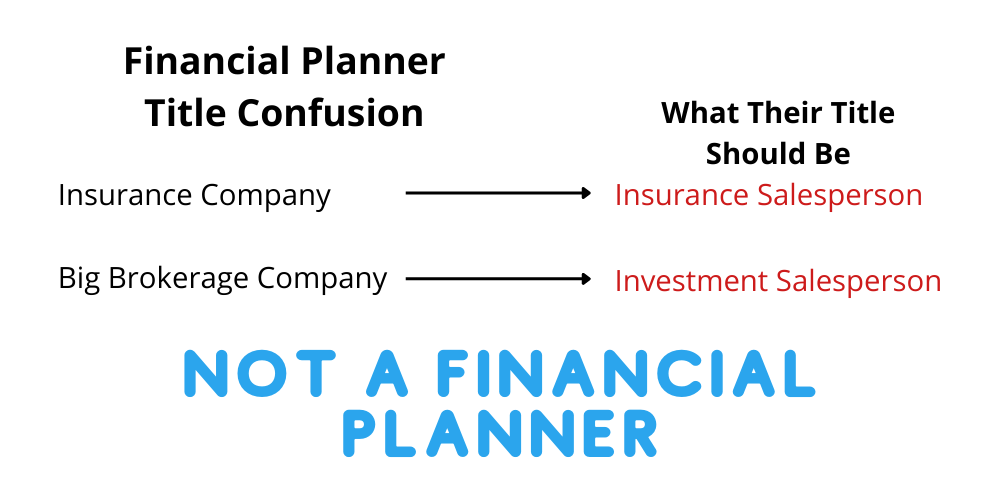

The financial world is confusing and does a horrible job of distinguishing between financial professionals. We don’t have much of a common educational requirement to be able to call ourselves a financial planner like physicians, attorneys, or accountants do. There are financial planners, wealth managers, financial consultants, investment advisor, family CFO, and other titles.

In most situations, a simple exam or two that lasts a few hours is all that is required to call oneself a financial advisor. Seriously, that’s it. That is what is considered the bar to be able to give financial advice or manage investments.

The title issue is a problem because it means a financial planner can call themselves a financial planner, but that can create a very different experience depending on the firm they work for.

For example, if you encounter a “financial planner” (I’m using quotes on purpose here.) at an insurance company, they are constrained by what they can offer. They may offer a “free financial plan”, but it’s not really financial planning. The point of it is to identify assets to then pitch you an insurance solution.

If you encounter a “financial planner” at a big, well-known brokerage company, they are also limited by what they can offer. They can usually only offer internal products and services and are compensated by how you invest your money and which services you choose. They are not being compensated by their advice, but based on their sales, with you being the sale.

Even a financial planner working at a large investment advisor firm may be limited in what they can recommend or give advice about. For example, if the financial planner thinks certain investments are better, but the investment committee selects different investments, they may only be able to recommend what their investment committee selects. If the firm decides they don’t want to help with tax planning, they may not be able to provide holistic financial planning. Most people understand they are limited by what their employer allows them to do, and it’s the same in the financial planner space.

If you meet a “financial planner” who is limited in what they can recommend or are masquerading as a financial planner while only a salesperson in reality, that may be a good reason not hire them as your financial planner.

Imagine hiring someone to build your custom home, and they could only buy tools, parts, and materials from one manufacturer, who dictated exactly how you could build the house. The builder had no leeway to adjust the plans to what you wanted, go with lower cost options when available, or hire outside contractors with certain specialties.

That’s what you are getting when you hire a financial planner who is constrained by where they work.

Within the category of financial planner, there are also different ways of being compensated. You could have a fee-only, fee-based, or commission-based financial planner. You can have a fiduciary or someone who only needs to abide by the suitability standard.

It’s a confusing maze of trying to figure out if you are working with a financial planner who can provide independent advice, compensated by what you pay them directly, and is a fiduciary.

Personally, I would want to work with someone who is a fiduciary 100% of the time (hint: some financial planners don’t have to be a fiduciary all the time), where the compensation is transparent, and has more training and experience than a simple exam.

To me, that’s a true financial planner.

Final Thoughts – My Question for You

There are very good reasons to not hire a financial planner.

Not everybody needs one. Some people do a great job as a do-it-yourselfer. They don’t get worried or stressed about their financial future and have the time to stay up to date on new legislation. If they are in a relationship, they manage finances as a couple.

On the other hand, sometimes you are not ready to engage in the financial planning process. It is an investment of your time and money, and if you are not ready to commit both, that’s a good reason to not hire a financial advisor.

Also, if money is tight, that may be a reason to not hire a financial advisor. Normally, there are better ways to spend your time and money to get on a better financial footing.

Lastly, there are many salespeople masquerading as financial advisors who are constrained by what they can offer and incentivized monetarily to recommend certain products or services over others. Personally, I don’t see them as a true financial planner who will be in your corner advocating for your best interests, and that is a reason I would not hire them as a financial advisor.

If you are interested in hiring a financial planner, here are 10 questions you can ask a financial advisor before hiring them.

I’ll leave you with one question to act on.

What’s your reason for not hiring a financial advisor?