You’re retired, and it’s the start of 2023. What is on your financial planning New Year’s checklist?

Instead of waiting until the end of the year, getting too busy in summer, or ignoring it during tax time, take a few moments to go through this financial planning new year checklist to potentially put yourself in a better position.

Whether it’s taxes, cash flow, or reviewing your investment portfolio, there are actions you can take now to do a financial health checkup.

Review What’s in Your Ideal Life

Many people start the year with New Year’s resolutions. Perhaps they want to exercise three times a week or eat healthier. I am for New Year’s resolutions, but I want you to think more deeply about what’s in your ideal life.

Seriously, what are the most essential elements to have in your life?

Close your eyes, let your mind wander. What comes up?

If you had all the money in the world to do whatever you wanted, what would you do? What would be in your life? How would you live it? What would change?

Would you have an exercise room in your house? Get regular massages? Vacation each quarter? Buy a new house? Spend more time with friends and family? Get season tickets to your favorite sporting event? Go back to school? Hire a house cleaner? Something else?

I’ve found that many people live life on autopilot. How it’s been is how it will be.

It doesn’t have to be that way. You can consciously make a choice to make proactive changes in your life, see how you feel about them, and adapt to more changes.

If you are unhappy you haven’t done something, but have always thought about doing it, why not place it in your ideal life?

Life is fragile, and often, too short.

Living anything less than your ideal life and not exploring what you have the means to do may become a regret.

Review Cash Flow

Even if you are not spending more than anticipated, I recommend reviewing your spending and upcoming cash needs. Where is your money going and does it align with your ideal life?

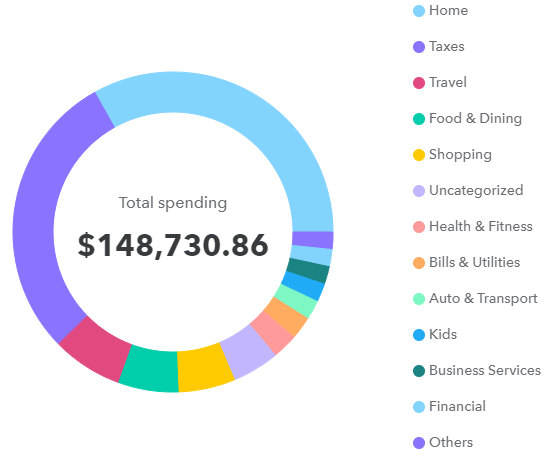

Review Spending Over the Past Year

One of the common phrases I hear is, “I had no idea we were spending that much on XYZ.”

Reviewing your spending can be an eye-opening experience. Even if you are spending the amount you intended, people often feel like they want to make adjustments after seeing where their money goes.

It’s about aligning your money with your ideal life.

Are the dollars flowing to the areas you want or are there changes you can make to better align them?

If you do most of your spending on a credit card, login and see the amounts for each category. If travel is an area in which you want to increase spending, have you increased it to be in alignment?

This isn’t about budgeting or constricting your life.

Reviewing your spending is about being mindful of where you are spending and whether it aligns with your intentions.

Plan for Withdrawals

Since it’s the beginning of the year, it’s also a good time to plan for any major withdrawals.

Do you have a new car you need to buy, an expensive vacation, or gifting to family members?

It’s important to plan earlier in the year for tax planning purposes and operationally where those funds will come from.

If Social Security, pension, or income from the portfolio won’t cover it, you should know whether you are going to dip into your cash funds or need to make a withdrawal from the portfolio.

The more notice you have, the better you can plan how to decide to take it from your investment portfolio and from which asset to avoid selling low.

Emergency Fund

People have different comfort levels with how much cash to have in retirement.

If the stock market dropped 30%+ in the next year, would you have enough cash in your emergency fund to feel comfortable?

Although cash can be a drag on returns, it can be a great emotional stabilizer during downturns. If you know where you can take withdrawals for a set period of time, such as a few months or a year, you may have more peace of mind going through a stock market decline.

Each person has a different comfort level with how much cash to have available. Is yours at that point?

Gift to Family

If you plan to make gifts for your family during the year, start thinking about it now. Will you do the $17,000 annual gift tax exclusion amount upfront?

Will you help a child or grandchild with a down payment on a house that goes above the annual gift tax exclusion amount, meaning you may need to file a gift tax return?

Like planning for your own withdrawals, it’s important to have an idea of how much money you need to have available to help decide when to withdraw it from the portfolio.

Review Investment Portfolio

Although many people check their portfolios at the end of the year, the beginning of the year is also a good time to review your investment portfolio.

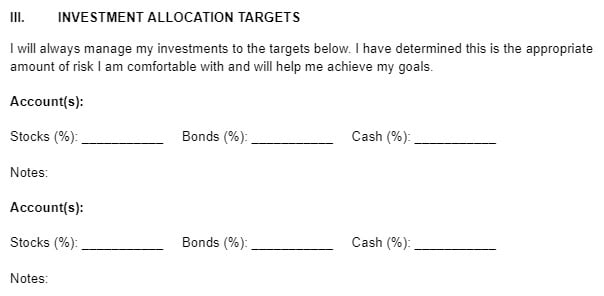

Review or Design Investment Policy Statement

If you don’t already have an investment policy statement, now is a good time to create one.

If you have an investment policy statement, review it. Does it still make sense?

If so, are there any portfolio changes you need to make?

Tax-Loss Harvesting

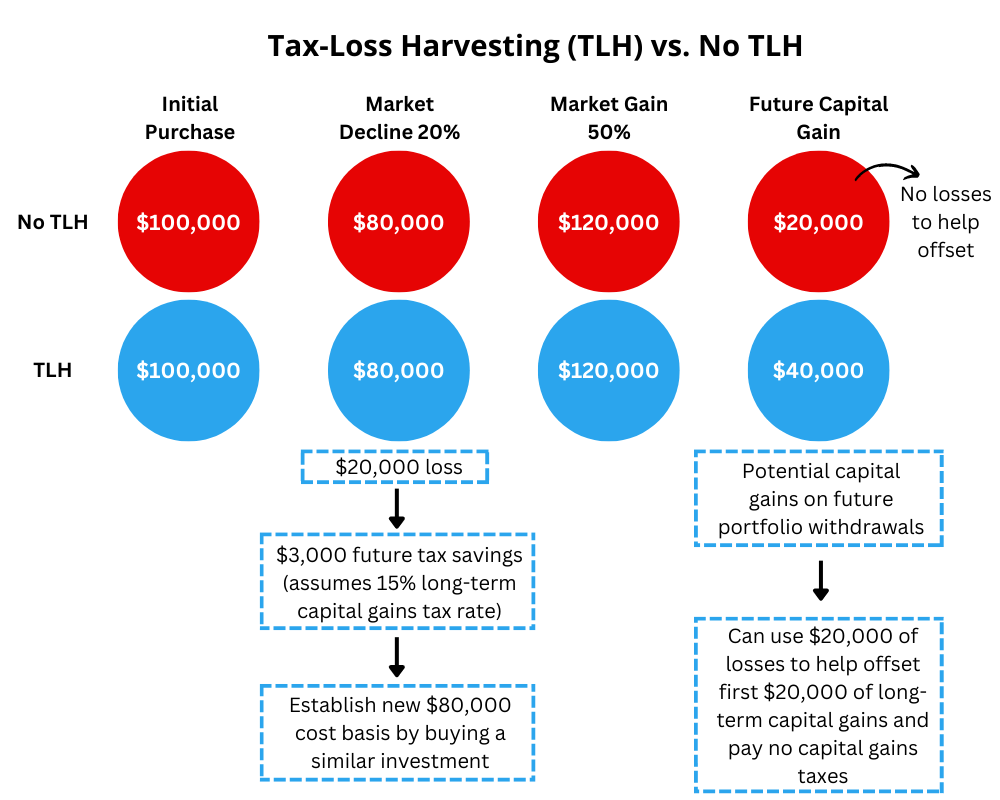

If you aren’t in the 0% capital gains bracket, could benefit from taking losses in your brokerage portfolio, and didn’t take them last year, you may want to sell investments with losses now.

Tax-loss harvesting could reduce the amount in taxes you pay.

It’s best to monitor your brokerage account for losses throughout the year, but if you are not, the start of the year is a good time to look because the losses may allow you to make other portfolio changes later in the year without paying additional taxes.

Rebalancing

Given the market swings last year, your portfolio may need rebalancing. Some of your stock positions may be underweight from the neutral target.

You may need to sell investments that went up in value or didn’t go down in value as much to buy the positions that went down more.

Rebalancing is a fancy way of saying “buy low, sell high.” With rebalancing, you are selling the investments that did better (sell high) to buy the investments that didn’t do as well (buy low).

Asset Location

One of the common mistakes I see people make is not use asset location when they could benefit from it.

For example, assets with higher expected returns should often go in a Roth IRA and assets with lower expected returns should go in an IRA. I often see a balanced portfolio in a Roth IRA and Rollover IRA when people would benefit from putting more of the stocks in the Roth IRA and more of the bonds in the IRA.

The reason for this is that growth and future withdrawals are tax-free in the Roth IRA, which means you get to keep 100% of the return you earn. With a Rollover IRA, the IRS is a partner in that account. Whatever you earn and distribute, they will take a portion of it through taxes.

You can also review your 1099 tax form for brokerage accounts to see if you have tax-inefficient funds in your account. You can also review to see if municipal or taxable bonds make more sense inside your brokerage account.

It’s not what you earn that matters. It’s what you keep after taxes.

Distribute Required Minimum Distributions

Although many people wait until the end of the year to distribute their Required Minimum Distributions (RMDs), I favor distributing them earlier in the year.

If you don’t plan on spending your RMD, you could move it to your brokerage account and reinvest. If you do that, it often has better tax treatment. If the market goes down, you can tax-loss harvest. If the market goes up, you can get capital gains treatment, which is often more favorable than the ordinary income treatment inside of the IRA.

Also, if you plan on doing Roth conversions, your RMD must be done before you can do a Roth conversion. By distributing the RMD earlier in the year, you are prepared to do a Roth conversion at any point, which can be a huge benefit if markets decline rapidly.

Lastly, you avoid the end of year rush when custodians are busy and it’s harder to reach them.

Qualified Charitable Distributions

As you decide how much of your Required Minimum Distribution to take for yourself and how much to send to charity via a Qualified Charitable Distribution (QCD), distributing a QCD earlier in the year is helpful for the charity because they get the money sooner.

Plus, if you are mailing a check, there is less of a chance of it getting lost in the mail or not being cashed in time for it to count for the current year, which may happen if you wait until December.

Tax Planning

I know it may seem like you still have plenty of time before you need to organize your tax files, but 1099-Rs are normally released near the end of January and first drafts of 1099s are usually released in mid-February.

Now is a good time to get a jump start on tax planning.

Organize Tax Files

If you don’t keep an electronic tax file and put documents in it throughout the year, you may want to think about starting one.

If you donate to a charity and get a receipt, snap a picture and put it in the file. If you get an IRS notice or other communication related to taxes, scan it and put it in the file.

If you do this throughout the year, it’s less to deal with now or at tax time.

As you start to receive notifications that tax documents are available, download them and put them in the electronic tax file. It’s much easier to do it as you go rather than trying to sit down for an hour or two to download everything.

Roth Conversion Planning

For those who are retired, they often have a sense of what their income will be for the year, which means they can normally run a preliminary Roth conversion projection at the start of the year instead of waiting until the end.

For example, most people know their Social Security, pension, and RMD amounts. They may have to estimate their dividends and capital gains, but they likely can make a fairly good estimate of their income for the year.

Once they have an income estimate, they can do a tax projection analysis to see which tax bracket they fall into and whether they want to convert money to the top of that tax bracket or possibly recognize income into the next tax bracket.

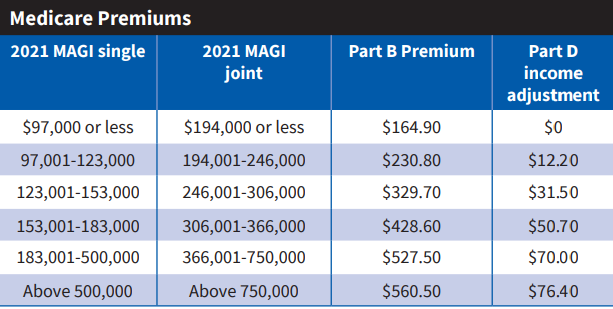

They can also start planning which IRMAA bracket they will be in for the year and decide whether to try to avoid the higher Medicare premiums.

Once they have the tax projection done, they can start planning how they want to do the Roth conversions for the year – all at once, a dollar cost average approach, or a large sum now and a little at the end of the year to account for any other surprise sources of income.

Charitable Giving

Instead of scrambling at the end of the year trying to catch up on your charitable giving plans, why not make a tentative plan at the start of the year?

Take time to decide which types of organizations you wish to support, research specific charities, and how much you want to give to each.

Then, you can make contributions throughout the year – either directly to charity with cash, highly appreciated securities, through a Donor-Advised Fund, or a Qualified Charitable Distribution.

It’s better to start the year with an outline of how you plan to give and make calendar reminders to fulfill it throughout the year. By doing this, you may be more likely to stick with your charitable intentions without feeling rushed at the end of the year.

Miscellaneous

If you made it this far and plan to do most of the items on the list, good for you!

It can be hard to produce the energy to start proactively working on these items.

Consider this next list an extra credit of sorts. These are items you don’t necessarily need to review every year, but I find most people haven’t reviewed them for many years, which means this year would be a good year to review them.

Review Credit Report

If you haven’t reviewed your credit report recently, consider pulling at least one report from the three major credit bureaus at annualcreditreport.com.

Is everything in order to maintain or build a good credit score?

Is your credit currently frozen?

Review Life Insurance

You may no longer need life insurance, but if you are not financially independent and someone is dependent on you, such as a parent, child, grandchild, sibling, or spouse, you may need life insurance.

Do you have the right amount? Is the term appropriate or do you need a new life insurance policy that lasts longer? If you have cash value, is it enough to support the death benefit and if so, for how long? Is the cash value the best use of your money or could you 1035 exchange it into a more efficient product? Would surrendering the policy be best?

Life insurance is a major asset and may need fine tuning as your life changes.

Review Home, Auto, and Umbrella Insurance

With home values increasing and the cost of labor going up, your dwelling coverage may be insufficient. You also may not have enough liability insurance on your homeowners or auto insurance policy.

Do you have umbrella insurance? It’s usually cheap and may provide more liability coverage.

Take a few moments to review your policies and see if you see any gaps. Better yet, have your insurance agent or financial planner review it to see if they see any issues.

Review Estate Plan

This one takes time, but don’t skip it because it could be the most important.

Carefully read your entire estate plan. Are the right people in the right roles? Has anything changed that warrants updating the plan? Are your assets properly titled? Are your beneficiaries correct? Do you know what will pass through probate and what won’t? Is it intentional?

I often see people make an estate plan and not review it – or worse, don’t understand it. Taking the time to understand it and whether it reflects your current wishes may spare your loved ones time, pain, and a significant amount of money.

Final Thoughts – My Question for You

Instead of waiting until the middle or end of the year, try taking a proactive approach to your financial planning in 2023.

Discover what’s in your ideal life and whether your current spending aligns with it.

From there, the other items should fall into place, such as your investment review, RMDs, tax planning, and miscellaneous planning items you may have not reviewed for a few years.

I’ll leave you with one question to act on.

What will be your first step in your 2023 financial planning New Year’s checklist?