Retirement is an exciting milestone!

Many look forward to it, eager to experience weeks without work and time to do as they please. They’ve worked decades, and now, want to enjoy the fruits of their labor.

You get one opportunity to retire well.

If you don’t, you may need to head back to work.

These are the 27 retirement planning mistakes I’ve seen people make that you may regret.

Whether you are in retirement, decades away, or a few years away from retiring, these retirement planning mistakes can help you start thinking ahead. The sooner you can plan for these retirement planning mistakes, the better.

Retirement Planning Mistakes – Cash Flow and Organization

1. One Spouse Responsible for the Finances

If only one spouse is responsible for the finances, consider changing that ASAP!

Having one spouse manage the finances is a major retirement planning mistake.

Having worked with widows for over a decade, I’ve seen how challenging it can be when only one spouse is responsible for managing the finances.

Most couples tend to divide responsibilities, and dividing who does the finances is okay, but you should at least be having regular conversations and keeping each other informed.

If the spouse who manages the finances passes away, what happens to the surviving spouse?

Consider whether they will know how to do the following:

- Know where all the important financial accounts are

- Know how to pay the bills

- Access each financial account

- Know what to sell or how to take income from investments

- File a tax return or locate important tax documents

- Carry out the estate plan and any trusts that need to be setup

- Step up the cost basis in non-retirement accounts

I recommend couples have a document that outlines what to do if they die. It can include where your accounts are located, how to access them, and more information that may be helpful.

You both don’t have to be financial experts, but the surviving spouse should know who to turn to or what to do if you were not around to take care of the finances.

2. Selecting Life Only Pensions If You Have a Spouse

I’m almost always disappointed when I hear from couples that they decided to select the life only pension option instead of the highest survivorship percentage option available.

There are a few cases where selecting the life only option makes sense, but it’s rare in most marriages.

For most couples, they want certainty of income for the longer of their two lives — not one.

If the spouse who had the pension dies, what would life look like for the surviving spouse if the pension goes away?

It’s usually not an easy adjustment, and it’s a retirement planning mistake that can change the rest of retirement.

3. Not Having a Budget or Not Knowing How Much You Spend

One of the biggest retirement planning mistakes I see is not having a budget or knowing how much you spend.

I don’t think everyone needs a budget in retirement, but if you don’t know how much you spend, it’s nearly impossible to know when you will reach a comfortable point to retire.

If you think you spend $100,000 each year, but it turns out you only spend $80,000, that could mean retiring much sooner or working part-time earlier.

You should have a system in place to see your historical spending. That could be Mint, YNAB, Monarch, Tiller, or another system. When you have a system in place, it’s easy to go back and see whether your estimate of what you thought you would spend is aligning with reality.

Plus, it gives you the opportunity to reflect on your spending and whether it aligns with what’s in your ideal life. From there, you can make changes.

You should have a good idea of what you spend each year because you’ll need those numbers for your financial plan.

4. Having High Interest Debt

It’s rare, but I sometimes come across individuals that have millions of dollars, but still have credit card debt or get hit with late fees and interest.

If you are carrying a credit card balance with high interest rates, but you have assets to pay off your credit card balance, you may want to consider paying it off.

It’s unlikely a portfolio of stocks and bonds is going to have a higher rate of return than the cost of the interest on most credit card debt.

You don’t have to be debt free going into retirement, but high interest debt should ideally be paid off before retirement.

5. Claiming Social Security Too Early

Some people fear Social Security is going “bankrupt” and want to get as much out of the program as possible. That’s not really happening as the media portrays it.

Some people “want to get their money back” and are afraid of dying early without paying any attention to the likelihood of them living a normal or longer than expected life.

They are not considering that they may have to withdraw more money from their investments for a longer period of time if they claim early, which can increase the risk of depleting their investments.

While claiming early makes sense for some people, particularly those with health issues that may indicate a shorter life span, claiming Social Security early can cause a devastatingly drastic drop in income and lifestyle later if one spouse passes away early.

It’s important to do a Social Security analysis and look at the possible ways a couple can claim Social Security benefits that gives them the highest likelihood of maximizing benefits over their joint lives — not their individual lives.

Looking at Social Security benefits as individuals when married or failing to understand longevity is a retirement planning mistake I regularly see.

6. High Fees, Opportunity Costs, and Lack of Value

A huge retirement planning mistake I see people make is to pay high fees for little value.

This could come in the form of an advisor who only manages your investments and does not offer proactive tax or financial planning advice. If the financial planning is merely a report with numbers, that’s not financial planning.

The same can be said if every solution is a product, particularly an insurance product.

I also see people decide not to hire a financial planner because they have only read or had bad experiences with one.

But, at what cost?

I see people sell out of investments and stay in cash. If markets go up 5% and you have $1,000,000, that’s $50,000 of an opportunity cost.

If you don’t proactively plan for taxes, that may cost you tens or hundreds of thousands of dollars in taxes. Even a lifetime of advisor fees could be less than the opportunity cost of certain tax strategies.

Then there are estate tax issues. If you don’t plan for those, those could also cost you huge sums of money.

Finally, there is the administrative burden. Do you want to be in charge of your finances?

Most of us could figure out how to exercise and eat healthy, but many find it helpful to hire fitness coaches and nutritionists to do the heavy lifting and provide accountability.

A common retirement planning mistake is hiring the wrong “financial advisor”, who is not really helping you live your ideal life. Or, the other side of it is trying to navigate the complexity of tax, legal, and investing by yourself and potentially making costly mistakes.

7. Thinking You Have to Have a Paid Off Mortgage Before Retiring

I often hear from families and on forums that people want to have a paid off mortgage before retirement.

Why do they feel that way?

Property taxes and insurance are paid indefinitely.

It’s okay to have a mortgage going into retirement, particularly for those who refinanced with rates below 4%.

A house is an illiquid asset with equity that is hard to use. Having more money tied up in your home may not support your retirement goals.

Depleting a brokerage account or other liquid assets to lock up money in your home could be a retirement planning mistake, particularly if it takes away the ability to do other tax planning strategies with your liquid assets.

From an emotional perspective, it’s okay if you want to have no mortgage going into retirement. There are pros and cons to it.

The key is to be active in that decision and not assume it has to be the default path.

8. Falling Victim to Scams

As you age in retirement, the odds of falling victim to a scam increase.

Many people are not thinking about scams being a retirement planning mistake, but failing to plan for them can be.

I’ve heard of people giving money to what they thought was a charity (it wasn’t), paying someone claiming to be a contractor for services (never provided), and input their credit card into the wrong websites or send money for computer help (only to be scammed out of it).

Whether it’s a scam on the elderly or the allure of high returns with minimal risk, pay particular attention and make a plan for how you will deal with how to make payments or invest money in the future.

You could consider an investment policy statement for evaluating new investments in the future.

You could have a friend or family member double check large payments before making them to be another set of eyes.

Retirement planning is not only about taxes. It’s also about how to safeguard your money throughout retirement.

Retirement Planning Mistakes – Estate Planning

9. Not Having an Updated Estate Plan

This is one of the most common retirement planning mistakes I see when I begin working with families.

The estate plan is old, there isn’t one, or they are unsure what it says.

If you did an estate plan 20 years ago when your kids were young and now they are grown, it’s time to revisit your estate plan.

You may need to name new beneficiaries, remove beneficiaries, name a new executor, list more backup executors, update your Will to align with the laws of your state if you moved, plan around estate tax consequences, or more.

If you update it, don’t forget to update the titling of accounts and property deeds (for your home or other property).

Not having an updated estate plan can result in more taxes, an administrative burden for survivors, and have the incorrect people receive assets.

10. Ignoring Estate Tax Consequences

Many people don’t need to worry about the federal estate tax because of the high exemption amount, but there are eleven states with an estate tax at much lower levels of wealth.

The eleven states with an estate tax include:

- Connecticut

- Hawaii

- Illinois

- Maine

- Massachusetts

- Minnesota

- New York

- Oregon

- Rhode Island

- Vermont

- Washington

- Washington D.C.

Some states have very low estate tax exemption amounts, such as Oregon and Washington. Oregon has a $1 million estate tax exemption while Washington has about $2.2M.

What this means is that if you die and have an estate worth more than the exemption amount, you may owe state estate taxes.

If you own a house in Portland, OR or Seattle, WA and are approaching retirement, there is a good chance you may be above those amounts given the rise in home values.

If your estate plan doesn’t include language to give you flexibility to use a disclaimer trust, you may have less money going to heirs and more money being paid in estate taxes.

If you primarily have illiquid assets, such as a farm or business, you may want to explore life insurance as a means to cover estate taxes. Otherwise, the farm or business may need to be sold (potentially in a fire sale) to help pay the estate taxes.

If most of your money is in a tax-deferred retirement account, such as an IRA, that may be another reason to explore life insurance. If your estate needs to pay estate taxes and the only funds available to pay them are the IRA, those distributions may be taxable at a very high rate.

Estate taxes don’t affect everybody, but for those who they do, proper planning can help mitigate the tax burden.

11. Giving Heirs Illiquid Assets They Must Own Together

In my ideal world, heirs would not own illiquid assets together.

If you have a business, a family vacation home, or other illiquid assets, I urge you to think carefully about whether your family can handle owning an asset together.

Common issues I see:

- Different levels of wealth to support illiquid assets

- Living in different locations that make managing a business or real estate challenging

- Conflicting ideas about how to manage the illiquid asset

I rarely hear about families that want to own and operate a business together. Why leave part of the business to an heir who does not want to be an active participant? Issues can arise quickly when one person is receiving income from a business where they are not involved and another family member is involved.

I’ve seen family real estate (rental properties, vacation homes, or other properties) cause issues in families.

Usually, one person in the family has more resources to provide money for upkeep and maintenance. They may also want to remodel or make changes to the property that another family member doesn’t.

Then, there is the issue of who gets to use it and when.

I’m a firm believer that in most situations, illiquid assets should not be split among heirs. It’s often better to leave entire illiquid assets to one person and even it out with other illiquid or liquid assets, or use life insurance to make up the difference.

12. Not Reviewing Beneficiaries

Please — review your beneficiaries.

Find the old life insurance policy, annuity, IRA, Roth IRAs, retirement accounts, and any other accounts with beneficiaries and review them.

Consider talking with your attorney to make sure the beneficiaries are in alignment with your Will.

I see people do great planning in their Will or Trust, but then don’t update their beneficiaries or they put beneficiaries on accounts they should not have.

You want the right assets going to the right people. If your beneficiaries are incorrect, that may mean assets in the wrong hands, additional taxes, and administrative headaches.

Retirement Planning Mistakes – Investments

13. Aggressively Investing Right Before Retirement

While stocks have offered higher returns over longer periods of time, they come with more fluctuations.

Having an aggressive portfolio right before retirement could prevent you from retiring on time or reduce the amount of money you can take from your investments.

For example, if you are 100% stocks in the years leading up to retirement, are counting on having $2 million to begin retirement, and markets drop by 50%, you now have $1 million to support your retirement.

That’s a much different retirement than anticipated, right?

Every investor should align their investments with the anticipated time frame for using them. Having money in stocks that you need in a year or two is not a wise decision.

Money you need to spend in the short-term should be in more conservative investments.

14. Thinking Your Time Horizon is Short

For a 65 year old couple, there is about a 50/50 chance of one of them living to age 90 or beyond.

People are living longer, health care costs are rising, and you could need an investment portfolio that supports you for over 30 years.

I’ve talked with people who approach retirement and feel they need to be conservative with their investments, but for many, their time horizon is still twenty years or more. For some, they will never spend their entire investment portfolio, which means some of it is earmarked for kids or grandkids with a time horizon of 50 years or more.

Retirement can last decades. Inflation eats away at the purchasing power of your investments.

Unless you have reliable sources of income that increase with inflation or more money than you’ll ever know what to do with it, you may need a portion of your investments in stocks and other long-term investments that have offered higher returns.

15. Owning a Risky, Concentrated Investment Portfolio

Creating wealth and keeping wealth often requires different actions.

I’ve seen people create tremendous wealth by owning a risky investment portfolio of one or two individual stocks.

The problem with this approach in retirement is that you could be betting the happiness and success of your retirement on one stock.

Fraud, new regulation, innovation, or a variety of other factors could cause the stock price to drop and never recover or go out of business entirely.

I’ve even seen people use margin (borrow money from their brokerage account) on an individual stock and get margin calls.

Owning only a handful of stocks could wreck a retirement plan.

16. Getting Out of the Market During a Downturn

Unfortunately, I’ve met people who sold out of stocks during 2009 and did not get back in for more than a decade.

The Great Financial Crisis scared them, and they missed out on the recovery.

The overwhelming evidence suggests that people can’t consistently time markets after taxes and fees. What are the odds you can do it?

Imagine getting out during the market decline in March of 2020 during COVID. Markets dropped by about 30% and recovered in a few weeks.

Markets have rewarded investors for being long-term investors.

If you make decisions based on short-term noise, you may miss out on good long-term returns that help your retirement.

17. Not Considering Inflation When Investing

People often say investing in stocks is risky.

They see the value go up and down on a daily basis, and to them, that seems risky.

Do you know what else is risky?

Keeping your investments in conservative assets with lower returns while inflation eats away at the purchasing power of the money you worked hard to save.

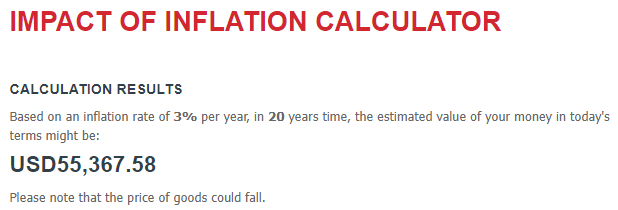

For example, if you had $100,000 in cash that earned 0% and inflation was 3% over 20 years, the $100,000 would only be worth about $55,368.

You can calculate how inflation has impacted prices over time.

Many people need an allocation to investments with a higher return potential to help pay for expenses 10, 20, and 30 years from now.

18. Buying Expensive Annuities as a Hedge

In general, the more complicated an annuity, the worse it is — usually.

If you can’t easily understand it and explain it to a friend or family member, it may not be the right product for you.

Annuities with income riders and other features often hide the actual rate of return you may experience.

A single premium immediate annuity can be a good tool for some people to hedge against the risk of living a long time, but in my experience, when I show people the rate of return and how they are spending their own money for the first 10 to 15 years of owning it, they often rethink the purchase.

Annuities can serve a place in retirement planning, but I recommend seeking a second opinion from a financial planner who is not being compensated based on you buying an annuity.

Unfortunately, I’m often hired by people to help fix their retirement planning when they buy an expensive annuity that was not in their best interest.

19. Not Planning for Long-Term Care or Health Care Costs

Long-term care costs are expensive.

I’m confident you’ve seen the headlines where people may spend hundreds of thousands of dollars on end of life care.

If it’s only one person, the more common approach is to spend down assets until qualifying for Medicaid. The places that accept Medicaid aren’t always good, but it is an option.

The problem is that if you are a married couple and one spouse needs care while the other is healthy, qualifying for Medicaid becomes harder.

Medicaid rules are different in every state, but generally, the healthy spouse can keep the home, a car, household furnishings, and around $50,000 to $200,000 in other assets, such as retirement or brokerage accounts. There is also a monthly income limit, usually slightly below $3,000.

As you can imagine, trying to maintain the same standard of living may be difficult on less income and minimal assets.

Married couples need to carefully think about how they will handle long-term care costs in retirement.

Retirement Planning Mistakes – Tax Planning

20. Ignoring Tax Planning

Please don’t be the person who merely reports what happened on their tax return.

Often, that means you are tipping the IRS — you may be unnecessarily paying them more than legally obligated.

Do you want to pay more in taxes than you are legally obligated?

No? Do tax planning.

People who retire early often find themselves in the lowest tax bracket they’ve seen for years. That is an opportunity!

They may be able to do Roth conversions or recognize long-term capital gains in the 0% long-term capital gains bracket.

Don’t be the person who decides they need a large IRA distribution for a car or home repair and gets bumped into a higher tax bracket when they could have spread out the tax over multiple years at a lower tax bracket.

Retirement is also a great time to strategize around charitable giving. Whether you want to use a Donor-Advised fund to avoid capital gains on brokerage assets or Qualified Charitable Distributions to reduce the taxability of your Required Minimum Distribution, proactively make a plan for taxes.

Tax planning involves looking at the estimated tax rate you will pay over your lifetime and taking action to potentially reduce your lifetime tax bill — not just your tax bill in any single year.

21. Not Taking Advantage of Mega Back Door Roth Contributions

If you have made the maximum contribution to your 401(k), have the ability to save more, and your 401(k) allows for after-tax contributions and in-plan Roth conversions, you may want to consider contributing more.

Not every 401(k) plan allows for after-tax contributions and in-plan Roth conversions, but for those that do, you have the opportunity to contribute more than $60,000 per year!

That’s money that could be growing tax-free for your retirement.

Deciding to which accounts to contribute and in what amounts is a key part of retirement planning.

22. Spending from Your HSA When You Could Invest

I see many people in retirement with HSAs or other plans, like a VEBA account, that could be invested and grow tax-free for qualified medical expenses later.

Instead, they are often spending from these plans or leaving them in conservative investments.

One retirement planning strategy is covering health care expenses from other income sources or assets and allowing the HSA to grow tax-free for qualified medical expenses later in retirement.

Retirement Planning Mistakes – Lifestyle

23. Going Without a Social Circle

Many people focus on the financial pieces of retirement, but many forget to plan for their community or social circle.

Work provides a purpose, a sense of belonging, and daily social interactions.

Imagine if that went away tomorrow.

How will you create community in retirement life? What activities will give you purpose? How will you continue to have social interactions?

Those are key questions to consider prior to retiring.

If you haven’t, you may find retirement lonely and disappointing.

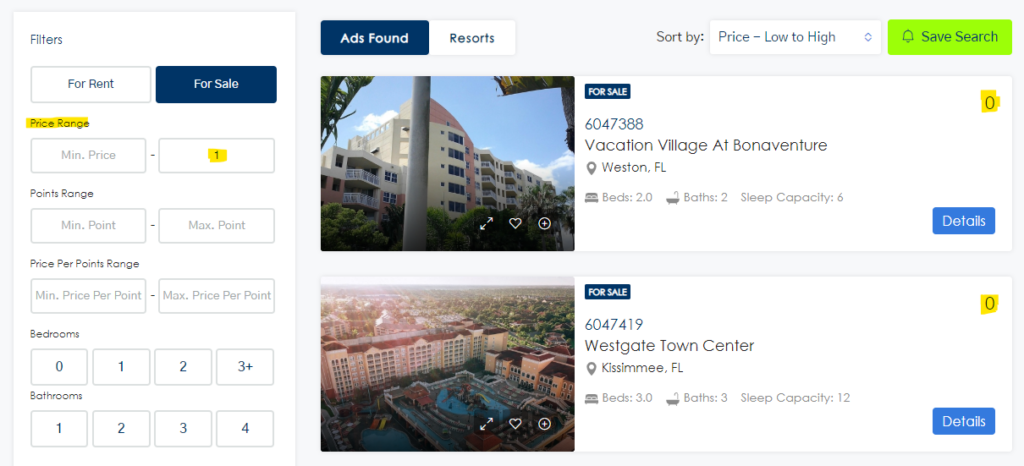

24. Buying a Timeshare

From a financial perspective, I’ll never say nobody should or shouldn’t do something, but a timeshare is as close as I’ll get.

I’ve never known a situation where buying a timeshare made sense.

If you are curious about the horrors of buying and owning a timeshare, John Oliver has you covered.

Timeshares come with expensive ongoing fees that are nearly impossible to get out of, hard to use weeks, and surprise upgrade fees.

People want to get rid of them so badly that they try to resell them for $1 or less.

Yes, even if it is free, it can be an expensive mistake.

Buying a timeshare is a retirement mistake too many people make.

25. Buying a Second Home Without Trying It Out First

This is one of my favorite tips for people in retirement who want to try living in a new location: rent a home for a few months and live like a local!

Sometimes, I meet people who want to move somewhere because they spent a week or two there during vacation.

Vacation and living are very different.

Vacations provide a snapshot in time during one small period of time — often in a good mood.

Living somewhere exposes you to what it’s actually like with different weather, traffic, and more.

I often recommend people rent a home for at least a month, though 2 to 3 months would be even better. You get bonus points if you can do it during the winter and summer to make sure you like it during both seasons!

Renting a place may be $5,000 to $15,000. Buying a home and selling it if you don’t like it will likely be more than that in real estate commissions and taxes.

Before you decide to retire to a new area, consider renting a place as part of your retirement planning.

26. Planning to Work As Long As Possible

I have regular conversations with people who say, “I’d like to keep working for as long as possible, even if it’s part time” because they love their work.

I love that they love their work!

At the same time, life happens.

A health event or other event may not allow you to physically or mentally keep working. Many people’s working lives are cut short.

If you are counting on money to last until a certain age, you need to recognize that may not happen and your plans may need to be adjusted.

The saying, “Don’t count your chickens before they hatch” applies.

27. Not Staying Active

While working, most people are go-go-go.

Retirement gives you an opportunity to pause and relax. I recommend people take the first year to explore how they want their life to look now that they have more options than they have had in a long time, but it’s important to still be active.

You don’t have to run marathons, but regularly walking, getting outside, yoga, stretching, and other activities to keep your body healthy are important.

There are far too many stories of people retiring, not staying active, and their body stops supporting them as well as it could have.

As you do your own retirement planning, make sure you include time in your calendar to stay active.

Final Thoughts – My Question for You

Retirement planning mistakes are common.

It’s difficult to be an expert on your own career and your finances, taxes, estate planning, insurance, and staying healthy.

Where you can, hire professionals to help coordinate these opportunities for you.

Although it’s an investment, the opportunity cost of not doing it may be many multiples higher.

I’ll leave you with one question to act on.

Which retirement planning mistake are you going to make a plan for?